3110 1023 2008-2026

What is the 3

The 3 form, also known as the id10t form, is a specific document used in various administrative processes. It serves as a means to collect essential information for compliance and record-keeping purposes. This form is often required in specific scenarios, such as applications for certain licenses or permits. Understanding the purpose and requirements of this form is crucial for individuals and businesses alike.

How to use the 3

Using the 3 form involves several straightforward steps. First, gather all necessary information, including personal details and any relevant documentation. Next, fill out the form accurately, ensuring that all sections are completed as required. After completing the form, it may need to be submitted to a designated authority or organization, depending on the specific purpose of the form. Always check for any additional requirements or instructions that may accompany the form.

Steps to complete the 3

Completing the 3 form can be broken down into a series of steps:

- Review the form to understand the required information.

- Gather necessary documents, such as identification or supporting paperwork.

- Fill out the form carefully, ensuring all fields are completed accurately.

- Double-check for any errors or omissions before submission.

- Submit the completed form as instructed, whether online, by mail, or in person.

Legal use of the 3

The legal use of the 3 form is essential for ensuring compliance with relevant regulations. This form must be filled out truthfully and accurately, as providing false information can lead to penalties or legal repercussions. It is important to understand the specific legal context in which the form is used, including any applicable laws and regulations that govern its submission and processing.

Key elements of the 3

Key elements of the 3 form typically include:

- Personal identification information, such as name and address.

- Details specific to the purpose of the form, including relevant dates and identifiers.

- Signature and date, confirming the accuracy of the information provided.

- Any additional documentation that may be required to support the form.

Form Submission Methods

The 3 form can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission via a designated portal.

- Mailing the completed form to the appropriate office.

- In-person submission at specified locations.

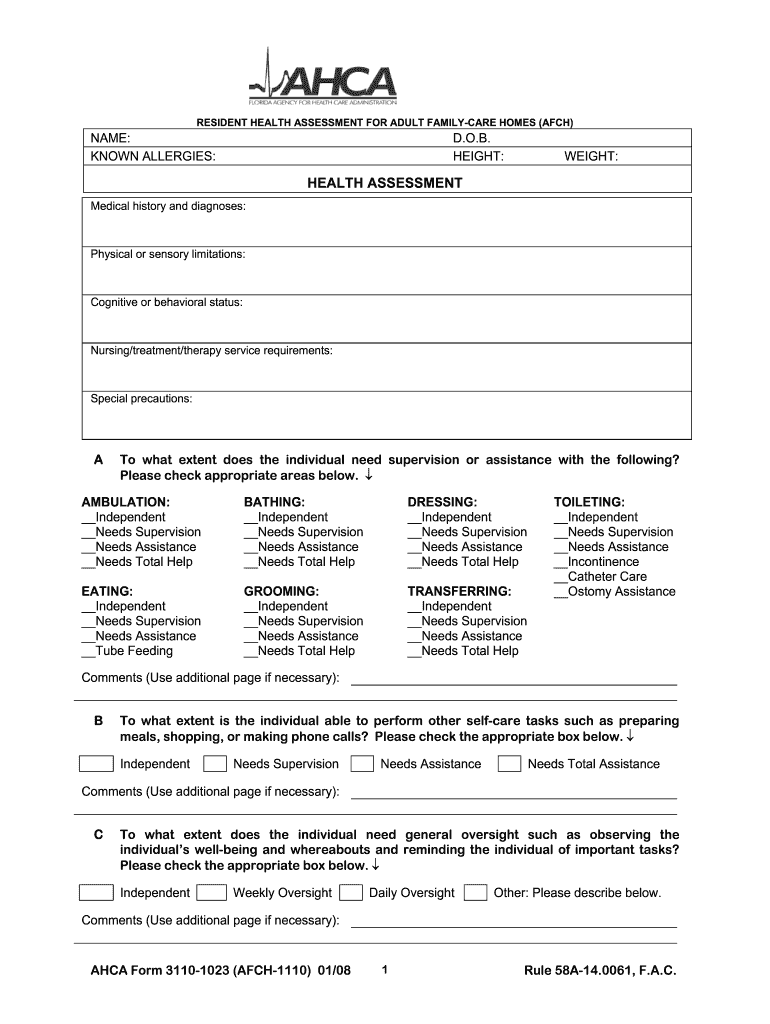

Quick guide on how to complete ahca health assessment form

Explore the simpler method to manage your 3110 1023

The traditional approaches to filling out and endorsing documents consume an excessive amount of time compared to modern document management options. Previously, you would look for suitable social forms, print them, fill in all the details, and mail them through the postal system. Now, you can access, fill out, and sign your 3110 1023 within a single browser window using airSlate SignNow. Preparing your 3110 1023 has never been easier.

Steps to finalize your 3110 1023 with airSlate SignNow

- Navigate to the category page you need and locate your state-specific 3110 1023. Alternatively, use the search bar.

- Verify the version of the form by viewing it.

- Click Get form to enter the editing mode.

- Fill in your document with the necessary details using the editing tools.

- Review the entered information and click the Sign feature to validate your form.

- Choose the most suitable method to create your signature: generate it, draw it, or upload its image.

- Click DONE to preserve the changes.

- Download the document to your device or go to Sharing settings to send it electronically.

Robust online platforms like airSlate SignNow enhance the process of completing and submitting your forms. Try it to discover how quickly document management and approval should be handled. You will save a substantial amount of time.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ahca health assessment form

How to generate an electronic signature for the Ahca Health Assessment Form in the online mode

How to create an eSignature for your Ahca Health Assessment Form in Google Chrome

How to make an eSignature for putting it on the Ahca Health Assessment Form in Gmail

How to make an electronic signature for the Ahca Health Assessment Form straight from your mobile device

How to make an electronic signature for the Ahca Health Assessment Form on iOS devices

How to generate an electronic signature for the Ahca Health Assessment Form on Android OS

People also ask

-

What is an id10t form and how can it benefit my business?

An id10t form is a specific type of digital document that facilitates the efficient signing and management of contracts. Using airSlate SignNow, businesses can create, send, and eSign id10t forms seamlessly, improving workflow efficiency and reducing turnaround time. This digital solution helps eliminate paperwork and provides easy access to documents from anywhere.

-

How much does it cost to use the id10t form with airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different business needs and budgets. The cost of using the id10t form is included in these plans, allowing users to enjoy unlimited document eSigning capabilities. For specific pricing details, it's best to check the airSlate SignNow website or contact their sales team.

-

Can I integrate id10t forms with other applications?

Yes, airSlate SignNow allows for easy integration of id10t forms with a wide variety of applications, including CRM systems and cloud storage services. This integration capability helps streamline business processes and allows for smooth document management across platforms. You can easily connect your existing software tools to enhance your workflow.

-

Is it easy to create an id10t form using airSlate SignNow?

Absolutely! Creating an id10t form using airSlate SignNow is a simple process that does not require any advanced technical skills. The platform provides user-friendly templates and a drag-and-drop interface to customize your forms according to your business needs.

-

What security measures does airSlate SignNow implement for id10t forms?

airSlate SignNow prioritizes document security by implementing several measures for id10t forms, including encryption, secure authentication, and compliance with industry standards. These protocols ensure that your sensitive data remains protected throughout the eSigning process. You can use airSlate SignNow with confidence, knowing your documents are secure.

-

Can I track the status of my id10t form after sending it?

Yes, with airSlate SignNow, you can easily track the status of your id10t form in real-time. The platform provides notifications and updates, allowing you to see when the document has been opened, signed, or completed. This feature enhances accountability and keeps you informed about your document's progress.

-

What types of businesses can benefit from using id10t forms?

All types of businesses, regardless of size or industry, can benefit from using id10t forms with airSlate SignNow. Whether you are in real estate, finance, or any other sector requiring document management, the platform streamlines the eSigning process, making it easier for teams to collaborate. This versatility makes it a valuable tool for any business.

Get more for 3110 1023

Find out other 3110 1023

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT