Canada Summer Jobs Payment Claim and Activity Report Form

What is the Canada Summer Jobs Payment Claim and Activity Report

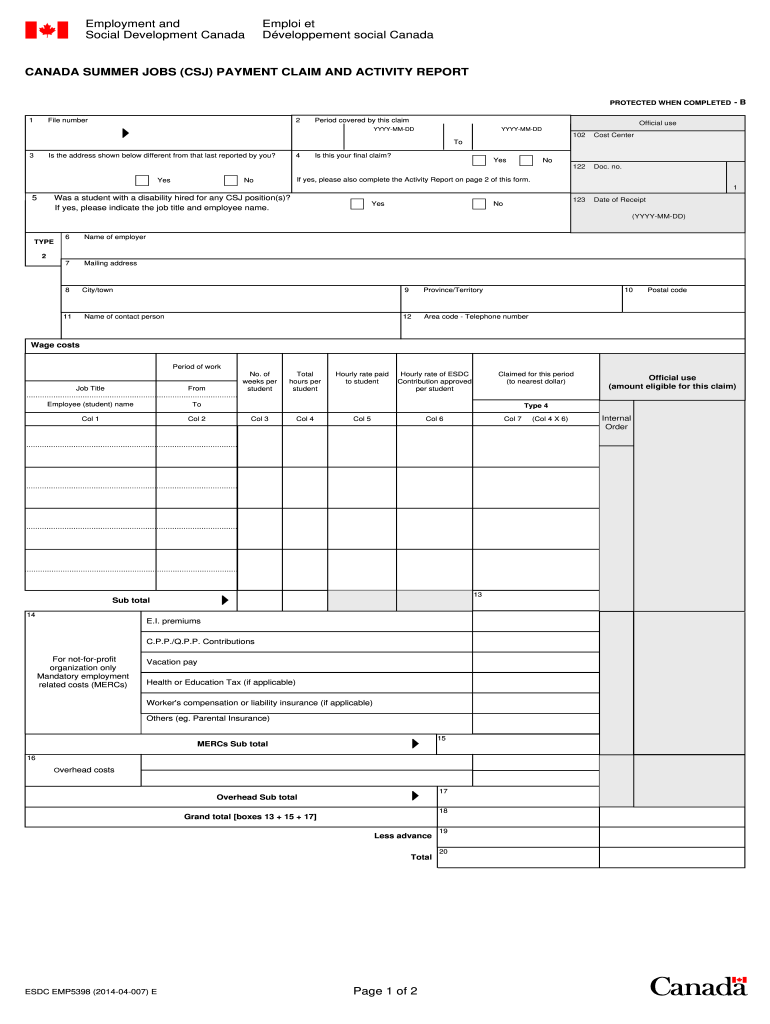

The Canada Summer Jobs Payment Claim and Activity Report is a crucial document designed for employers and employees participating in the Canada Summer Jobs (CSJ) program. This report serves to confirm the employment of youth and to facilitate the reimbursement process for wages paid to eligible students. It outlines the activities undertaken during the employment period, ensuring accountability and transparency in the use of government funding. The report must be completed accurately to ensure compliance with program requirements and to secure the necessary financial support.

Steps to complete the Canada Summer Jobs Payment Claim and Activity Report

Completing the Canada Summer Jobs Payment Claim and Activity Report involves several key steps:

- Gather necessary information, including employer details, employee information, and the specific activities performed during the job.

- Fill out the form with accurate details, ensuring that all sections are completed as required.

- Attach any supporting documents that may be needed, such as pay stubs or time sheets.

- Review the completed report for accuracy and completeness before submission.

- Submit the report through the designated method, either online or by mail, as specified by the program guidelines.

Key elements of the Canada Summer Jobs Payment Claim and Activity Report

The Canada Summer Jobs Payment Claim and Activity Report includes several essential components that must be addressed:

- Employer Information: Details about the organization providing employment, including name, address, and contact information.

- Employee Information: Information about the student employee, including their name, address, and Social Insurance Number (SIN).

- Employment Dates: The start and end dates of the employment period must be clearly stated.

- Activity Summary: A detailed description of the tasks and responsibilities undertaken by the employee during their employment.

- Financial Information: Total wages paid and any other relevant financial details necessary for reimbursement.

Legal use of the Canada Summer Jobs Payment Claim and Activity Report

The Canada Summer Jobs Payment Claim and Activity Report is legally binding when completed and submitted in accordance with the program's guidelines. It is essential for employers to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or denial of funding. By using digital tools to fill out and submit this report, employers can enhance security and maintain compliance with eSignature regulations, making the process more efficient and reliable.

Form Submission Methods

There are multiple methods for submitting the Canada Summer Jobs Payment Claim and Activity Report. Employers can choose to submit the form online through the designated government portal, which typically offers a streamlined process for electronic submission. Alternatively, the form can be printed and mailed to the appropriate government office. In-person submissions may also be possible, depending on local regulations and office availability. Each method has its own requirements and timelines, so it is important to follow the specific instructions provided by the program.

Eligibility Criteria

To qualify for the Canada Summer Jobs program and successfully complete the Payment Claim and Activity Report, both employers and employees must meet certain eligibility criteria. Employers must be registered organizations, including non-profits, public sector employers, or small businesses. For employees, eligibility typically includes being a student between the ages of 15 and 30, legally entitled to work in Canada, and intending to return to school after the summer employment period. Meeting these criteria is essential for ensuring compliance and securing funding.

Quick guide on how to complete canada summer jobs payment claim and activity report form

Effortlessly prepare Canada Summer Jobs Payment Claim And Activity Report on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the essential tools to create, amend, and eSign your documents quickly and without delays. Work with Canada Summer Jobs Payment Claim And Activity Report on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Canada Summer Jobs Payment Claim And Activity Report with ease

- Obtain Canada Summer Jobs Payment Claim And Activity Report and click on Get Form to initiate the process.

- Make use of the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Canada Summer Jobs Payment Claim And Activity Report and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

Will the NEET 2018 give admission in paramedical courses and Ayush courses too? If yes, how do you fill out the form to claim a seat if scored well?

wait for notifications.

-

I worked at a summer job with my father who doesn't care about me. When he had to fill out a form for me he has to ask my full name and birthday. Should I feel even worse about it?

I know that is hurtful. However, the best thing to do is to forgive and go on. Resentment and anger will only destroy you.“But if ye do not forgive, neither will your Father which is in heaven forgive your trespasses.” Mar_11:26“A person's wisdom yields patience; it is to one's glory to overlook an offense.” Proverbs 19:11"God so love the world that He gave His only Son, that whoever believed in Him should not perish but have eternal life" John 3:16

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

I am a working software professional in the Bay Area and looking to switch jobs. I can't openly write in my LinkedIn profile about the same. How do I approach recruiters/companies? Is there an easier way than filling out 4 - 5 page forms in the career website of the company?

I'd say that you should just seek out the jobs that interest you and apply for them. Many don't have such onerous application forms. Some even allow you to apply through LinkedIn. And if you target a small set of companies that really interest you, then it's worth the extra effort to customize each application. Many recruiters and hiring managers, myself included, give more weight to candidates who seem specifically interested in an opportunity, as compared to those who seem to be taking a shotgun approach to the job seeking process.

Create this form in 5 minutes!

How to create an eSignature for the canada summer jobs payment claim and activity report form

How to generate an electronic signature for the Canada Summer Jobs Payment Claim And Activity Report Form online

How to make an electronic signature for the Canada Summer Jobs Payment Claim And Activity Report Form in Chrome

How to generate an eSignature for signing the Canada Summer Jobs Payment Claim And Activity Report Form in Gmail

How to make an electronic signature for the Canada Summer Jobs Payment Claim And Activity Report Form from your smart phone

How to make an eSignature for the Canada Summer Jobs Payment Claim And Activity Report Form on iOS

How to make an electronic signature for the Canada Summer Jobs Payment Claim And Activity Report Form on Android devices

People also ask

-

What is the purpose of the Canada summer jobs employer and employee declaration?

The Canada summer jobs employer and employee declaration is a crucial document that outlines the agreement between employers and their summer employees. It helps ensure compliance with government requirements for summer employment programs. By utilizing airSlate SignNow, businesses can easily manage and eSign this declaration to streamline the hiring process.

-

How does airSlate SignNow simplify the Canada summer jobs employer and employee declaration?

airSlate SignNow simplifies the process by providing an intuitive platform for creating, sending, and eSigning the Canada summer jobs employer and employee declaration. With its user-friendly interface, you can quickly prepare the necessary documents, reducing time spent on administrative tasks. This efficiency allows employers to focus on onboarding their summer employees instead.

-

Are there any costs associated with using airSlate SignNow for the Canada summer jobs employer and employee declaration?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Pricing typically varies based on features and user access, making it a cost-effective solution for managing the Canada summer jobs employer and employee declaration. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Canada summer jobs employer and employee declaration?

airSlate SignNow includes features such as customizable templates, document tracking, and automated reminders for the Canada summer jobs employer and employee declaration. These features help ensure timely completion and compliance. Additionally, the platform supports secure sharing and storage of all documents.

-

Can airSlate SignNow integrate with other tools for managing Canada summer jobs?

Yes, airSlate SignNow offers various integrations with popular tools to enhance your workflow for managing the Canada summer jobs employer and employee declaration. Integrations with applications like Google Drive, Dropbox, and CRM systems allow you to streamline processes and keep all your documents organized in one place.

-

How does eSigning via airSlate SignNow ensure compliance for the Canada summer jobs employer and employee declaration?

eSigning through airSlate SignNow is legally binding and compliant with government regulations for the Canada summer jobs employer and employee declaration. The platform employs advanced encryption to safeguard signatures and documents, ensuring their authenticity. This gives both employers and employees confidence in the integrity of their agreements.

-

What benefits does airSlate SignNow offer for employers handling Canada summer jobs?

Employers can benefit signNowly from airSlate SignNow when managing the Canada summer jobs employer and employee declaration by saving time and resources. The platform allows for quick access to templates and documents, enabling faster hiring processes. Furthermore, electronic signatures reduce paperwork, making record-keeping easier and more efficient.

Get more for Canada Summer Jobs Payment Claim And Activity Report

- Football prospect list template form

- Sunnyvale busineas license application form

- Form it 201 100538263

- Dh 4015 page 1 pdf form

- Chemical checklist form

- Alabama dor reminds minimum business privilege tax form

- Bpt v alabama department of revenue form

- Schedule k 1 form 41 instructions ty 20231 19 24f pdf

Find out other Canada Summer Jobs Payment Claim And Activity Report

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple