It 204 Ll PDF Form

What is the IT-204-LL PDF?

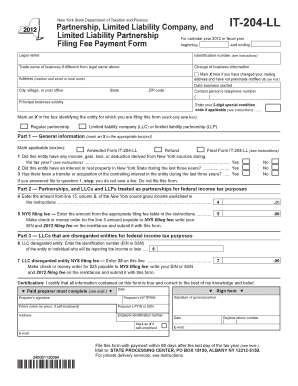

The IT-204-LL PDF is a form used by limited liability companies (LLCs) in New York for tax purposes. This form is essential for reporting the company’s income and ensuring compliance with state tax regulations. It is designed for LLCs that are treated as partnerships or disregarded entities for federal tax purposes. By completing this form, LLCs can accurately report their income, deductions, and other relevant financial information to the New York State Department of Taxation and Finance.

How to Use the IT-204-LL PDF

Using the IT-204-LL PDF involves several steps to ensure accurate completion. First, download the form from the New York State Department of Taxation and Finance website. Next, gather all necessary financial documents, including income statements and expense records. As you fill out the form, make sure to provide accurate information regarding your LLC’s income and deductions. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Steps to Complete the IT-204-LL PDF

Completing the IT-204-LL PDF requires careful attention to detail. Here are the steps to follow:

- Download the IT-204-LL PDF from the official website.

- Fill in the identification section with your LLC's name, address, and Employer Identification Number (EIN).

- Report your LLC’s income by entering the total revenue earned during the tax year.

- List any deductions your LLC is eligible for, such as business expenses.

- Calculate the total tax due based on the reported income and deductions.

- Sign and date the form to certify its accuracy.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the IT-204-LL PDF. Typically, the form must be filed by the 15th day of the fourth month following the end of your LLC’s tax year. For most LLCs operating on a calendar year, this means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Staying informed about these deadlines can help avoid penalties and ensure timely compliance.

Legal Use of the IT-204-LL PDF

The IT-204-LL PDF is legally binding when completed accurately and submitted on time. It complies with New York State tax laws, which require LLCs to report their income and pay any applicable taxes. To ensure legal validity, it is essential to follow all instructions provided with the form and maintain accurate records of your LLC’s financial activities. Failure to comply with these legal requirements can result in penalties or additional scrutiny from tax authorities.

Who Issues the Form

The IT-204-LL PDF is issued by the New York State Department of Taxation and Finance. This agency is responsible for administering tax laws and ensuring compliance among businesses operating within the state. The department provides resources and guidance for LLCs to help them understand their tax obligations and the proper use of the IT-204-LL form. For any questions or clarifications, LLCs can contact the department directly for assistance.

Quick guide on how to complete it 204 ll pdf

Complete It 204 Ll Pdf effortlessly on any device

Web-based document administration has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can acquire the necessary form and securely preserve it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without any delays. Manage It 204 Ll Pdf on any platform using airSlate SignNow Android or iOS applications and enhance your document-driven tasks today.

The easiest method to alter and eSign It 204 Ll Pdf effortlessly

- Find It 204 Ll Pdf and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your requirements in document administration with just a few clicks from any device of your preference. Edit and eSign It 204 Ll Pdf while ensuring effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 204 ll pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for IT204LL users?

airSlate SignNow provides a comprehensive range of features for IT204LL users, including customizable templates, mobile signing, and secure storage options. These features are designed to streamline document management and enhance the signing experience. With airSlate SignNow, you can quickly send, track, and manage documents from any device.

-

How does airSlate SignNow pricing work for IT204LL?

airSlate SignNow offers competitive pricing plans tailored to the needs of IT204LL users. Whether you’re a small business or a large enterprise, there are flexible options to fit your budget. Plus, airSlate SignNow’s cost-effective solution helps you reduce administrative costs associated with document processes.

-

Is airSlate SignNow suitable for businesses of all sizes for IT204LL?

Absolutely! airSlate SignNow is designed to support businesses of all sizes including IT204LL enterprises. Its user-friendly interface and robust features cater to the unique needs of both small businesses and larger organizations, making it a versatile choice for all.

-

What benefits can IT204LL users expect from airSlate SignNow?

IT204LL users can expect numerous benefits from airSlate SignNow, including faster turnaround times for document signing and improved workflow efficiency. The platform’s ease of use reduces the learning curve, enabling teams to adopt eSigning quickly. Additionally, you’ll enhance compliance and security with a legally binding signature solution.

-

Does airSlate SignNow integrate with other applications used in IT204LL?

Yes, airSlate SignNow features robust integrations that cater to IT204LL users. It seamlessly connects with popular applications like Google Drive, Dropbox, and Salesforce, facilitating a smooth workflow across your existing tools. This helps streamline your processes and ensures that you can manage documents easily.

-

How secure is airSlate SignNow for IT204LL document management?

Security is a top priority for airSlate SignNow, especially for IT204LL users. The platform employs advanced encryption protocols and complies with industry standards to ensure that your documents are safe during transmission and storage. With airSlate SignNow, you can trust that your sensitive information is well-protected.

-

Can IT204LL users try airSlate SignNow before committing to a plan?

Yes, airSlate SignNow offers a free trial for IT204LL users to explore its features and benefits. This allows you to test the platform and see how it can enhance your document management processes without any financial commitment. Experience firsthand how airSlate SignNow can optimize your workflow.

Get more for It 204 Ll Pdf

Find out other It 204 Ll Pdf

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free