Schedule Ct 1040crc Form

What is the Schedule CT 1040CRC

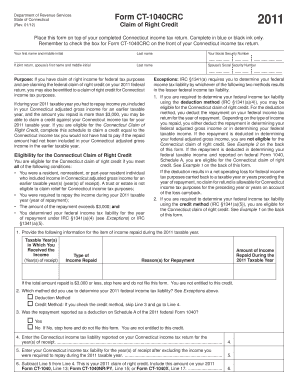

The Schedule CT 1040CRC is a form used by taxpayers in Connecticut to claim a credit for income tax purposes. This schedule is specifically designed for individuals who have earned income and are eligible for a credit against their Connecticut income tax liability. The form allows taxpayers to report their qualifying income and calculate the appropriate credit, which can reduce their overall tax burden. Understanding the purpose and requirements of the Schedule CT 1040CRC is crucial for ensuring accurate tax filing and maximizing potential credits.

How to use the Schedule CT 1040CRC

Using the Schedule CT 1040CRC involves several steps to ensure accurate completion. First, gather all necessary documentation, including income statements and any relevant tax records. Next, carefully fill out the form, providing details about your income and any applicable deductions. It is important to follow the instructions provided with the form to ensure that all information is accurately reported. After completing the schedule, it should be submitted along with your main tax return to the Connecticut Department of Revenue Services.

Steps to complete the Schedule CT 1040CRC

Completing the Schedule CT 1040CRC requires attention to detail. Start by entering your personal information, including your name and Social Security number. Next, report your total income from all sources. Then, calculate the credit by following the guidelines provided on the form. Be sure to double-check all calculations for accuracy. Finally, sign and date the form before submitting it with your Connecticut income tax return. Keeping a copy for your records is also recommended.

Legal use of the Schedule CT 1040CRC

The Schedule CT 1040CRC is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or audits by the Connecticut Department of Revenue Services. Compliance with all relevant tax laws and guidelines is necessary to maintain the legal validity of the form and any credits claimed.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule CT 1040CRC align with the general tax filing deadlines in Connecticut. Typically, individual income tax returns, including the Schedule CT 1040CRC, are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes to deadlines and ensure timely submission to avoid penalties.

Required Documents

To complete the Schedule CT 1040CRC, several documents are necessary. These include your W-2 forms, 1099 forms, and any other income statements that reflect your earnings for the tax year. Additionally, documentation supporting any deductions or credits claimed should be collected. Having all required documents on hand will streamline the completion process and help ensure accuracy.

Who Issues the Form

The Schedule CT 1040CRC is issued by the Connecticut Department of Revenue Services. This state agency is responsible for administering tax laws and collecting taxes in Connecticut. Taxpayers can obtain the form directly from the agency's website or through authorized tax preparation services. It is important to use the most current version of the form to ensure compliance with state regulations.

Quick guide on how to complete schedule ct 1040crc

Effortlessly Prepare Schedule Ct 1040crc on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Handle Schedule Ct 1040crc on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign Schedule Ct 1040crc Without Breaking a Sweat

- Locate Schedule Ct 1040crc and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or hide sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put aside worries about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Schedule Ct 1040crc while ensuring effective communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule ct 1040crc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT 1040 CRC form and why is it important?

The CT 1040 CRC form is a crucial tax document used by residents of Connecticut to report their income and calculate state taxes owed. It is important because accurate filing can lead to potential tax refunds and avoid penalties. Understanding the CT 1040 CRC can also assist businesses in maintaining compliance with state tax regulations.

-

How can airSlate SignNow help with completing the CT 1040 CRC?

airSlate SignNow offers a seamless solution for eSigning and managing your CT 1040 CRC forms. With easy-to-use templates, users can quickly fill out and send their tax documents for signature. This streamlines the filing process, ensuring that you meet deadlines efficiently.

-

Is there a cost associated with using airSlate SignNow for the CT 1040 CRC?

Yes, airSlate SignNow offers various pricing plans that accommodate different business needs. The pricing includes features tailored for eSigning and document management, making it a cost-effective option for completing the CT 1040 CRC. Check our website for detailed pricing information to find the right plan for you.

-

What features does airSlate SignNow offer for managing the CT 1040 CRC?

airSlate SignNow provides features such as template creation, bulk sending, and automatic tracking for your CT 1040 CRC forms. Additionally, it ensures that all signatures are legally binding and compliant with state regulations. This makes managing your tax documents simple and efficient.

-

Can I integrate airSlate SignNow with other software for handling the CT 1040 CRC?

Absolutely! airSlate SignNow integrates seamlessly with various business applications such as CRM tools and cloud storage services. This makes it easier to handle your CT 1040 CRC forms alongside other essential business processes without any complications.

-

What are the benefits of using airSlate SignNow for the CT 1040 CRC?

Using airSlate SignNow for your CT 1040 CRC provides numerous benefits, including reduced paperwork, enhanced security for your sensitive tax information, and faster processing times. The platform improves collaboration, allowing multiple parties to sign and submit documents easily. Overall, it's a smart choice for managing your tax documents efficiently.

-

How secure is airSlate SignNow when dealing with CT 1040 CRC forms?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the CT 1040 CRC. The platform employs robust encryption to protect your data and ensures that all eSigning processes comply with legal standards. This gives you peace of mind knowing that your personal and tax information is safe.

Get more for Schedule Ct 1040crc

- Hearing diagnostic report form

- Ohio j 1 waiver form

- J 1 visa waiver program ohio department of health ohiogov form

- Kansas department for children and families dcfksgov form

- Patient information sheet patient osage county

- Verification of registered nurse rn competency to perform texas health steps checkups form verification of registered nurse rn

- Rehabilitation form apply

- Wwwuslegalformscomform library361910rehabilitation form apply fill and sign printable template

Find out other Schedule Ct 1040crc

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement