Who Qualifies for the Earned Income Tax Credit EITC Income Limits and Range of EitcEarned Income Tax CreditHow to Claim the Earn 2021

Who Qualifies for the Earned Income Tax Credit (EITC)

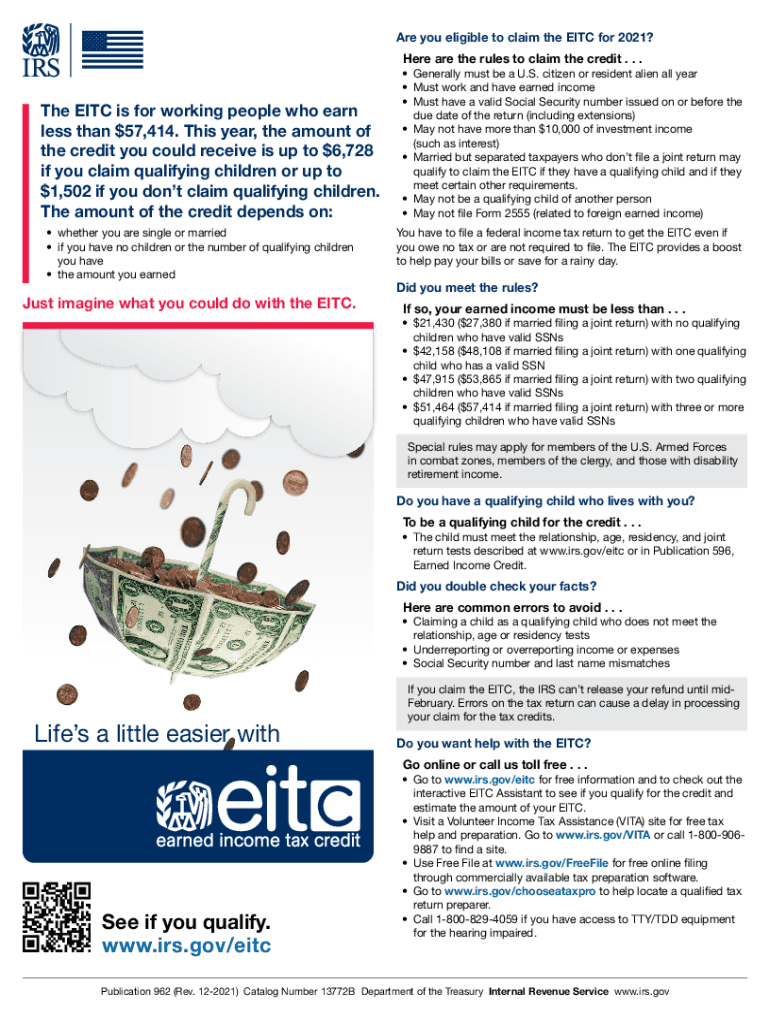

The Earned Income Tax Credit (EITC) is designed to benefit low to moderate-income working individuals and families. To qualify for the EITC, you must meet several criteria:

- You must have earned income from employment or self-employment.

- Your filing status can be single, married filing jointly, head of household, or qualifying widow(er).

- Your investment income must be below a certain threshold, which is updated annually.

- You must have a valid Social Security number.

- Depending on your filing status, you may need to have qualifying children or meet specific age requirements if you do not.

How to Claim the Earned Income Tax Credit (EITC)

Claiming the EITC involves a few straightforward steps:

- Ensure you meet the eligibility criteria outlined by the IRS.

- Gather necessary documentation, including your Social Security number, income statements, and any relevant tax forms.

- Complete your tax return using Form 1040 or 1040-SR, and include the EITC information on the form.

- File your tax return by the deadline, either online or by mail.

Key Elements of the EITC

Understanding the key elements of the EITC can help you maximize your benefits:

- The amount of the credit varies based on your income, filing status, and number of qualifying children.

- The EITC is refundable, meaning if the credit exceeds your tax liability, you may receive the difference as a refund.

- Annual updates to income limits and credit amounts are published by the IRS, reflecting changes in inflation and tax law.

Required Documents for EITC

To successfully claim the EITC, you will need to provide several documents:

- Proof of earned income, such as W-2 forms or self-employment income documentation.

- Social Security cards for you and any qualifying children.

- Tax forms from prior years, if applicable.

Filing Deadlines for EITC

Filing deadlines are crucial for claiming the EITC:

- The standard deadline for filing your federal tax return is April 15 each year.

- If you are unable to file by this date, you may request an extension, but this does not extend the time to pay any taxes owed.

IRS Guidelines for EITC

The IRS provides detailed guidelines for claiming the EITC, which include:

- Eligibility requirements based on income and family size.

- Instructions for filling out the necessary tax forms accurately.

- Information on how to appeal if your claim is denied.

Quick guide on how to complete who qualifies for the earned income tax credit eitc income limits and range of eitcearned income tax credithow to claim the

Effortlessly prepare Who Qualifies For The Earned Income Tax Credit EITC income Limits And Range Of EitcEarned Income Tax CreditHow To Claim The Earn on any device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Manage Who Qualifies For The Earned Income Tax Credit EITC income Limits And Range Of EitcEarned Income Tax CreditHow To Claim The Earn on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to edit and eSign Who Qualifies For The Earned Income Tax Credit EITC income Limits And Range Of EitcEarned Income Tax CreditHow To Claim The Earn with ease

- Locate Who Qualifies For The Earned Income Tax Credit EITC income Limits And Range Of EitcEarned Income Tax CreditHow To Claim The Earn and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or mislaid files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign Who Qualifies For The Earned Income Tax Credit EITC income Limits And Range Of EitcEarned Income Tax CreditHow To Claim The Earn and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct who qualifies for the earned income tax credit eitc income limits and range of eitcearned income tax credithow to claim the

Create this form in 5 minutes!

How to create an eSignature for the who qualifies for the earned income tax credit eitc income limits and range of eitcearned income tax credithow to claim the

The way to generate an e-signature for your PDF in the online mode

The way to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an e-signature for a PDF document on Android OS

People also ask

-

What is 'publication 962' and how does it relate to airSlate SignNow?

‘Publication 962’ refers to the IRS document that outlines tax guidelines for various business structures. Understanding 'publication 962' can help airSlate SignNow users comply with tax compliance when managing eSigned documents for their businesses.

-

How does airSlate SignNow assist in managing documents related to 'publication 962'?

With airSlate SignNow, businesses can easily eSign and manage important documents related to 'publication 962.' The platform ensures that your signed documents are securely stored and accessible for tax-related purposes, streamlining your compliance process.

-

Are there any specific features in airSlate SignNow that cater to the requirements of 'publication 962'?

Yes, airSlate SignNow includes features such as customizable templates and automated workflows that can help organizations manage their 'publication 962' documentation needs effectively. These features ensure that users adhere to tax regulations while optimizing document management.

-

What are the pricing options available for airSlate SignNow, particularly for businesses focusing on 'publication 962' compliance?

airSlate SignNow offers various pricing tiers to accommodate businesses of all sizes, including those focused on 'publication 962' compliance. Choose the plan that fits your team's needs and access features essential for efficient document management and eSigning.

-

Can airSlate SignNow integrate with other software for managing documents related to 'publication 962'?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, making it easier to manage documents tied to 'publication 962.' These integrations allow for streamlined workflows and improved efficiency in handling tax-related documents.

-

How does eSigning with airSlate SignNow benefit businesses dealing with 'publication 962' forms?

eSigning with airSlate SignNow offers businesses faster turnaround times and enhanced security for 'publication 962' forms. This not only improves efficiency but also helps ensure compliance with IRS guidelines, reducing the risk of errors in tax documentation.

-

Is airSlate SignNow suitable for small businesses dealing with 'publication 962'?

Yes, airSlate SignNow is an excellent choice for small businesses managing 'publication 962.' Its user-friendly interface and cost-effective pricing make it accessible for smaller operations while providing the necessary features for compliance and document management.

Get more for Who Qualifies For The Earned Income Tax Credit EITC income Limits And Range Of EitcEarned Income Tax CreditHow To Claim The Earn

- Paving contractor package idaho form

- Site work contractor package idaho form

- Siding contractor package idaho form

- Refrigeration contractor package idaho form

- Idaho drainage 497305843 form

- Tax free exchange package idaho form

- Landlord tenant sublease package idaho form

- Buy sell agreement package idaho form

Find out other Who Qualifies For The Earned Income Tax Credit EITC income Limits And Range Of EitcEarned Income Tax CreditHow To Claim The Earn

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free