Illinois Form 2210

What is the Illinois Form 2210

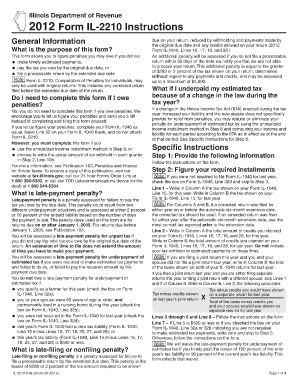

The Illinois Form 2210 is a tax form used by individuals and businesses to calculate and report underpayment penalties for state income tax. This form is essential for taxpayers who did not pay enough tax throughout the year, either through withholding or estimated payments. The form helps determine if a penalty applies and the amount owed, ensuring compliance with Illinois tax regulations.

How to use the Illinois Form 2210

To effectively use the Illinois Form 2210, taxpayers must first gather their income and tax payment information for the year. The form requires details such as total income, tax liability, and any payments made. After completing the calculations, taxpayers can determine if they owe a penalty for underpayment. This form is crucial for accurately reporting tax obligations and avoiding additional penalties.

Steps to complete the Illinois Form 2210

Completing the Illinois Form 2210 involves several key steps:

- Gather all necessary financial documents, including income statements and payment records.

- Calculate your total tax liability for the year.

- Determine the total amount of tax paid through withholding and estimated payments.

- Compare your total tax liability with the amount paid to identify any underpayment.

- Complete the form by filling in the required sections, including calculations for any penalties.

- Review the form for accuracy before submission.

Key elements of the Illinois Form 2210

Several key elements are included in the Illinois Form 2210 that taxpayers should be aware of:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Tax Liability Calculation: A section to calculate the total tax owed for the year.

- Payment History: A summary of all payments made towards the tax liability.

- Penalty Calculation: A formula to determine if a penalty applies and how much is owed.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Illinois Form 2210. Typically, the form must be submitted along with your state income tax return by the due date of the return, which is usually April 15. If you are unable to meet this deadline, you may request an extension, but any penalties for underpayment may still apply if the tax owed is not paid on time.

Penalties for Non-Compliance

Failure to file the Illinois Form 2210 when required can result in significant penalties. Taxpayers may face a penalty of up to 20% of the underpaid tax amount. Additionally, interest may accrue on any unpaid tax, further increasing the total liability. It is crucial for taxpayers to understand their obligations and ensure timely and accurate filing to avoid these penalties.

Quick guide on how to complete il 2210 instructions

Complete il 2210 instructions effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, enabling users to locate the correct form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents promptly without delays. Manage form il 2210 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related operation today.

How to edit and eSign il form 2210 seamlessly

- Find illinois form 2210 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes only seconds and has the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, either via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign il 2210 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to il2210

Create this form in 5 minutes!

How to create an eSignature for the illinois form 2210 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask underpayment penalty form il 2210

-

What is il 2210 and how does it relate to airSlate SignNow?

Il 2210 is a tax form that pertains to underpayment penalties for estimated taxes. While airSlate SignNow does not directly manage tax forms, it provides a seamless platform for eSigning and sending necessary documents, including those like il 2210, ensuring compliance and timeliness in your filing.

-

How does airSlate SignNow simplify the signing process for documents like il 2210?

AirSlate SignNow streamlines the signing process by allowing users to easily upload, send, and eSign documents like il 2210. The platform's intuitive interface ensures that recipients can sign quickly from any device, reducing turnaround times for important tax documents.

-

Are there any costs associated with using airSlate SignNow for documents like il 2210?

AirSlate SignNow offers various pricing plans that cater to different business needs. Regardless of the plan, users can efficiently manage and sign important documents like il 2210 at a cost-effective rate, making it an ideal choice for both individuals and enterprises.

-

What features does airSlate SignNow offer that can help with documents like il 2210?

AirSlate SignNow includes features such as customizable templates, reminders for signers, and secure cloud storage, which can be extremely beneficial when managing documents like il 2210. These tools help ensure that you never miss deadlines and maintain compliance.

-

Can I integrate airSlate SignNow with other applications when handling il 2210?

Yes, airSlate SignNow offers integrations with various applications, including CRM systems and cloud storage platforms. This allows you to streamline your workflow and easily manage your il 2210 documents alongside other important business processes.

-

Is airSlate SignNow secure for signing sensitive documents like il 2210?

Absolutely, airSlate SignNow prioritizes security, employing encryption and secure data storage to protect sensitive documents such as il 2210. Users can eSign with confidence, knowing that their information is safe throughout the signing process.

-

How can airSlate SignNow help speed up the process of submitting il 2210?

By using airSlate SignNow, you can expedite the submission process for il 2210 by utilizing features like automated reminders and tracking functionalities. This ensures that all parties are alerted to sign in a timely manner, helping avoid any penalties related to late submissions.

Get more for form il 2210

- Annual financial checkup package west virginia form

- Bill of sale package west virginia form

- Living wills and health care package west virginia form

- Last will and testament package west virginia form

- Subcontractors package west virginia form

- Protecting minors from identity theft package west virginia form

- Identity theft prevention package west virginia form

- West virginia deceased form

Find out other il form 2210

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed