Colorado 104 Fil in on Line Form

What is the Colorado 104 Fil In On Line Form

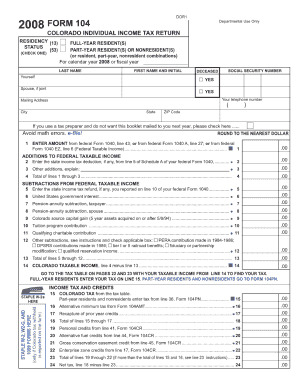

The Colorado 104 Fil In On Line Form is a state-specific tax document used by residents of Colorado to report their income and calculate their state tax liability. This form is essential for individuals who need to file their annual state income tax returns. It allows taxpayers to provide detailed information about their income, deductions, and credits, ensuring compliance with Colorado tax laws.

This form is designed to be filled out electronically, making it accessible and convenient for users. It is part of Colorado's efforts to streamline the tax filing process and encourage digital submissions, which can lead to faster processing times and reduced errors.

How to use the Colorado 104 Fil In On Line Form

Using the Colorado 104 Fil In On Line Form involves several straightforward steps. First, ensure you have all necessary documents and information, including your W-2 forms, 1099s, and any other income statements. Next, access the form through a secure online platform that supports digital signatures and submissions.

Once you have the form open, carefully enter your personal information, including your name, address, and Social Security number. Follow the prompts to input your income details, deductions, and credits. After completing the form, review all entries for accuracy before submitting it electronically.

Steps to complete the Colorado 104 Fil In On Line Form

Completing the Colorado 104 Fil In On Line Form requires several key steps:

- Gather all necessary financial documents, such as W-2s and 1099s.

- Access the Colorado 104 Fil In On Line Form through a secure online platform.

- Fill in your personal information accurately.

- Enter your income details, including wages, interest, and any other sources of income.

- Input applicable deductions and credits to reduce your taxable income.

- Review the completed form for any errors or omissions.

- Submit the form electronically and save a copy for your records.

Legal use of the Colorado 104 Fil In On Line Form

The Colorado 104 Fil In On Line Form is legally recognized as a valid method for filing state income taxes. To ensure its legal standing, it must be completed accurately and submitted in accordance with Colorado tax regulations. Electronic submissions are valid under the Electronic Signatures in Global and National Commerce (ESIGN) Act, provided that the platform used complies with eSignature laws.

It is important to retain copies of the submitted form and any supporting documents, as they may be required for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado 104 Fil In On Line Form typically align with federal tax deadlines. Generally, the annual deadline for filing state income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Taxpayers should also be aware of any extensions that may apply, as well as deadlines for estimated tax payments if applicable. Staying informed about these dates is crucial to avoid penalties and ensure timely compliance.

Required Documents

To complete the Colorado 104 Fil In On Line Form, several key documents are required:

- W-2 forms from employers, detailing annual wages and tax withholdings.

- 1099 forms for any freelance or contract work.

- Documentation for other income sources, such as rental income or dividends.

- Records of deductible expenses, including receipts for business expenses, medical costs, and charitable contributions.

Having these documents ready will streamline the process and help ensure accurate reporting on your tax return.

Quick guide on how to complete colorado 104 fil in on line form

Complete Colorado 104 Fil In On Line Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any hold-ups. Manage Colorado 104 Fil In On Line Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-centered task today.

How to alter and eSign Colorado 104 Fil In On Line Form effortlessly

- Locate Colorado 104 Fil In On Line Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Colorado 104 Fil In On Line Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado 104 fil in on line form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 104 Colorado?

Form 104 Colorado is the state's individual income tax return form used by residents to report their annual income for tax purposes. It includes various schedules that allow taxpayers to detail their earnings, deductions, and credits. Understanding what is Form 104 Colorado is essential for accurate tax filing and compliance with state tax laws.

-

How do I complete Form 104 Colorado?

To complete Form 104 Colorado, you need to gather your financial documents, including W-2s and 1099s. Carefully fill out the form, making sure to include all necessary income sources and applicable deductions. If you're unsure, resources are available to help you understand what is Form 104 Colorado and guide you through the process.

-

What are the key features of using airSlate SignNow for tax documents?

airSlate SignNow offers features such as secure electronic signatures and customizable templates, making it easier to manage documents like Form 104 Colorado. Users can streamline their document workflows and ensure compliance with state regulations. The platform also provides tracking capabilities for peace of mind during tax season.

-

Is airSlate SignNow cost-effective for filing Form 104 Colorado?

Yes, airSlate SignNow provides a cost-effective solution for sending and eSigning tax documents such as Form 104 Colorado. With flexible pricing plans tailored to businesses of all sizes, you can choose an option that fits your budget. The investment in airSlate SignNow can ultimately save you time and resources.

-

What benefits does airSlate SignNow offer for businesses needing to file Form 104 Colorado?

Using airSlate SignNow allows businesses to eSign documents securely and efficiently, streamlining the filing process for Form 104 Colorado. This solution reduces paper usage and facilitates faster transactions. Additionally, compliance with electronic signature laws ensures that your filings are legally binding.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing your ability to file Form 104 Colorado. These integrations help automate your workflow and minimize errors, making it easier for businesses to manage their financial documentation effectively.

-

What types of documents can I sign besides Form 104 Colorado?

With airSlate SignNow, you can sign a variety of documents in addition to Form 104 Colorado, such as contracts, agreements, and other tax forms. The platform supports diverse document types, allowing businesses to consolidate their signing processes into one user-friendly interface. This versatility enhances efficiency and organization.

Get more for Colorado 104 Fil In On Line Form

- 14 day notice to quit form

- Tpg termination request form

- Center for spine sports ampamp physical medicine p form

- Fillable online healthy tipshouston spine ampampampamp sports form

- Consignment form alex lyon amp son

- Case 205 cv 00441 mam document 204 form

- Case 418 cv 00068 jhm document 9 filed 110918 page 1 of 16 pageid form

- Fiu deposit waiver form

Find out other Colorado 104 Fil In On Line Form

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast