GONAZALES FORM 1040 SCHEDULE 3 PDF SCHEDULE 3 Department 2021

Understanding the 1040 Schedule 3 IRS Form

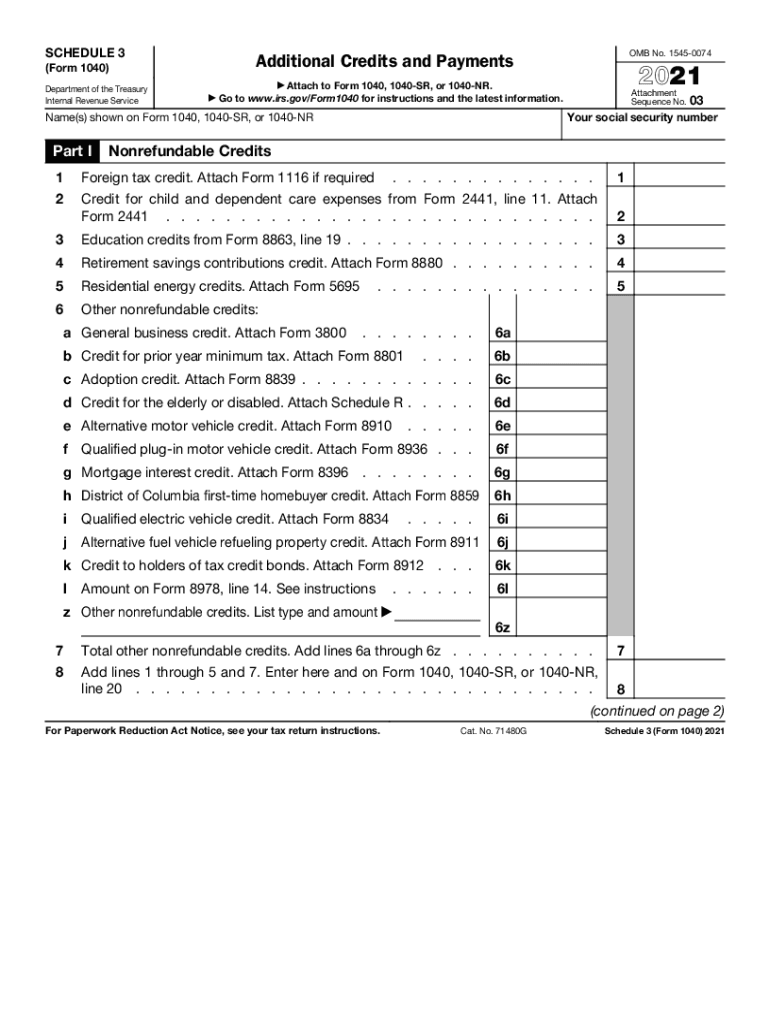

The 1040 Schedule 3 IRS form is a crucial document used by taxpayers in the United States to report certain credits and payments that may reduce their overall tax liability. This form is typically filed along with the main Form 1040 and is essential for individuals who qualify for specific tax credits, including the foreign tax credit, credit for the elderly or disabled, and other nonrefundable credits. Understanding the purpose and requirements of Schedule 3 can help ensure accurate tax reporting and compliance with IRS regulations.

Steps to Complete the 1040 Schedule 3 IRS Form

Completing the 1040 Schedule 3 IRS form involves several straightforward steps. First, gather all necessary documentation, including income statements and details about any applicable credits. Next, accurately fill out the form, ensuring that you report all relevant credits and payments. It's important to cross-check your entries with IRS guidelines to avoid errors. Once completed, attach Schedule 3 to your Form 1040 before submitting it to the IRS, either electronically or via mail.

Eligibility Criteria for Using the 1040 Schedule 3 IRS Form

To use the 1040 Schedule 3 IRS form, taxpayers must meet specific eligibility criteria. This includes having income that qualifies for certain credits, such as those related to education, foreign taxes, or the elderly and disabled. Additionally, taxpayers must ensure they are not claiming credits that are not applicable to their situation. Understanding these criteria can help avoid delays or complications during the tax filing process.

IRS Guidelines for Filing the 1040 Schedule 3 IRS Form

The IRS provides detailed guidelines for completing and filing the 1040 Schedule 3 form. These guidelines cover various aspects, including which credits can be claimed, how to calculate them, and the necessary documentation required for verification. Taxpayers are encouraged to review these guidelines thoroughly to ensure compliance and to maximize their eligible credits, which can significantly impact their overall tax liability.

Form Submission Methods for the 1040 Schedule 3 IRS Form

Taxpayers can submit the 1040 Schedule 3 IRS form through various methods. The most common methods include electronic filing, which is often faster and more secure, or mailing a paper copy to the appropriate IRS address. When filing electronically, ensure that all information is accurately entered to prevent delays. If submitting by mail, consider using certified mail to confirm receipt by the IRS.

Common Mistakes to Avoid with the 1040 Schedule 3 IRS Form

When completing the 1040 Schedule 3 IRS form, taxpayers should be aware of common mistakes that can lead to issues with their tax filings. These include failing to report all eligible credits, incorrect calculations, and not attaching the form to the main Form 1040. Additionally, overlooking the submission deadlines can result in penalties. Careful review and attention to detail can help mitigate these risks.

Quick guide on how to complete gonazales form 1040 schedule 3pdf schedule 3 department

Complete GONAZALES FORM 1040 SCHEDULE 3 pdf SCHEDULE 3 Department effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the right form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage GONAZALES FORM 1040 SCHEDULE 3 pdf SCHEDULE 3 Department on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign GONAZALES FORM 1040 SCHEDULE 3 pdf SCHEDULE 3 Department with ease

- Find GONAZALES FORM 1040 SCHEDULE 3 pdf SCHEDULE 3 Department and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from a device of your preference. Edit and electronically sign GONAZALES FORM 1040 SCHEDULE 3 pdf SCHEDULE 3 Department and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gonazales form 1040 schedule 3pdf schedule 3 department

Create this form in 5 minutes!

How to create an eSignature for the gonazales form 1040 schedule 3pdf schedule 3 department

The way to generate an e-signature for your PDF document in the online mode

The way to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is schedule 3 in airSlate SignNow?

Schedule 3 in airSlate SignNow refers to a specific plan that offers enhanced features for businesses looking to streamline their eSigning processes. This plan includes advanced functionality tailored to meet the needs of teams requiring more robust signing solutions.

-

How much does schedule 3 cost?

The pricing for schedule 3 in airSlate SignNow is competitive, designed to provide great value for businesses of all sizes. It includes options for monthly or annual billing, allowing you to choose a plan that best fits your budget and needs.

-

What features are included in schedule 3?

Schedule 3 includes features such as advanced document editing, bulk sending, and integrations with popular productivity tools. These features are designed to enhance your workflow and improve collaboration within your team.

-

How does schedule 3 benefit businesses?

By choosing schedule 3, businesses benefit from increased efficiency in document management and signing procedures. The plan supports faster turnaround times and offers superior tracking capabilities, ensuring that you never miss an important signature.

-

Can I integrate schedule 3 with other software?

Yes, schedule 3 allows seamless integrations with various applications such as Google Drive, Dropbox, and Salesforce. This connectivity helps centralize your workflows and enhances productivity by allowing you to manage documents from familiar platforms.

-

Is there a trial available for schedule 3?

AirSlate SignNow offers a free trial for schedule 3, allowing prospective users to explore its features before committing to a subscription. This trial period enables you to assess how schedule 3 can meet your specific business needs.

-

What support options are available for schedule 3 users?

Schedule 3 users have access to comprehensive support including live chat, email assistance, and a detailed knowledge base. AirSlate SignNow is committed to ensuring that you have all the help you need to maximize the benefits of your eSigning solution.

Get more for GONAZALES FORM 1040 SCHEDULE 3 pdf SCHEDULE 3 Department

- Special durable power of attorney for bank account matters idaho form

- Idaho small business startup package idaho form

- Idaho property management package idaho form

- Id annual form

- Idaho bylaws 497305875 form

- Sample corporate records for an idaho professional corporation idaho form

- Idaho corporation form

- Sample transmittal letter for articles of incorporation idaho form

Find out other GONAZALES FORM 1040 SCHEDULE 3 pdf SCHEDULE 3 Department

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online