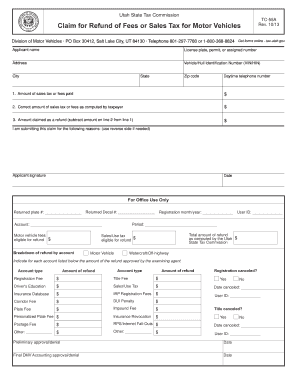

Tc 55a Form

What is the TC 569D Form?

The TC 569D form is a specific document used primarily in the context of tax reporting and compliance. It is designed to capture essential information related to various tax obligations and is often required by businesses and individuals to ensure accurate reporting to the IRS. Understanding the purpose of this form is crucial for anyone involved in tax preparation or financial reporting.

How to Use the TC 569D Form

Using the TC 569D form involves several key steps. First, gather all necessary information, including personal identification details and any relevant financial data. Next, carefully fill out each section of the form, ensuring accuracy to avoid potential issues with tax authorities. Once completed, the form must be submitted according to the guidelines provided, which may include online submission or mailing to the appropriate IRS office.

Steps to Complete the TC 569D Form

Completing the TC 569D form requires attention to detail. Follow these steps for successful completion:

- Gather all required documents, such as previous tax returns and financial statements.

- Carefully read the instructions accompanying the form to understand each section.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form as instructed, either electronically or by mail.

Legal Use of the TC 569D Form

The TC 569D form holds legal significance in the context of tax compliance. Properly completing and submitting this form ensures adherence to IRS regulations, which can help avoid penalties or legal issues. It is essential to understand the legal implications of the information provided on the form, as inaccuracies can lead to complications in tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the TC 569D form are critical to ensure compliance with tax regulations. Typically, the form must be submitted by specific dates set forth by the IRS, often coinciding with annual tax filing deadlines. Keeping track of these dates is essential for individuals and businesses to avoid late fees and penalties.

Required Documents

To complete the TC 569D form, several documents may be required. These typically include:

- Identification documents, such as a Social Security number or taxpayer identification number.

- Financial records, including income statements and expense reports.

- Previous tax returns for reference and accuracy.

Who Issues the Form

The TC 569D form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. Understanding that the IRS oversees this form underscores its importance in maintaining compliance with federal tax laws.

Quick guide on how to complete tc 55a form

Complete Tc 55a Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Tc 55a Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Tc 55a Form seamlessly

- Locate Tc 55a Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant portions of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method of sharing your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Tc 55a Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 55a form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc 569d and how does it work?

The tc 569d is a document management tool integrated into airSlate SignNow that helps streamline eSigning processes. It allows users to create, send, and manage documents digitally, enhancing workflow efficiency. By utilizing tc 569d, businesses can ensure secure and legally binding document transactions.

-

What are the key features of tc 569d?

The tc 569d offers several features including customizable templates, real-time tracking, and secure storage. Users can easily create personalized documents and monitor their signing status. This tool is designed to simplify document workflows and improve collaboration among teams.

-

How does tc 569d benefit businesses?

With tc 569d, businesses can save time and reduce costs associated with paper-based processes. The efficiency of electronic signatures leads to faster transaction completions and improved customer satisfaction. Additionally, the integration of tc 569d enhances productivity by automating repetitive tasks.

-

What is the pricing model for tc 569d?

airSlate SignNow provides flexible pricing plans for tc 569d, accommodating various business needs. Users can choose between monthly or annual subscriptions, with options for additional features as their requirements grow. It's advisable to review the pricing page for the most current rates and plans.

-

Can tc 569d integrate with other software?

Yes, tc 569d offers seamless integrations with various software applications, enhancing its functionality. Common integrations include CRM systems, project management tools, and document storage solutions. These integrations allow for a more connected and efficient workflow.

-

Is tc 569d secure for sensitive documents?

Absolutely, tc 569d prioritizes security for sensitive documents with encryption, secure access controls, and compliance with legal standards. This makes it a reliable choice for businesses handling confidential information. Users can trust that their data is well-protected throughout the signing process.

-

How can I track the status of documents sent with tc 569d?

Tracking the status of documents sent through tc 569d is simple and efficient. The platform provides real-time notifications and allows users to monitor the signing process directly from their dashboard. This transparency ensures that businesses stay informed about their document transactions.

Get more for Tc 55a Form

- High risk pregnancy servicesuci healthorange county ca form

- Alaska request exemption form

- Mailing list rental agreementorder formdoc

- Surat dokter pdf form

- Application for employment krkallentxcom form

- Boat rental agreement fish camp marine new amp used form

- Auscultated acceleration test form

- Cr 445 sentencing affidavit criminal forms

Find out other Tc 55a Form

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online