Order Requiring Debtor's Employer to Remit Deductionsfrom a Debtor's Paycheck to Trustee Form

What is the Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee

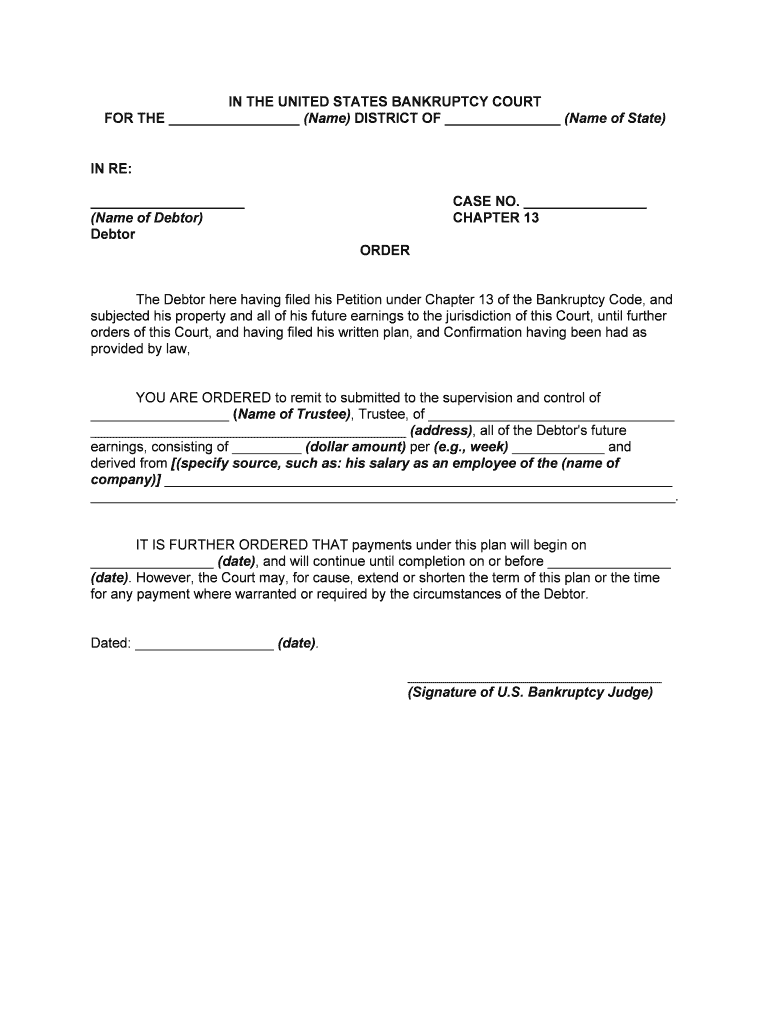

The Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee is a legal document that instructs an employer to withhold a specified amount from an employee's paycheck. This amount is then directed to a trustee, typically in cases of bankruptcy or debt repayment. The order is a critical tool in ensuring that debt obligations are met in a structured manner, allowing for a systematic approach to debt management.

How to Use the Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee

To effectively use this order, the debtor must first ensure that it is correctly filled out and signed. The employer must receive a copy of the order, which outlines the specific deductions to be made. Once the employer acknowledges the order, they are legally obligated to comply with the deductions as specified. It is important for the debtor to maintain communication with both the trustee and the employer to ensure that the process runs smoothly and that all parties are informed of any changes.

Steps to Complete the Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee

Completing the order involves several key steps:

- Gather necessary information, including debtor details and trustee contact information.

- Clearly specify the amount to be deducted from each paycheck.

- Sign the document to validate it legally.

- Distribute copies of the order to the employer and the trustee.

- Keep a copy for personal records.

Key Elements of the Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee

Key elements that must be included in this order are:

- Debtor's full name and contact information.

- Employer's name and address.

- Trustee's name and contact details.

- The specific amount to be deducted from each paycheck.

- Frequency of deductions (e.g., weekly, bi-weekly).

- Effective date of the order.

Legal Use of the Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee

This order is legally binding and must be adhered to by the employer once it is issued. It serves as a formal request to ensure that the debtor's financial obligations are met. Compliance with this order protects the rights of both the debtor and the creditor, as it provides a structured method for repayment. Failure to comply with the order by the employer can result in legal consequences.

State-Specific Rules for the Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee

Each state may have specific regulations regarding the issuance and enforcement of this order. It is essential for debtors to be aware of their state's laws to ensure compliance. Some states may have limits on the amount that can be deducted or specific procedures that must be followed. Consulting with a legal professional familiar with state laws can provide clarity and guidance.

Quick guide on how to complete order requiring debtors employer to remit deductionsfrom a debtors paycheck to trustee

Effortlessly Complete Order Requiring Debtor's Employer To Remit Deductionsfrom A Debtor's Paycheck To Trustee on Any Device

The management of documents online has gained traction among both businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documentation, allowing you to obtain the necessary forms and store them safely online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly and without interruptions. Manage Order Requiring Debtor's Employer To Remit Deductionsfrom A Debtor's Paycheck To Trustee from any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Edit and Electronically Sign Order Requiring Debtor's Employer To Remit Deductionsfrom A Debtor's Paycheck To Trustee with Ease

- Obtain Order Requiring Debtor's Employer To Remit Deductionsfrom A Debtor's Paycheck To Trustee and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, the hassle of searching for forms, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Order Requiring Debtor's Employer To Remit Deductionsfrom A Debtor's Paycheck To Trustee to guarantee outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee?

An Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee is a legal directive that mandates an employer to withhold a portion of an employee's paycheck and remit it to a bankruptcy trustee. This process helps ensure that debt obligations are met in an organized manner, benefiting both the debtor and the creditors.

-

How can airSlate SignNow help with legal documents related to an Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning documents related to an Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee. With its intuitive interface and templates tailored for legal documents, businesses can ensure compliance while saving time and reducing errors.

-

What are the pricing options for airSlate SignNow when dealing with legal orders?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those requiring management of an Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee. You can select from monthly or annual subscriptions, enabling you to choose the best fit for your budget and document management needs.

-

Are there any integrations available with airSlate SignNow for legal processes?

Yes, airSlate SignNow integrates seamlessly with various tools and software relevant to legal processes, including document management systems and accounting software. These integrations enhance functionality and streamline the workflow associated with an Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee.

-

What features does airSlate SignNow offer for handling an Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee?

airSlate SignNow offers key features like customizable templates, automated workflows, and secure cloud storage, all helpful in managing an Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee. These features ensure that legal documents are handled efficiently and securely.

-

How does airSlate SignNow enhance compliance for legal documents like an Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee?

With built-in compliance tools, airSlate SignNow helps ensure that all legal documents, including an Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee, meet necessary regulations. This minimizes the risk of legal issues and provides peace of mind for businesses and their clients.

-

Can airSlate SignNow expedite the process of sending an Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee?

Absolutely! airSlate SignNow streamlines the document sending process for an Order Requiring Debtor's Employer To Remit Deductions from A Debtor's Paycheck To Trustee, allowing for quick eSigning and delivery. This efficiency helps ensure compliance with legal timelines and improves overall satisfaction for clients.

Get more for Order Requiring Debtor's Employer To Remit Deductionsfrom A Debtor's Paycheck To Trustee

- Texas equity form

- Frisco family ear nose and throatadult and pediatric form

- Prior authorizaton form addendum prior authorizaton form addendum

- Texas minor child power of attorney form

- Occupational therapy services cdn form

- Communication template form

- Medical release of information

- Moc part iv credit application form childrens health

Find out other Order Requiring Debtor's Employer To Remit Deductionsfrom A Debtor's Paycheck To Trustee

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form