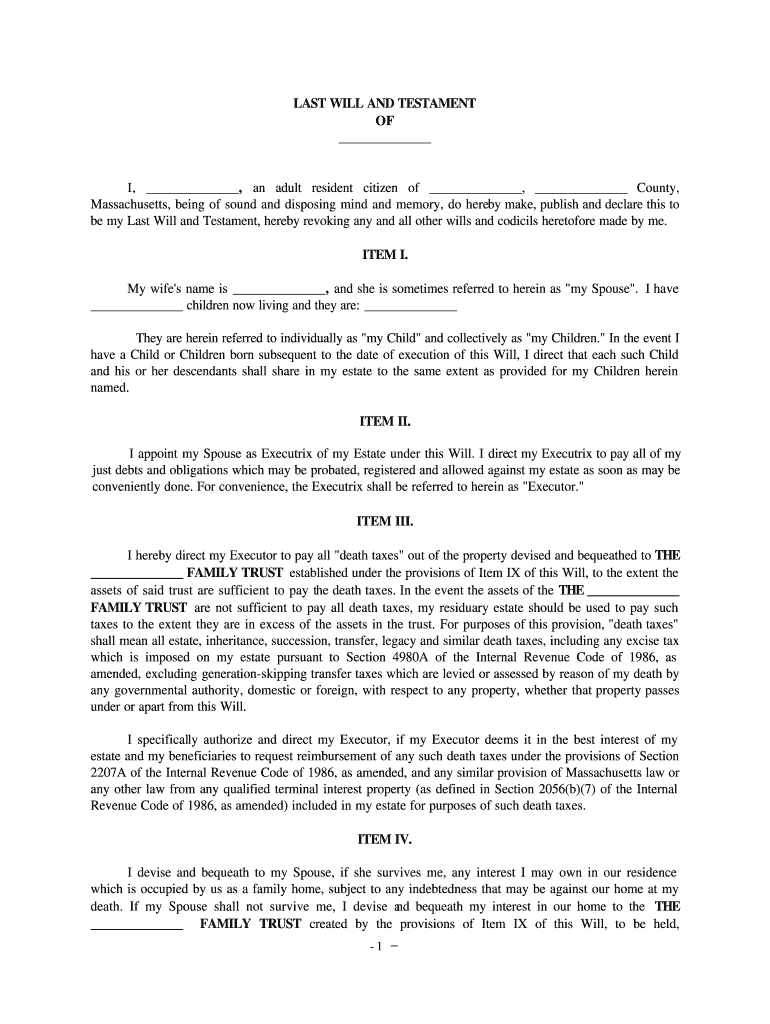

Credit Shelter Trust Form

What is the Credit Shelter Trust Form

The credit shelter trust form is a legal document used to establish a trust that can help minimize estate taxes for married couples. This form allows individuals to allocate assets into a trust, ensuring that a certain amount of the estate is exempt from taxation upon the death of the first spouse. By utilizing this form, couples can effectively manage their assets and provide for their heirs while maximizing tax benefits. The credit shelter trust is particularly relevant in Massachusetts, where estate tax laws can significantly impact the financial legacy left behind.

How to use the Credit Shelter Trust Form

Using the credit shelter trust form involves several key steps. First, individuals must gather necessary information about their assets, beneficiaries, and any specific terms they wish to include in the trust. Once this information is compiled, the form can be filled out accurately, ensuring all required fields are completed. After completing the form, it is essential to sign it in accordance with Massachusetts law to ensure its validity. Consulting with a legal professional can provide additional guidance and ensure that the trust is set up correctly to meet the individual's needs.

Steps to complete the Credit Shelter Trust Form

Completing the credit shelter trust form involves a systematic approach:

- Gather information about your assets, including real estate, bank accounts, and investments.

- Identify your beneficiaries and their respective shares in the trust.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Sign the form in the presence of a notary public to ensure its legal standing.

- Store the completed form in a safe place and share copies with relevant parties.

Legal use of the Credit Shelter Trust Form

The legal use of the credit shelter trust form is governed by both state and federal laws. In Massachusetts, it is crucial to adhere to specific regulations regarding trust creation and management. The form must be executed properly to ensure that it is recognized by the courts and tax authorities. Additionally, individuals should be aware of the implications of the trust on their estate planning, including how it affects the distribution of assets and potential tax liabilities. Consulting with an estate planning attorney can help clarify any legal complexities associated with the credit shelter trust.

State-specific rules for the Credit Shelter Trust Form

In Massachusetts, there are particular rules that govern the establishment and operation of credit shelter trusts. These rules dictate how assets can be allocated, the rights of beneficiaries, and the tax implications for the estate. For instance, Massachusetts has a relatively low estate tax exemption threshold compared to other states, making the credit shelter trust an important tool for estate planning. Understanding these state-specific regulations is essential for ensuring compliance and maximizing the benefits of the trust.

Required Documents

To complete the credit shelter trust form, certain documents are typically required. These may include:

- Proof of ownership for all assets intended to be placed in the trust.

- Identification documents for all parties involved, including the grantor and beneficiaries.

- Any existing wills or estate planning documents that may affect the trust.

- Financial statements that provide a clear picture of the grantor's assets.

Examples of using the Credit Shelter Trust Form

There are various scenarios in which the credit shelter trust form can be beneficial. For example, a married couple with significant assets may use the trust to ensure that their estate remains below the taxable threshold after the death of the first spouse. Another example could involve a couple wanting to provide for their children while minimizing tax liabilities. Each situation may require tailored provisions within the trust, making it essential to consider individual circumstances when utilizing the form.

Quick guide on how to complete credit shelter trust form

Effortlessly Prepare Credit Shelter Trust Form on Any Device

The management of documents online has become increasingly popular among both companies and individuals. It offers an ideal environmentally friendly option to traditional printed and signed documents, allowing you to access the appropriate template and securely store it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Manage Credit Shelter Trust Form on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to Modify and Electronically Sign Credit Shelter Trust Form with Ease

- Obtain Credit Shelter Trust Form and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Credit Shelter Trust Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit shelter trust form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit shelter trust in Massachusetts?

A credit shelter trust in Massachusetts is a legal arrangement that allows individuals to set aside a portion of their estate tax-free for their beneficiaries. This trust is designed to maximize wealth transfer while minimizing tax liabilities, making it a popular choice for estate planning.

-

How does airSlate SignNow assist with managing credit shelter trust documents in Massachusetts?

airSlate SignNow simplifies the process of managing credit shelter trust documents in Massachusetts by allowing users to create, send, and eSign essential documents electronically. Its user-friendly interface and features ensure that all necessary estate planning documents are easy to handle and securely stored.

-

What are the benefits of using airSlate SignNow for credit shelter trusts in Massachusetts?

Using airSlate SignNow for credit shelter trusts in Massachusetts provides several benefits, including increased efficiency, enhanced security, and cost-effectiveness. It allows estate planners to streamline their document management process, ensuring quicker execution and access to important documents.

-

Is airSlate SignNow compliant with Massachusetts laws regarding credit shelter trusts?

Yes, airSlate SignNow is compliant with Massachusetts regulations concerning credit shelter trusts. Users can create legally-binding electronic signatures and documents, ensuring that all procedures are consistent with state laws and requirements.

-

How much does airSlate SignNow cost for managing credit shelter trust documents in Massachusetts?

airSlate SignNow offers flexible pricing plans that cater to various needs, including those managing credit shelter trust documents in Massachusetts. Potential customers can explore different packages and choose one that suits their document management requirements while being budget-friendly.

-

Can airSlate SignNow integrate with other tools for credit shelter trust management in Massachusetts?

Absolutely! airSlate SignNow integrates seamlessly with various platforms and applications, facilitating efficient management of credit shelter trust documents in Massachusetts. This interoperability allows users to enhance their workflow and synchronize their document management processes across different tools.

-

What features does airSlate SignNow offer for credit shelter trust planning in Massachusetts?

airSlate SignNow provides several key features for effective credit shelter trust planning in Massachusetts, including customizable templates, bulk send capabilities, and secure storage options. These features are designed to enhance collaboration and facilitate efficient document handling.

Get more for Credit Shelter Trust Form

- Select university of alberta form

- Instructions for completing the critical accident recovery plan form

- Application for admission university of alberta form

- Site declaration form

- Family history form general

- B2b bank form

- Report of completion of candidacy examination student has form

- 2018 process for minor box lacrosse release requests form

Find out other Credit Shelter Trust Form

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later