Pgh 40 Form

What is the Pgh 40 Form

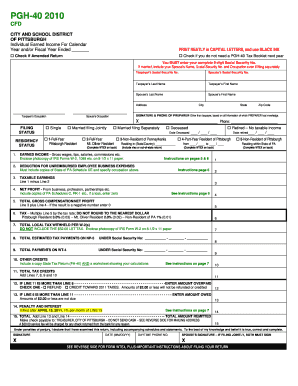

The Pgh 40 Form is a specific document used primarily for tax reporting purposes within the United States. It is designed to collect information related to income, deductions, and credits for individuals or businesses. This form plays a crucial role in ensuring that taxpayers accurately report their financial activities to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the Pgh 40 Form is essential for compliance with federal tax laws.

How to use the Pgh 40 Form

Using the Pgh 40 Form involves several steps to ensure that all necessary information is accurately captured. First, gather all relevant financial documents, such as income statements and receipts for deductions. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Carefully report your income and any applicable deductions or credits. Finally, review the completed form for accuracy before submitting it to the IRS.

Steps to complete the Pgh 40 Form

Completing the Pgh 40 Form requires attention to detail. Follow these steps for a successful submission:

- Collect all necessary financial documents, including W-2s and 1099s.

- Enter your personal information accurately at the top of the form.

- Report all sources of income in the designated sections.

- List any deductions you are eligible for, ensuring you have supporting documentation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Pgh 40 Form

The Pgh 40 Form must be completed in accordance with IRS regulations to be considered legally valid. This includes providing truthful and accurate information, as any discrepancies can lead to penalties or audits. Additionally, it is important to retain copies of the form and any supporting documents for your records, as they may be required for future reference or verification.

Filing Deadlines / Important Dates

Timely filing of the Pgh 40 Form is essential to avoid penalties. The IRS typically sets specific deadlines for tax submissions each year. Generally, individual taxpayers must file by April fifteenth, while businesses may have different deadlines based on their structure. It is advisable to check the IRS website or consult a tax professional for the exact dates relevant to your situation.

Form Submission Methods (Online / Mail / In-Person)

The Pgh 40 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to file electronically using tax software, which often simplifies the process and ensures accuracy.

- Mail: Completed forms can be printed and mailed to the appropriate IRS address. Ensure that you use the correct postage and keep a copy for your records.

- In-Person: Some individuals may prefer to submit their forms in person at designated IRS offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete pgh 40 form

Complete Pgh 40 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Manage Pgh 40 Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest method to modify and eSign Pgh 40 Form without hassle

- Locate Pgh 40 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and bears the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to confirm your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

No need to worry about lost or misplaced documents, tiring form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Edit and eSign Pgh 40 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pgh 40 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pgh 40 Form and how does it work?

The Pgh 40 Form is a critical document for tax reporting purposes, designed to streamline financial declarations. With airSlate SignNow, you can easily fill, sign, and send your Pgh 40 Form electronically, ensuring compliance and efficiency. Our platform not only simplifies the process but also ensures your document is securely stored and easily accessible.

-

How can airSlate SignNow help me with the Pgh 40 Form?

airSlate SignNow offers a user-friendly interface that allows you to fill out the Pgh 40 Form with minimal effort. Our platform supports electronic signatures, ensuring that your forms are not only completed quickly but also legally binding. Beyond simplicity, you can track your document's status in real time.

-

Is airSlate SignNow a cost-effective solution for managing the Pgh 40 Form?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By using our platform to manage your Pgh 40 Form, you can reduce paper usage and save on printing and mailing costs. Our competitive pricing plans cater to various needs, ensuring you find the best fit for your budget.

-

Can I integrate airSlate SignNow with other software for processing the Pgh 40 Form?

Absolutely! airSlate SignNow provides various integrations with popular software solutions to enhance your workflow. By integrating with platforms like CRM systems and accounting software, you can simplify the process of managing the Pgh 40 Form and ensure that all related documents are seamlessly connected.

-

What features should I expect when using airSlate SignNow for the Pgh 40 Form?

When using airSlate SignNow for the Pgh 40 Form, you can expect features like customizable templates, secure electronic signatures, and document tracking capabilities. Additionally, our platform allows you to set reminders for signing deadlines, making it easier to manage your submissions. These features work together to enhance efficiency and accuracy.

-

Is my data safe when using airSlate SignNow for the Pgh 40 Form?

Yes, data security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to protect your information while handling the Pgh 40 Form. Our compliance with industry standards ensures that your documents remain confidential and secure throughout the process.

-

Can I access the Pgh 40 Form on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is optimized for mobile devices, allowing you to access and manage the Pgh 40 Form anytime, anywhere. Whether you are on a smartphone or tablet, our mobile-friendly interface makes it easy to fill out, sign, and send your forms. This flexibility enhances your productivity while on the go.

Get more for Pgh 40 Form

- Bsped paediatric nurse award application form complete

- Pdf consumer complaint against a businesscorporation form

- Piu 2 consumer complaint against a businesscorporation piu 2 consumer complaint against a businesscorporation oag ca form

- Nletc application proceduresadmission requirements form

- Bcia8705 form

- Bcia8705 580277319 form

- Attorney grievance commission v christal elizabeth edwards form

- Cr 125 jv 525 form

Find out other Pgh 40 Form

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online