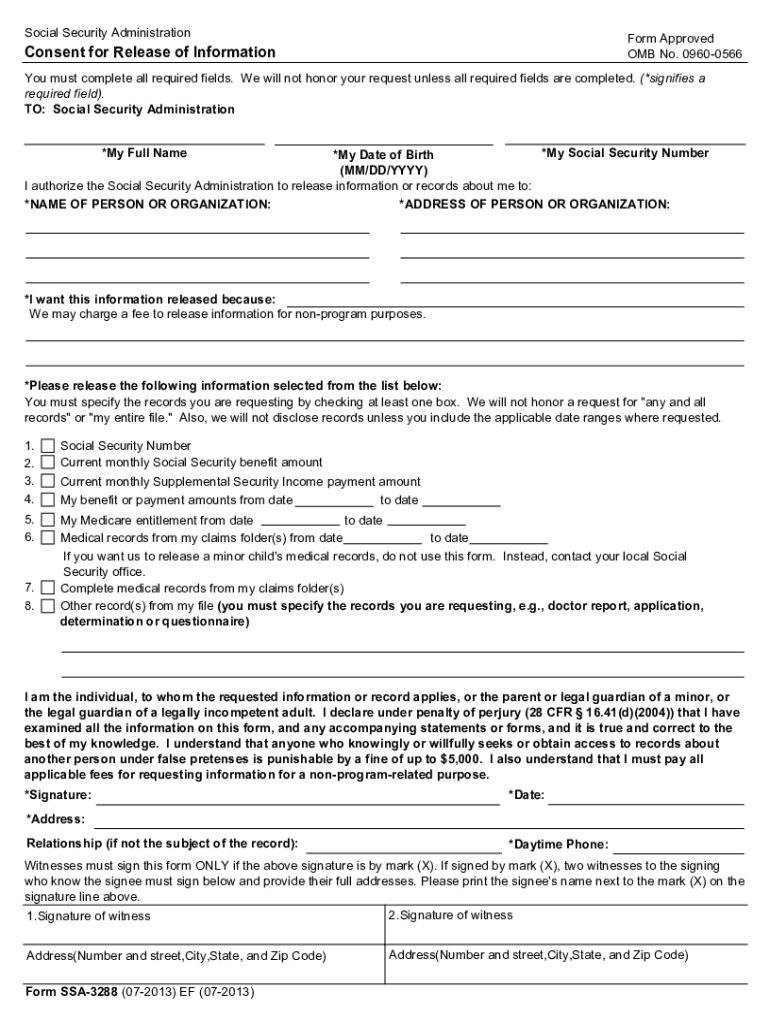

Ssa 3288 Form

What makes the social security administration form ssa 3288 legally valid?

Because the society ditches office work, the execution of paperwork increasingly happens electronically. The social security administration form ssa 3288 isn’t an any different. Dealing with it utilizing electronic means is different from doing so in the physical world.

An eDocument can be viewed as legally binding on condition that particular needs are met. They are especially critical when it comes to signatures and stipulations associated with them. Typing in your initials or full name alone will not guarantee that the organization requesting the form or a court would consider it performed. You need a reliable solution, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your social security administration form ssa 3288 when completing it online?

Compliance with eSignature laws is only a fraction of what airSlate SignNow can offer to make document execution legitimate and secure. It also gives a lot of opportunities for smooth completion security wise. Let's quickly go through them so that you can stay certain that your social security administration form ssa 3288 remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: major privacy standards in the USA and Europe.

- Two-factor authentication: adds an extra layer of security and validates other parties' identities through additional means, like a Text message or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the information securely to the servers.

Completing the social security administration form ssa 3288 with airSlate SignNow will give greater confidence that the output form will be legally binding and safeguarded.

Quick guide on how to complete social security administration form ssa 3288

Complete Ssa 3288 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without any holdups. Manage Ssa 3288 on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Ssa 3288 effortlessly

- Locate Ssa 3288 and click on Get Form to begin.

- Utilize the tools we provide to submit your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Ssa 3288 and guarantee seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why does the Social Security Administration send out form SSA-1709?

Why SSA send form 1079?Verify workers compensation or disability benefits that may be subject to payroll taxes which replace earned income.DI 52145.010 - Completion and Receipt of the Form SSA-1709 (Request for Workers' Compensation/Public Disability Benefit Information) - 10/06/2011SSA-1709 - SSDFacts http://bit.ly/2S2nOHyForms and Publications / SSAMost workers' compensation benefits are not taxable at the state or federal levels. However, a portion of your workers' comp benefits may be taxed if you also receive Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI).Are Workers' Compensation Benefits Taxable? - FindLawThe income you receive from disability income insurance may or may not be taxable. The taxability of disability income insurance benefits depends on what type of benefits you receive, whether the premiums were paid with pretax or after-tax dollars, and who paid the premiums (you or your employer).Is disability income taxable? | Ameriprise FinancialSOURCE: signNowSOURCE: signNowIs disability income taxable?Disability benefits you receive from the Department of Veterans Affairs (VA) aren't taxable and don't need to be reported on your return. However, Military Disability Retirement pay could be taxable if reported on form 1099-R.Generally, Social Security Disability Benefits (SSDI), are not taxable unless you have substantial additional income (more than $25,000 for an individual or $32,000 for married filers).Workers' compensation benefits are not normally considered taxable income on your federal or state return. There is an exception when you receive both workers’ compensation and Social Security (or Railroad Retirement) benefits and part of your workers' compensation reduces your Social Security, that part may be taxable.Disability benefits for loss of income or earning capability resulting from injuries under a no-fault auto insurance policy aren't taxable either.Disability paid by an insurance company for lost wages, loss of limb, loss of sight (etc.) may or may not be taxable, depending on circumstance: . . . Get Help Using TurboTax

-

How do Social Security Administration (SSA) and Supplemental Security Income (SSI) differ?

SSA, to which you refer in your question, is the acronym for the United States Social Security Administration. I assume that you are instead referring to the differences between Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) which are most commonly confused.Social Security RetirementSocial Security Retirement benefits are entitlements (the right to guaranteed benefits under a government program, as Social Security or unemployment compensation) and require the following:meet the required work credits,paid into Social Security and Medicare through payroll deductions or self-employment,are of retirement age, 62-70.Simply put, SSDI is available to workers who have accumulated a sufficient number of work credits and become disabled and unable to work before retirement age. SSI benefits may be available for disabled, low-income individuals who have never worked or have not earned enough work credits.Many people mistakenly believe that SSI and SSDI are the same things. Where in fact, they are two entirely different programs. Despite the fact that both programs are managed by the Social Security Administration, and medical eligibility for disability is determined using the same requisites for both programs, there remain distinct differences between the two; the main point in error is funding.Social Security payments are funded by the Social Security trust fund.SSI is financed by U.S. Treasury general funds.Social Security is an earned benefit (entitlement) which workers pay into through earnings deductions or paid from self-employment.Social Security Disability InsuranceSSDI is available before retirement age if the individual becomes disabled, (SSA definition: workers who meet medical and insured requirements) and has accumulated enough work credits. Generally, you need 40 credits, 20 of which were earned in the last 10 years ending with the year you become disabled. There are provisions in place for younger workers who may qualify with fewer credits. Unless you are blind, you must have earned at least 20 of the credits in the 10 years immediately before you became disabled.Supplemental Security IncomeSSI is a government program administered by the SSA that provides stipends to low-income people who are age 65 or older or disabled. SSI is based on financial need for individuals or couples that have not accumulated enough qualifying hours and become disabled. If the household countable income exceeds the current income limits, the determination will indicate that there is no need. For 2017, the income limits are $8,830.84 for an individual or $13,244.80 for a couple. SSI also outlines guidelines for couples: if you are both disabled (SSA definition) and demonstrate financial need (insufficient or no income and less than $2,000 in assets), you may qualify for SSI.

-

Does the SSA (Social Security Administration) require an appointment when I want to ask about my retirement benefits? Can I just walk in?

First, let me say that SSA employees are NOT “order takers”. Yes, you will be presented with all available options. That's our job. (Even though I'm retired, I still consider myself part of the SSA family). The Claims Representative/Social Insurance Specialist cannot make your decision for you. That's obvious. It's a free country - at least for now. :). However, they will guide you and do the math to show you gains and losses depending on the choice you make. If you choose something that is clearly not in your best financial interest causing you to lose money in the long term, and we can't change your mind, we must have you sign a statement that you are aware of the adverse effects.Whew. Sorry. Had to get that off my chest. Now, back to the question at hand.Yes, you can simply walk in. However, depending on the day, and how busy the office is, you will likely have a wait and should be prepared for that. Please be aware though that most things these days can be handled online or by phone. If you would like to minimize your wait, call for an appointment , but be prepared to wait 2–3 weeks for one, especially in large urban areas. You will always be taken care of however you decide to seek the services. If you walk in, avoid Mondays, days immediately after holidays, and the first week of the month.Hope this helps! I didn't mean to write a book, but I spent 38 years with the agency, all of it in a Field Office on the front lines. I strongly feel that the overwhelming majority of SSA employees take pride in serving their country every day. We just do it with pen, paper, and computers instead of weapons.

-

When did the Social Security Administration (SSA) begin to require immigrants to apply for a Social Security number (SSN) cards as part of the immigration process?

The original purpose of the SSN was a way of keeping track of a person's earnings for later retirement benefits. Other places started using the number for other things, but as far as SSA is concerned, that number keeps track of your earnings.If an immigrant didn't get a card, SSA wouldn't care.Employers, however, will need to see an SSN in order to report earnings and all of that stuff, or use the number to verify that the person can work in the US.So SSA doesn't require it. But other people might.Of course, it's easy. Go to the office with the DHS documents and your ID and wait 2 weeks, unless DHS is slow with your information.

-

Why is Social Security Administration (SSA) denying disability claims and making the claims go to a hearing level in front of a judge?

A few years ago there was a lot of news articles stating a similar theories and attorneys gain customers from these rumors. SSA is open with their yearly data on the website, you can read more about the 2016 ALJ Disposition Data and Hearing Office Workload Data. You can see from these links that the workload for processing claims is huge, often details will get overlooked if you are not prepared when you file your claim. Also if you hire an attorney early in the disability claim process there is an incentive for them to extend the time for processing the claim, the attorney will receive a larger back pay.SSA disability is a long term disability program, only. Most approved disability claims will continue payments for many years (and of course this is based on eligibility). It’s hard to get on SSA disability for a reason, and one of those reasons is to help deter fraud or deter ineligible claimants.SSA disability claims are denied for a lot of different reasons. SSA is not purposefully sending claims directly to an ALJ judge as that is wasteful behavior, but rather it’s a complicated program and there are a lot of reasons that can cause disability denial. I will list a few of these reasons below.Most commonly seen reasons for denial;a problem getting the medical records - often times claimants will have more than one medical condition and a series of doctors in which they need to collect records from,the severity of the disability is not reported in the medical record(s),the medical record(s) are unclear.If the disability claim involves Supplemental Security Income (SSI) there can be many more issues with SSI eligibility (such as income, living arrangement, etc).Other possible but less common reasons for denial;the disabled person is still working (this can mean self employment too) and is actively making too much money,insured status issues (this could mean not enough current work history before becoming disabled),proof of age/identification/proof of immigration or citizenship and related issues.

-

The IRS asked for an SSA exemption statement when I filed Form 843 to claim a refund of my Social Security taxes. What is this Social Security exemption statement?

You need to provide a copy of your F, J M or Q visa (those which are exempt from Social Security) and a copy of your immigration paperwork showing that your Visa Status is valid (I-20 or DS-2019, for example).You cite IRC Section 3121(b)(19) indicating that this section excludes nonresidents in this status from social security. Indicate that your employer incorrectly withheld FICA while you were a nonresident in exempt status.

Create this form in 5 minutes!

How to create an eSignature for the social security administration form ssa 3288

How to make an eSignature for your Social Security Administration Form Ssa 3288 in the online mode

How to make an eSignature for your Social Security Administration Form Ssa 3288 in Google Chrome

How to generate an eSignature for putting it on the Social Security Administration Form Ssa 3288 in Gmail

How to create an eSignature for the Social Security Administration Form Ssa 3288 from your smart phone

How to generate an electronic signature for the Social Security Administration Form Ssa 3288 on iOS

How to generate an eSignature for the Social Security Administration Form Ssa 3288 on Android

People also ask

-

Can you mail a Social Security card?

If you can't apply online, you can print out the application and submit it \u2014 and your documents \u2014 by mail, or take them to your local Social Security office or Social Security card center. Look online for the mailing address of the nearest Social Security office or card center.

-

Can I get a Social Security card the same day?

Unfortunately, it's not possible to get a Social Security card the same day. The government takes anywhere from 7-10 days or more to process your application. There is no way to expedite this process.

-

What documents do I need to get a replacement Social Security card?

To Obtain a New Social Security Number and Card you will need to provide at least two documents to prove age, identity, and U.S. citizenship or current immigration status. To Obtain a Replacement Card, if lost or stolen, you must prove your identity and U.S. citizenship.

-

Where do I send my Social Security records?

Request detailed information about your earnings or employment history. Instead, complete and mail form SSA-7050-F4. You can obtain form SSA-7050-F4 from your local Social Security office or online at www.ssa.gov/online/ssa-7050.pdf.

-

How long does it take to get a Social Security card after applying?

You should receive your SSN card within 2 weeks after we have everything we need to process your application, including verification of your immigration document with the USCIS. If we are unable to immediately verify your immigration document with the USCIS, it may take 2 additional weeks to receive your card.

Get more for Ssa 3288

- Fm crcf 01 june optional state supplementation form

- Army lesson plan example form

- Vs 16 3 form

- Chapter 4 biology test answer key form

- Temporary event notice crawley borough council form

- Renewal form for ttc wheel trans support person assistance card fill

- Faller trainee weekly training plan and bcforestsafe org form

- Elementary progress report card grades 7 8 progress report card public version form

Find out other Ssa 3288

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast