Form it 201

What is the Form It 201

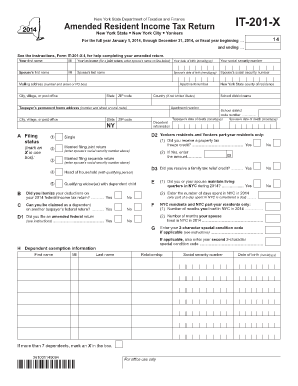

The Form It 201 is a tax return form used by residents of New Jersey to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state and need to comply with state tax regulations. It is specifically designed for use by individuals and includes sections for reporting various types of income, deductions, and credits applicable to New Jersey taxpayers.

How to use the Form It 201

Using the Form It 201 involves several steps to ensure accurate reporting of income and taxes owed. Taxpayers should first gather all necessary documentation, including W-2 forms, 1099s, and any other relevant income statements. Once the required documents are collected, individuals can begin filling out the form by entering their personal information, income details, and any applicable deductions or credits. It is important to follow the instructions carefully to avoid errors that could lead to delays or penalties.

Steps to complete the Form It 201

Completing the Form It 201 requires a systematic approach:

- Gather all income documents, such as W-2 and 1099 forms.

- Fill in personal information, including name, address, and Social Security number.

- Report total income from all sources in the designated sections.

- Claim any deductions or credits for which you qualify, ensuring to follow the guidelines provided.

- Calculate the total tax owed or refund due based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the Form It 201

The Form It 201 is legally binding when completed accurately and submitted according to New Jersey tax laws. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the New Jersey Division of Taxation. This includes using the most current version of the form, providing truthful information, and signing the document. Electronic signatures are accepted, provided that they comply with the relevant eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form It 201 are crucial for compliance. Typically, the deadline for submitting the form is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply and ensure they file their returns on time to avoid penalties and interest on unpaid taxes.

Required Documents

To complete the Form It 201 successfully, taxpayers must gather several key documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as rental income or interest

- Documentation for deductions, such as mortgage interest statements and property tax receipts

- Any relevant tax credit information

Quick guide on how to complete form it 201 100538263

Complete Form It 201 effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed forms, allowing you to discover the right document and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form It 201 on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Form It 201 with ease

- Find Form It 201 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive data using tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to store your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it onto your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Form It 201 and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 201 100538263

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IT 201 tax return?

The IT 201 tax return refers to the New York State personal income tax return form used by residents to report their income. It is essential for individuals and businesses to file this form accurately to ensure compliance with state tax laws. Using airSlate SignNow can help streamline this process by providing easy eSigning and document management features.

-

How does airSlate SignNow help with IT 201 tax returns?

airSlate SignNow simplifies the IT 201 tax return process by allowing users to easily create, send, and eSign documents online. This reduces the time spent on paperwork and helps prevent errors in document submission. The platform's user-friendly interface ensures that tax documents are handled efficiently and securely.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to meet different business needs, including options that are budget-friendly for both small businesses and larger enterprises. Users can choose monthly or annual subscriptions, with features tailored for managing documents like the IT 201 tax return. The pricing structure is designed to provide maximum value for users dealing with important tax documents.

-

Can I integrate airSlate SignNow with other tax software?

Yes, airSlate SignNow can integrate seamlessly with various third-party tax software and applications, making it easier to manage your IT 201 tax return alongside other financial tasks. This integration ensures that you can work fluidly between platforms, enhancing efficiency in your tax preparation process. It eliminates the hassle of switching between different tools.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security by employing advanced encryption methods to protect all documents, including the IT 201 tax return. The platform is compliant with various industry standards to ensure that sensitive information remains confidential. Users can trust that their tax-related documents are safe while using our services.

-

What features does airSlate SignNow offer for tax professionals?

airSlate SignNow includes features specifically designed for tax professionals, such as template creation for documents like the IT 201 tax return, bulk sending, and automated reminders. These tools help streamline the workflow, allowing tax professionals to assist clients more effectively. The intuitive dashboard also makes it easy to track document progress and manage multiple clients.

-

Can I track the status of my IT 201 tax return documents with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all document statuses, including those related to your IT 201 tax return. Users can easily see when documents are viewed, signed, and completed, allowing for better communication and follow-ups. This feature helps ensure that your tax documents are processed in a timely manner.

Get more for Form It 201

Find out other Form It 201

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract