Ohio Injured Spouse Form

What is the Ohio Injured Spouse Form

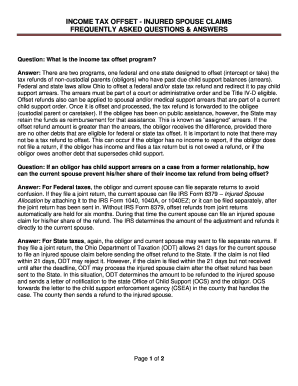

The Ohio Injured Spouse Form, officially known as Form 8379, is a tax form used by married couples to claim their share of a tax refund when one spouse has outstanding debts, such as student loans or child support. This form allows the "injured" spouse to protect their portion of the refund from being applied to the other spouse's debts. By filing this form, the injured spouse can ensure they receive their rightful share of any tax refund due.

How to use the Ohio Injured Spouse Form

To effectively use the Ohio Injured Spouse Form, individuals must first complete the form accurately, providing all required information regarding both spouses' incomes and debts. The form should be submitted along with the couple's joint tax return. It is essential to ensure that the injured spouse's information is clearly indicated to avoid any delays in processing. Once submitted, the IRS will review the form and determine the appropriate refund allocation based on the information provided.

Steps to complete the Ohio Injured Spouse Form

Completing the Ohio Injured Spouse Form involves several key steps:

- Gather necessary documents, including W-2s and any relevant tax information for both spouses.

- Fill out Form 8379, ensuring all sections are completed, especially those detailing income and debts.

- Sign and date the form, ensuring both spouses review the information for accuracy.

- Submit the form along with the joint tax return to the IRS, either electronically or by mail.

- Keep a copy of the submitted form for personal records.

Required Documents

When filing the Ohio Injured Spouse Form, certain documents are necessary to support the claim. These include:

- W-2 forms for both spouses.

- Any additional income statements, such as 1099s.

- Documentation of debts for the spouse with outstanding obligations.

- Previous tax returns may also be helpful for reference.

Form Submission Methods (Online / Mail / In-Person)

The Ohio Injured Spouse Form can be submitted in various ways. Taxpayers can file electronically through approved tax software, which allows for quicker processing. Alternatively, the form can be mailed directly to the IRS along with the joint tax return. It is not typically submitted in person, as the IRS does not accept walk-in submissions for tax forms.

Eligibility Criteria

To qualify for filing the Ohio Injured Spouse Form, certain eligibility criteria must be met. The couple must file a joint tax return, and one spouse must have a refund that is subject to being offset due to the other spouse's debts. The injured spouse must have earned income and must not be responsible for the debts that led to the offset. Meeting these criteria is essential to successfully reclaiming the portion of the tax refund.

Quick guide on how to complete ohio injured spouse form

Effortlessly prepare Ohio Injured Spouse Form on any device

Managing documents online has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, as you can obtain the appropriate form and securely store it on the internet. airSlate SignNow provides you with all the essential tools to create, modify, and eSign your documents quickly without delays. Manage Ohio Injured Spouse Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

The easiest way to alter and eSign Ohio Injured Spouse Form with minimal effort

- Obtain Ohio Injured Spouse Form and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Select important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign Ohio Injured Spouse Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio injured spouse form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Where do I send my injured spouse form in Ohio?

You can send your injured spouse form in Ohio to the address specified on the form itself. Typically, this would be the tax office or processing center designated by the Ohio Department of Taxation. Ensure that you check the latest instructions from the state to confirm the correct address before mailing.

-

What documents do I need when sending my injured spouse form in Ohio?

When submitting your injured spouse form in Ohio, you should include your completed form along with any supporting documentation that shows your income and tax obligations. This may include your tax return and any W-2 forms. Ensuring you have all necessary documents can expedite the processing of your claim.

-

How does airSlate SignNow simplify the process of sending my injured spouse form?

airSlate SignNow makes it easy to eSign and send your injured spouse form quickly and securely. With its user-friendly interface, you can upload your documents, add signatures, and send them right from your device. This eliminates the hassle of printing and mailing paperwork, streamlining your experience.

-

Is there a fee for using airSlate SignNow to send my injured spouse form in Ohio?

airSlate SignNow offers a range of pricing plans, including a free trial for new users. While some features may come with a cost, sending your injured spouse form in Ohio can be done at an affordable price. Check their website for details on current plans and pricing options.

-

Can I track my injured spouse form after sending it with airSlate SignNow?

Yes, one of the great features of airSlate SignNow is the ability to track your document's status in real time. Once you send your injured spouse form in Ohio, you will receive notifications about its progress, ensuring you stay informed throughout the process.

-

What types of documents can I eSign besides the injured spouse form?

With airSlate SignNow, you can eSign a variety of documents beyond the injured spouse form in Ohio, including contracts, agreements, and tax forms. The platform supports a wide range of file types, making it an ideal solution for all your eSigning needs. This flexibility allows for efficient document management in one place.

-

Are there integrations available with airSlate SignNow for my other tools?

Yes, airSlate SignNow offers integrations with popular applications such as Google Drive, Dropbox, and CRM tools. This allows you to seamlessly manage your documents and eSign your injured spouse form in Ohio alongside your other workflows. Check the integrations page for a full list of supported apps.

Get more for Ohio Injured Spouse Form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession indiana form

- Letter from tenant to landlord about illegal entry by landlord indiana form

- Letter from landlord to tenant about time of intent to enter premises indiana form

- Letter from tenant to landlord containing notice to cease unjustified nonacceptance of rent indiana form

- Letter from tenant to landlord about sexual harassment indiana form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children indiana form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure indiana form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497306865 form

Find out other Ohio Injured Spouse Form

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF