Indiana Form 130

What is the Indiana Form 130?

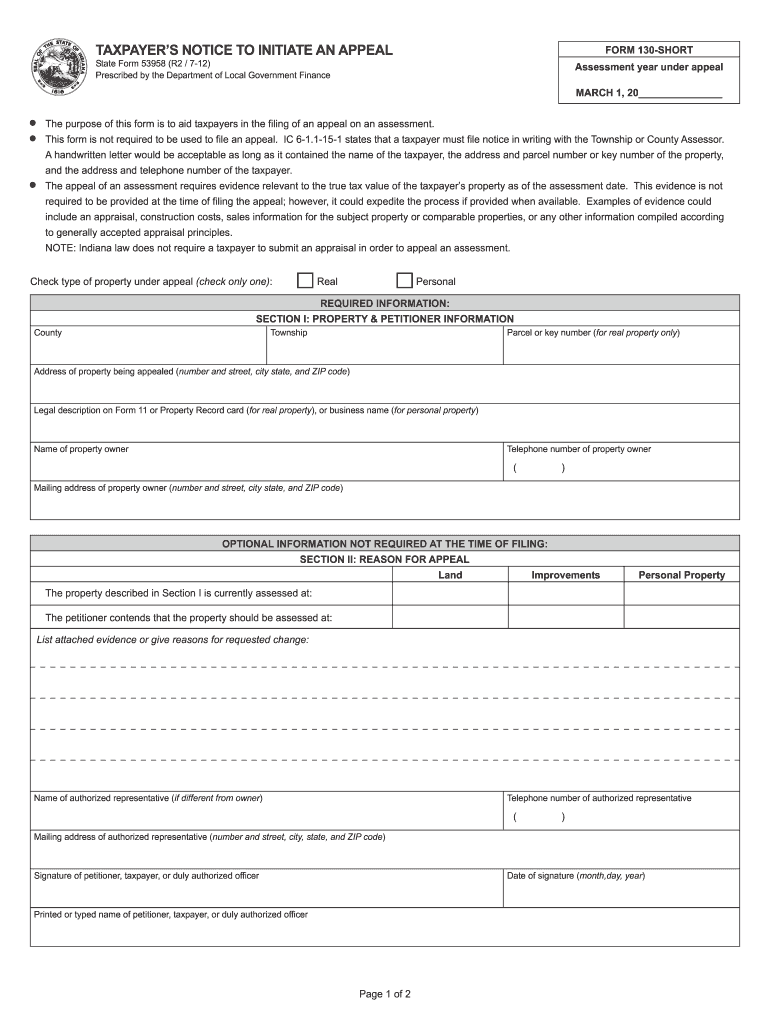

The Indiana Form 130, also known as the Indiana Property Tax Appeal Form, is a document used by property owners in Indiana to appeal their property tax assessments. This form allows taxpayers to challenge the assessed value of their property, which can directly impact the amount of property tax owed. By filing this form, individuals can seek a reassessment if they believe their property has been overvalued by the local assessor.

How to use the Indiana Form 130

Using the Indiana Form 130 involves several key steps. First, property owners must gather relevant information, including their property tax assessment details and any evidence supporting their claim for a lower assessment. Next, they should complete the form accurately, providing all required information, such as property identification and the basis for the appeal. Once completed, the form must be submitted to the appropriate county office within the specified deadline to ensure consideration of the appeal.

Steps to complete the Indiana Form 130

Completing the Indiana Form 130 requires careful attention to detail. Follow these steps:

- Obtain the form from the Indiana Department of Local Government Finance or your local county assessor's office.

- Fill in your property details, including the parcel number and address.

- Clearly state the reasons for your appeal, providing supporting documentation where applicable.

- Sign and date the form to validate your submission.

- Submit the form to your local county assessor's office by mail or in person, ensuring it is done within the appeal deadline.

Legal use of the Indiana Form 130

The Indiana Form 130 is legally recognized as a valid means for property owners to contest their property tax assessments. When properly completed and submitted, it initiates a formal review process by the local assessment board. It is essential that all information provided is truthful and accurate, as any discrepancies could lead to penalties or dismissal of the appeal.

Filing Deadlines / Important Dates

Timeliness is crucial when filing the Indiana Form 130. Typically, the deadline for submitting this form is June 15 of the assessment year. Property owners should be aware of this date and ensure their appeal is filed on time to avoid missing the opportunity for a reassessment. Additionally, it is advisable to check for any specific local deadlines that may apply.

Required Documents

When filing the Indiana Form 130, certain documents may be required to support your appeal. These can include:

- Copy of the current property tax assessment notice.

- Evidence of comparable property values, such as recent sales data.

- Photographs of the property, if applicable.

- Any other documentation that substantiates your claim for a lower assessment.

Who Issues the Form

The Indiana Form 130 is issued by the Indiana Department of Local Government Finance. Local county assessors also provide access to the form and can offer guidance on the appeal process. It is important for property owners to consult with their local office for any specific instructions or additional requirements related to their appeal.

Quick guide on how to complete taxpayers notice to initiate appeal form 130 short

Effortlessly Prepare Indiana Form 130 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily access the required form and securely maintain it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Indiana Form 130 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The Simplest Way to Modify and eSign Indiana Form 130 with Ease

- Obtain Indiana Form 130 and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Modify and eSign Indiana Form 130 to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Do I need US EIN taxpayer ID to properly fill out a W8-BEN form?

Since I have asked this question, I believe that I should share the knowledge I have managed to collect in its regard.So, it appears that you should file a SS-4 form to apply for the Employer Identification Number (EIN). To this successfully you will need to have a contract signed with customer in the USA. You will have to show given contract to the US IRA.The downside of this method is that:It requires for you to sign contract with US party prior to the acquiring the EINYou will have to mail originals of your Passport/Natinal ID and contract to the IRA.Instead of going that way, I have decided to register my own "Disregarded entity"-type LLC.If you are also considering going that way, please note that the most popular state for registering such companies (namely, Delaware) is not necessary best for your particular case.AFAICK, tax-wise, there are two top states:Delaware (DE): Sales Tax = 0%, Income Tax = 6.95%Nevada (NV): Sales tax = 7.93%, Income Tax = 0%You will need to find registered agent to register your LLC properly.

-

Can I print a notice of intent form to homeschool in Nevada, fill it out, and turn it in?

It's best to ask homeschoolers in your state. Every state has different laws. What works in one may not work in another.This looks like the information you need: Notice of Intent (NOI)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How can I take my child (16yrs) to the U.S if my immigrant visa is approved? My husband, a US citizen, filled out form I 130 for me and mentioned this child as migrating in future.

Just petition using a I-130 yourself. Read the instructions very carefully. I am not sure but it’s possible that the affidavit of support will need to be filled by your husband since he is the citizen and he filled one for you - again, check the instructions very carefully. It should be a pretty clear, straightforward process.Your child is still well below the age limit and should be fine. If there are any problems, do the same thing you did with your own process - use the numbers you are given to check on the process and if you see it stuck call to make sure they have everything they need early.It is my understanding that the age limit of the child is based on the petition date, so go ahead and do it.You still have plenty of time at 16, just don’t delay.

Create this form in 5 minutes!

How to create an eSignature for the taxpayers notice to initiate appeal form 130 short

How to generate an electronic signature for the Taxpayers Notice To Initiate Appeal Form 130 Short in the online mode

How to create an eSignature for the Taxpayers Notice To Initiate Appeal Form 130 Short in Chrome

How to generate an electronic signature for putting it on the Taxpayers Notice To Initiate Appeal Form 130 Short in Gmail

How to create an eSignature for the Taxpayers Notice To Initiate Appeal Form 130 Short straight from your smartphone

How to generate an electronic signature for the Taxpayers Notice To Initiate Appeal Form 130 Short on iOS devices

How to make an eSignature for the Taxpayers Notice To Initiate Appeal Form 130 Short on Android devices

People also ask

-

What is state form 53958?

State form 53958 is a document used for specific administrative purposes within the state. It is essential for individuals or businesses to complete and submit this form accurately to comply with state regulations. airSlate SignNow can streamline the process of completing and eSigning state form 53958 electronically.

-

How can airSlate SignNow help with state form 53958?

airSlate SignNow provides an easy-to-use platform for filling out and eSigning state form 53958. With advanced features, users can quickly complete the form online, ensuring accuracy and efficiency. Our service eliminates the hassles of paper forms, making compliance effortless.

-

Is there a cost associated with using airSlate SignNow for state form 53958?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to all features necessary for managing documents like state form 53958. Evaluating our pricing options can help you choose the best fit for your budget and requirements.

-

What features does airSlate SignNow offer for managing state form 53958?

airSlate SignNow includes features such as customizable templates, secure electronic signatures, and detailed audit trails specifically for documents like state form 53958. Additionally, collaboration tools allow teams to work together seamlessly and ensure that all necessary parties can review and approve the document.

-

Can I integrate airSlate SignNow with other software for state form 53958 management?

Absolutely! airSlate SignNow integrates with a variety of popular software applications. This functionality allows for an efficient workflow when managing state form 53958, enabling you to connect with tools you already use and automate repetitive tasks to save time.

-

What are the benefits of using airSlate SignNow for state form 53958?

Using airSlate SignNow for state form 53958 provides numerous benefits including faster processing times, enhanced security, and a reduction in paperwork. The platform's user-friendly interface ensures that even those with minimal technical skills can navigate the system easily. By digitizing your document workflow, you can focus more on your core business activities.

-

Is airSlate SignNow secure for eSigning state form 53958?

Yes, airSlate SignNow employs top-notch security measures to protect your documents, including state form 53958. We use encryption protocols and comply with industry standards to ensure your data remains confidential and secure. This gives our users peace of mind when managing sensitive information electronically.

Get more for Indiana Form 130

Find out other Indiana Form 130

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile