941a Me Form

What is the 941a Me Form

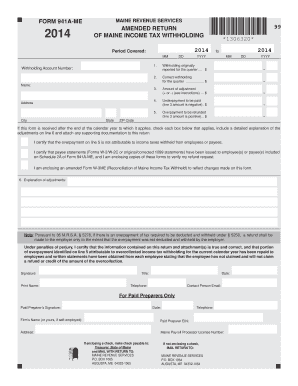

The 941a Me Form is a tax document used by employers in the United States to report employment taxes. It is specifically designed for reporting adjustments to previously filed Form 941, which is the Employer's Quarterly Federal Tax Return. This form allows businesses to correct errors or report changes in their payroll tax obligations. It is essential for maintaining accurate tax records and ensuring compliance with federal tax regulations.

Steps to complete the 941a Me Form

Completing the 941a Me Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your Employer Identification Number (EIN) and details of the original Form 941 that needs adjustment. Next, fill out the form by providing the required information in the designated fields. Be sure to include any corrections or adjustments to the tax amounts reported previously. After completing the form, review it carefully for any errors or omissions before submitting it to the IRS.

Legal use of the 941a Me Form

The legal use of the 941a Me Form is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the appropriate time frame. Electronic submissions are permissible, provided they comply with the eSignature regulations outlined in the ESIGN Act and UETA. Maintaining a record of the submission and any correspondence with the IRS is crucial for legal compliance and future reference.

Filing Deadlines / Important Dates

Filing deadlines for the 941a Me Form align with the quarterly deadlines for Form 941. Employers must submit the form within a specific time frame to avoid penalties. It is important to keep track of these deadlines, as late submissions can result in fines and interest on unpaid taxes. The IRS typically requires that adjustments be filed within three years of the original filing date to be considered valid.

Key elements of the 941a Me Form

Key elements of the 941a Me Form include the identification of the employer, the EIN, and the specific adjustments being made to previously reported figures. The form requires detailed information about the wages paid, taxes withheld, and any corrections to those amounts. Additionally, it includes sections for the employer's signature and date, confirming the accuracy of the information provided.

How to obtain the 941a Me Form

The 941a Me Form can be obtained directly from the IRS website or through authorized tax professionals. Employers can download the form in PDF format, which can be filled out electronically or printed for manual completion. It is essential to ensure that you are using the most current version of the form to comply with IRS requirements.

Examples of using the 941a Me Form

Examples of using the 941a Me Form include situations where an employer needs to correct an error in reported wages or tax withholdings from a previous quarter. For instance, if an employer discovers that they reported higher wages than actually paid, they can use the 941a Me Form to adjust the figures. Similarly, if there was an overpayment of payroll taxes, this form allows the employer to rectify the amounts reported on the original Form 941.

Quick guide on how to complete 941a me form

Prepare 941a Me Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage 941a Me Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign 941a Me Form without difficulty

- Obtain 941a Me Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 941a Me Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 941a me form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 941a Me Form and why is it important?

The 941a Me Form is a tax form used by employers to report quarterly payroll taxes to the IRS. It’s important because it helps ensure compliance with tax regulations and avoids penalties. Properly submitting the 941a Me Form can also enhance your business’s credibility and financial health.

-

How can airSlate SignNow help with the 941a Me Form?

airSlate SignNow streamlines the process of completing and signing the 941a Me Form electronically. With our intuitive platform, users can easily fill out, eSign, and send the form securely. This efficiency saves time and reduces the risk of errors, ensuring your tax documents are submitted accurately.

-

Is there a cost associated with using airSlate SignNow for the 941a Me Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. These plans provide access to features specifically designed for managing documents like the 941a Me Form. Additionally, the cost is generally competitive and can lead to signNow savings through improved efficiency.

-

What features does airSlate SignNow offer for managing the 941a Me Form?

airSlate SignNow includes features such as easy template creation, electronic signatures, and secure document storage specifically for the 941a Me Form. Users can also track document status in real-time and send reminders to signers, ensuring that your tax reporting process stays on schedule.

-

Can I integrate airSlate SignNow with other software for the 941a Me Form?

Absolutely! airSlate SignNow offers integrations with popular accounting and HR software, making it easier to manage the 941a Me Form alongside other business processes. Integrating these systems streamlines data transfer and ensures that all information related to payroll taxes is cohesive and up-to-date.

-

What benefits does airSlate SignNow provide for submitting the 941a Me Form?

Using airSlate SignNow for the 941a Me Form offers numerous benefits, including enhanced security, reduced processing time, and a user-friendly interface. This allows businesses to focus more on operations while ensuring that their tax forms are filed correctly and on time. Moreover, improved organization and tracking capabilities further support compliance.

-

Is airSlate SignNow compliant with federal regulations for the 941a Me Form?

Yes, airSlate SignNow is designed to comply with federal regulations, including those governing the 941a Me Form. We prioritize data security and adhere to best practices in electronic signature law, ensuring that all documents signed through our platform are legally binding and secure.

Get more for 941a Me Form

- How to replace your driver license commercial driver form

- Fillable online form oisss 160 request for data

- Academic review board policies and petition forms

- Confidential statement for financing studies amp sponsorship form

- Pdf course or event request form uc davis health

- Cobra insurancehealth benefits after job loss form

- Dept of labor podcast home page alaska department of form

- Form 43 notice to administrative law judge and employee

Find out other 941a Me Form

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal