Form 656b

What is the Form 656b

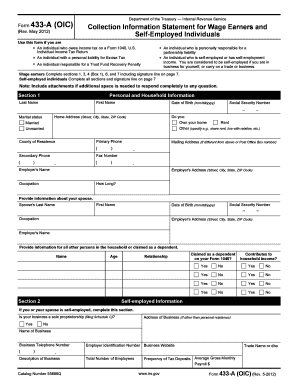

The Form 656b, also known as the IRS Form 656 B, is a crucial document used by taxpayers in the United States to apply for an offer in compromise with the Internal Revenue Service (IRS). This form allows individuals to settle their tax debts for less than the full amount owed. It is primarily designed for taxpayers who are unable to pay their tax liabilities in full due to financial hardship. Understanding the purpose and implications of Form 656b is essential for anyone considering this option for resolving tax debts.

Steps to complete the Form 656b

Completing the Form 656b requires careful attention to detail. Here are the steps to follow:

- Download the Form 656b from the IRS website or obtain a physical copy.

- Provide your personal information, including your name, address, and Social Security number.

- Detail your financial situation by listing your income, expenses, and assets. This information helps the IRS assess your ability to pay.

- Select the type of offer you are making, either a lump sum or a periodic payment.

- Sign and date the form to certify that the information provided is accurate and complete.

Once completed, ensure that all required documents are attached before submission.

Legal use of the Form 656b

The legal use of Form 656b is governed by IRS regulations and guidelines. When submitted correctly, this form can facilitate a legally binding agreement between the taxpayer and the IRS. It is important to ensure that all information is accurate and that the form is submitted within the appropriate timelines. The IRS will review the offer and may accept or reject it based on the financial information provided. Adhering to legal requirements ensures that the process is compliant with tax laws.

How to obtain the Form 656b

Obtaining the Form 656b is straightforward. Taxpayers can access the form through the IRS website, where it is available for download in PDF format. Additionally, physical copies can be requested by calling the IRS directly or visiting a local IRS office. It is essential to ensure that the most current version of the form is used to avoid any issues during the submission process.

Required Documents

When submitting the Form 656b, several supporting documents are required to substantiate the financial information provided. These include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of monthly expenses, including bills and receipts.

- Information on assets, such as bank statements and property deeds.

Providing complete and accurate documentation is critical for the IRS to evaluate the offer effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Form 656b are crucial for taxpayers seeking to resolve their tax debts. Generally, there are no specific deadlines for submitting the form; however, it is advisable to file as soon as possible to avoid accruing additional penalties and interest on unpaid taxes. Taxpayers should also be aware of any deadlines related to their specific tax situation, such as the expiration of the statute of limitations on tax debts.

Quick guide on how to complete form 656b

Effortlessly Prepare Form 656b on Any Device

Digital document management has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Form 656b on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Simplest Way to Alter and eSign Form 656b with Ease

- Locate Form 656b and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using specialized tools provided by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes only seconds and carries the same legal significance as an ink signature.

- Review the details and click the Done button to finalize your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 656b and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 656b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 656b and why is it important?

Form 656b is a key document used in the process of applying for a fee waiver for immigration benefits. It is important because it helps individuals prove their inability to pay certain fees, ensuring that financial constraints do not hinder their access to necessary legal processes.

-

How can airSlate SignNow help with form 656b?

airSlate SignNow simplifies the signing process for form 656b by allowing users to easily eSign and send the document securely. It eliminates the need for printing, scanning, or faxing, making the submission process much quicker and efficient.

-

Is there a cost associated with using airSlate SignNow for form 656b?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The plans are cost-effective, providing signNow value by streamlining the eSigning process for documents like form 656b.

-

What features does airSlate SignNow provide for managing form 656b?

airSlate SignNow includes features such as customizable templates, in-person signing, and advanced security options that ensure the integrity of your form 656b. These features enhance user experience and compliance with legal standards.

-

Can airSlate SignNow integrate with other software for form 656b?

Yes, airSlate SignNow integrates seamlessly with multiple applications like Google Drive, Zapier, and various CRM systems. This functionality allows for easy workflow management and document storage for form 656b.

-

What are the benefits of using airSlate SignNow for form 656b submissions?

Using airSlate SignNow for form 656b submissions increases efficiency, reduces processing time, and enhances document security. The platform ensures that your submissions are handled in a timely manner, which is critical in immigration processes.

-

Is it easy to track the status of form 656b with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking and notifications for your form 656b. This transparency allows you to monitor the signing process and ensures that you know when your document has been completed.

Get more for Form 656b

- Rules vital events mississippi secretary of state form

- A minor by form

- Civil procedure rules of mississippi first circuit court form

- Full text of ampquotconveyancing and other forms precedents for every

- In the circuit court of county mississippi form

- Mississippi rule of civil procedure 4h casetext form

- Mississippi probate blogmississippi probate attorney form

- Probateny courthelp new york state unified court system form

Find out other Form 656b

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy