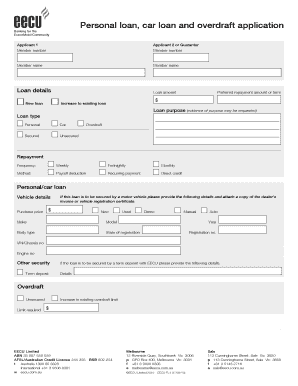

Personal Loan Car Loan and Overdraft Application EECU Form

What is the eecu auto loan?

The eecu auto loan is a financial product designed to help individuals purchase a vehicle. This loan typically offers competitive interest rates and flexible terms, making it an attractive option for those looking to finance a car. The application process is streamlined, allowing borrowers to apply online and receive quick approvals. Understanding the specifics of the eecu auto loan can empower potential borrowers to make informed decisions regarding their vehicle financing options.

Steps to complete the eecu auto loan application

Completing the eecu auto loan application involves several straightforward steps. First, gather necessary documentation, such as proof of income, identification, and details about the vehicle you intend to purchase. Next, visit the eecu website to access the online application form. Fill in the required information accurately, ensuring that all details are current and complete. After submitting the application, you may receive a preliminary decision within a short timeframe. If approved, you will receive further instructions regarding the loan terms and conditions.

Key elements of the eecu auto loan

When considering the eecu auto loan, several key elements are important to understand. These include the loan amount, which typically varies based on the vehicle's price and the borrower's creditworthiness. Interest rates are another crucial factor, as they can significantly impact the total cost of the loan. Additionally, the repayment term, which can range from a few years to several years, affects monthly payment amounts. Understanding these elements can help borrowers choose the best financing option for their circumstances.

Eligibility criteria for the eecu auto loan

Eligibility for the eecu auto loan generally depends on several factors. Applicants typically need to be at least eighteen years old and a resident of the United States. A stable income source is essential, as it demonstrates the ability to repay the loan. Additionally, credit history plays a significant role; while individuals with good credit may receive better terms, those with less favorable credit may still qualify with higher interest rates. Meeting these criteria can facilitate a smoother application process.

Legal use of the eecu auto loan application

The eecu auto loan application is legally binding once signed, whether digitally or physically. To ensure its validity, it must comply with relevant laws governing electronic signatures, such as the ESIGN Act and UETA. These laws establish that electronic signatures hold the same legal weight as traditional handwritten signatures, provided certain conditions are met. Borrowers should be aware of these legal frameworks to protect their rights and obligations throughout the loan process.

Form submission methods for the eecu auto loan

Submitting the eecu auto loan application can be done through various methods to accommodate different preferences. The most common method is online submission, which allows for quick processing and immediate feedback. Applicants can also choose to submit their forms via mail, ensuring that all documentation is securely sent. In-person submissions may be available at local eecu branches, providing an opportunity for applicants to ask questions and receive assistance directly from staff.

Quick guide on how to complete personal loan car loan and overdraft application eecu

Effortlessly Prepare Personal Loan Car Loan And Overdraft Application EECU on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Personal Loan Car Loan And Overdraft Application EECU on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Personal Loan Car Loan And Overdraft Application EECU with Ease

- Find Personal Loan Car Loan And Overdraft Application EECU and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and bears the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Personal Loan Car Loan And Overdraft Application EECU and ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal loan car loan and overdraft application eecu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an EECU auto loan and how does it work?

An EECU auto loan is a financial product offered by Educational Employees Credit Union that helps you finance the purchase of a vehicle. With competitive interest rates and flexible terms, these loans allow you to choose the amount you wish to borrow and the duration for repayment, making it easier to manage your budget while enjoying your new vehicle.

-

What are the benefits of choosing an EECU auto loan?

Choosing an EECU auto loan comes with several benefits, such as lower interest rates compared to traditional banks, personalized customer service, and flexible repayment options. Additionally, EECU members often receive exclusive offers and discounts, making your auto loan experience even more cost-effective.

-

How can I apply for an EECU auto loan?

Applying for an EECU auto loan is a straightforward process. You can start your application online or visit a local branch to speak with a loan officer. The application will require basic information about your finances and the vehicle you intend to purchase.

-

What are the eligibility requirements for an EECU auto loan?

To qualify for an EECU auto loan, you typically need to be a member of the credit union, meet minimum credit score requirements, and provide proof of income and employment. It's also essential to ensure that the vehicle you're purchasing is eligible under their guidelines.

-

What types of vehicles can I finance with an EECU auto loan?

With an EECU auto loan, you can finance a variety of vehicles, including new and used cars, trucks, and SUVs. Additionally, EECU may offer financing for certain types of recreational vehicles and motorcycles, helping you fund your transportation needs regardless of the type.

-

Are there any fees associated with EECU auto loans?

Generally, EECU auto loans come with very few fees, making them an affordable option for borrowers. You should review the loan agreement for any potential processing fees or penalties associated with late payments, ensuring you understand the full cost of the loan.

-

Can I refinance my existing auto loan with EECU?

Yes, EECU offers refinancing options for existing auto loans, potentially allowing you to lower your monthly payments or reduce your interest rate. It's a great way to improve your financial situation if you qualify for better terms based on your credit or financial changes.

Get more for Personal Loan Car Loan And Overdraft Application EECU

Find out other Personal Loan Car Loan And Overdraft Application EECU

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document