Tpt20 Form

What is the Tpt20 Form

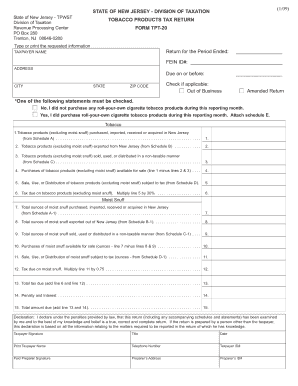

The Tpt20 Form is a specific document used primarily for tax purposes in the United States. It is essential for individuals and businesses to report certain financial details to the appropriate tax authorities. This form typically applies to various entities, including corporations and partnerships, and is crucial for maintaining compliance with federal and state tax regulations.

How to use the Tpt20 Form

Using the Tpt20 Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with precise information, ensuring that all sections are completed as required. After completing the form, review it for accuracy before submitting it to the relevant tax authority. It is advisable to keep a copy for your records.

Steps to complete the Tpt20 Form

Completing the Tpt20 Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Tpt20 Form from the appropriate tax authority.

- Fill in your personal or business information, including name, address, and identification numbers.

- Report your income and expenses accurately in the designated sections.

- Double-check all entries for errors or omissions.

- Sign and date the form before submission.

Legal use of the Tpt20 Form

The Tpt20 Form is legally binding when completed accurately and submitted on time. To ensure its legal validity, it must adhere to the guidelines set forth by the Internal Revenue Service (IRS) and any applicable state regulations. This includes proper signatures and compliance with eSignature laws if filed electronically. Utilizing a trusted eSigning solution can enhance the form's legal standing.

Filing Deadlines / Important Dates

Timely filing of the Tpt20 Form is crucial to avoid penalties. The specific deadlines may vary based on the filing status of the entity. Generally, the form must be submitted by the due date of the tax return for the corresponding year. It is advisable to check the IRS website or consult a tax professional for the exact dates relevant to your situation.

Required Documents

Before completing the Tpt20 Form, gather all necessary documents to ensure accurate reporting. Commonly required documents include:

- Income statements, such as W-2s or 1099s.

- Records of business expenses, including receipts and invoices.

- Previous tax returns for reference.

- Any additional documentation required by state authorities.

Who Issues the Form

The Tpt20 Form is typically issued by the state tax authority or the Internal Revenue Service, depending on the context in which it is used. It is important to ensure that you are using the correct version of the form for your specific filing requirements. Checking with the relevant tax authority can provide clarity on the issuance and applicability of the form.

Quick guide on how to complete tpt20 form

Easily Prepare Tpt20 Form on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Tpt20 Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Tpt20 Form Effortlessly

- Locate Tpt20 Form and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure confidential information using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the frustration of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Tpt20 Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tpt20 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tpt20 Form and how is it used?

The Tpt20 Form is a crucial document for businesses that need to report and manage certain transactions. With airSlate SignNow, you can easily prepare, send, and eSign the Tpt20 Form, ensuring accuracy and compliance. This efficient process helps streamline your documentation workflows.

-

How can I create a Tpt20 Form using airSlate SignNow?

Creating a Tpt20 Form with airSlate SignNow is straightforward. Simply log into your account, select the option to create a new document, and use our templates or customize your own. Once your form is ready, you can easily send it for eSignature.

-

Is there a cost associated with using airSlate SignNow for the Tpt20 Form?

Yes, airSlate SignNow offers various subscription plans tailored to your needs, including options for teams and businesses. These plans provide access to all features necessary for handling the Tpt20 Form efficiently. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for the Tpt20 Form?

airSlate SignNow provides features like customizable templates, bulk sending, and real-time tracking specifically for the Tpt20 Form. Additionally, you can securely store signed forms and ensure they are easily accessible whenever needed. These features enhance productivity and compliance.

-

Can I track the status of my Tpt20 Form with airSlate SignNow?

Absolutely! With airSlate SignNow, you have real-time tracking capabilities for your Tpt20 Form. You will receive notifications when the document is viewed, signed, and completed, providing transparency and ensuring that no steps in the process are missed.

-

What benefits does eSigning the Tpt20 Form provide?

eSigning the Tpt20 Form with airSlate SignNow offers numerous benefits, including speed, security, and convenience. It eliminates the need for physical paperwork, making it easier to complete transactions. Furthermore, eSigned documents are legally binding and provide an audit trail.

-

Are there integrations available for the Tpt20 Form with airSlate SignNow?

Yes, airSlate SignNow offers a variety of integrations with essential tools and platforms that can enhance how you manage the Tpt20 Form. Connect with applications like CRM systems and cloud storage services for seamless workflow. This flexibility helps streamline processes across your business.

Get more for Tpt20 Form

- Wwwirsgovpubirs pdfdeduction interest mortgage irs tax forms

- Who qualifies for the earned income tax credit eitc income limits and range of eitcearned income tax credithow to claim the form

- Publication 6961 rev 8 2021 calendar year projections of information and withholding documents for the united states and irs

- Fillable online swiss sustainability week fax email print form

- 2021 instructions for form 1042 internal revenue service

- Gonazales form 1040 schedule 3pdf schedule 3 department

- Wwwirsgovstatisticssoi tax stats projectionssoi tax stats internal revenue service form

- Cit 0014 f 470922517 form

Find out other Tpt20 Form

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure