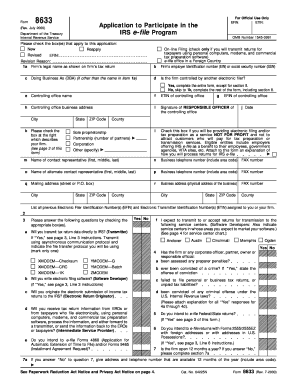

Form 8633

What is the Form 8633

The Form 8633, officially known as the Application to Participate in the IRS e-File Program, is used by tax professionals who wish to become authorized e-file providers. This form is essential for those who want to electronically file tax returns on behalf of clients. Completing this form allows tax professionals to access the IRS e-file system, facilitating a more efficient and streamlined filing process.

How to use the Form 8633

Using the Form 8633 involves several steps. First, ensure that you meet the eligibility criteria, which include being a registered tax professional. Next, download the form from the IRS website or obtain it through authorized channels. Complete the form by providing accurate information about your business, including your IRS Preparer Tax Identification Number (PTIN) and any other required details. Once completed, submit the form to the IRS for processing. It is advisable to keep a copy for your records.

Steps to complete the Form 8633

Completing the Form 8633 requires careful attention to detail. Follow these steps:

- Gather necessary information, including your PTIN and business details.

- Download the Form 8633 from the IRS website.

- Fill out the form accurately, ensuring all sections are completed.

- Review your entries for any errors or omissions.

- Submit the form to the IRS via the specified method, either electronically or by mail.

Legal use of the Form 8633

The legal use of the Form 8633 is governed by IRS regulations. It is essential that the information provided is truthful and accurate, as any discrepancies can lead to penalties or denial of e-file authorization. The form must be submitted in compliance with applicable laws and regulations to ensure that the application is processed correctly and efficiently.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8633 are crucial for tax professionals. Typically, the form should be submitted well in advance of the tax season to allow sufficient time for processing. It is advisable to check the IRS website for any specific deadlines related to e-file participation, as these can vary from year to year.

Required Documents

When completing the Form 8633, certain documents may be required to support your application. These can include:

- Your IRS Preparer Tax Identification Number (PTIN).

- Proof of your tax professional status, if applicable.

- Business identification details, such as your Employer Identification Number (EIN).

Who Issues the Form

The Form 8633 is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. As the authoritative body, the IRS establishes the guidelines and requirements for completing and submitting this form, ensuring that only qualified tax professionals gain access to the e-file program.

Quick guide on how to complete form 8633 1665962

Manage Form 8633 with ease on any device

Digital document handling has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly option to traditional printed and signed papers, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle Form 8633 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Form 8633 effortlessly

- Obtain Form 8633 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Leave behind the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 8633 to maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8633 1665962

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8633 and how is it used?

Form 8633 is an application for becoming an IRS e-file provider. It’s essential for businesses that want to electronically file tax returns and other documents with the IRS. By utilizing airSlate SignNow, you can conveniently manage and eSign your form 8633 online, streamlining the submission process.

-

How does airSlate SignNow simplify the submission of form 8633?

AirSlate SignNow simplifies the submission of form 8633 by providing a user-friendly platform for drafting, signing, and sending documents securely. With its intuitive workflow, businesses can ensure that all required fields are filled and that the document is signed electronically, saving time and reducing errors.

-

Is there a cost associated with submitting form 8633 through airSlate SignNow?

While submitting form 8633 through airSlate SignNow generally incurs no additional fees beyond your subscription, it's important to review the pricing plan you select. AirSlate offers various pricing tiers, providing flexibility for businesses of all sizes while ensuring access to essential features for managing form 8633.

-

What features does airSlate SignNow offer for managing form 8633?

AirSlate SignNow provides features like document templates, eSigning capabilities, and secure cloud storage to simplify managing form 8633. These tools allow businesses to create, edit, and track the status of their forms, ensuring compliance and enhancing efficiency throughout the filing process.

-

Can I integrate airSlate SignNow with other applications while handling form 8633?

Yes, airSlate SignNow offers integration capabilities with various business applications, allowing you to streamline your workflow related to form 8633. Integrating with tools like CRM systems and project management software enhances collaboration and efficiency across teams.

-

What are the benefits of using airSlate SignNow for form 8633 submissions?

Using airSlate SignNow for form 8633 submissions offers several benefits, including enhanced security, faster processing times, and reduced paper usage. The electronic eSigning feature not only saves time but also ensures that your submissions are legally binding and easily accessible.

-

Is support available for filling out form 8633 using airSlate SignNow?

Absolutely! AirSlate SignNow offers customer support to assist you with filling out form 8633 and using their platform effectively. Their knowledgeable support team is ready to help guide you through the process to ensure all your questions are answered.

Get more for Form 8633

- Georgia domestic relations case filing information form non domestic

- Georgia parole board phone number form

- Petition for change of name family clay county form

- Notice of stipulation to active list form

- Georgia notice of petition to change names of minor children form

- Affidavit of diligent search georgia form

- Notice of stipulation form

- Poverty affidavit superior court of fulton county 385337621 form

Find out other Form 8633

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter