Wells Fargo Secured Business Credit Card Form

What is the Wells Fargo Secured Business Credit Card

The Wells Fargo Secured Business Credit Card is designed for business owners looking to build or improve their credit profile. This card requires a security deposit, which serves as your credit limit. It allows businesses to manage expenses effectively while also providing an opportunity to establish a positive credit history. By making timely payments, cardholders can enhance their creditworthiness, which may lead to better financing options in the future.

How to obtain the Wells Fargo Secured Business Credit Card

To obtain the Wells Fargo Secured Business Credit Card, you must complete an application process that includes providing personal and business information. This includes your Social Security number, business tax identification number, and details about your business structure. Once you submit your application, Wells Fargo will review your credit history and determine your eligibility. Upon approval, you will need to make a security deposit, which will be held as collateral for your credit limit.

Steps to complete the Wells Fargo Secured Business Credit Card

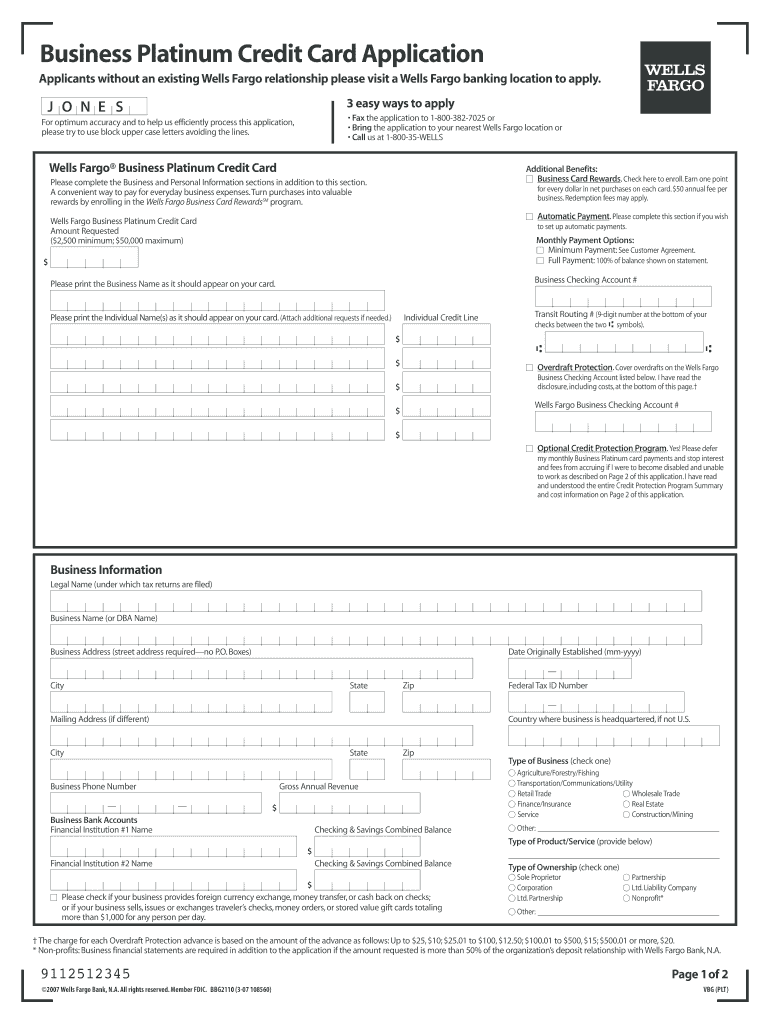

Completing the application for the Wells Fargo Secured Business Credit Card involves several key steps:

- Gather necessary documentation, including your business tax ID and financial information.

- Visit the Wells Fargo website or a local branch to access the application form.

- Fill out the application with accurate information regarding your business and personal details.

- Submit the application along with the required security deposit.

- Await approval and confirmation from Wells Fargo regarding your application status.

Legal use of the Wells Fargo Secured Business Credit Card

The Wells Fargo Secured Business Credit Card is legally valid as long as it is used in compliance with applicable laws and regulations. This includes adhering to the terms outlined in the cardholder agreement and ensuring that all transactions are legitimate business expenses. Proper record-keeping and documentation are essential for maintaining compliance, especially during audits or financial reviews.

Eligibility Criteria

To qualify for the Wells Fargo Secured Business Credit Card, applicants must meet specific eligibility criteria. These typically include:

- Being at least eighteen years old.

- Having a valid Social Security number or individual taxpayer identification number.

- Operating a registered business in the United States.

- Providing a security deposit that meets the minimum requirement set by Wells Fargo.

Key elements of the Wells Fargo Secured Business Credit Card

Several key elements define the Wells Fargo Secured Business Credit Card. These include:

- A security deposit that determines your credit limit.

- The ability to earn rewards on eligible purchases.

- Access to online account management tools for tracking expenses.

- Monthly reporting to credit bureaus to help build your credit history.

How to use the Wells Fargo Secured Business Credit Card

Using the Wells Fargo Secured Business Credit Card effectively involves understanding its features and benefits. Cardholders can use the card for everyday business expenses, such as office supplies, travel, and utilities. It is important to make timely payments to avoid interest charges and to maintain a positive credit history. Additionally, utilizing the card responsibly can help in building credit, which is essential for future financing opportunities.

Quick guide on how to complete wells fargo secured business credit card

Manage Wells Fargo Secured Business Credit Card conveniently on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Handle Wells Fargo Secured Business Credit Card on any device using airSlate SignNow's Android or iOS applications and enhance your document-driven processes today.

The simplest way to modify and eSign Wells Fargo Secured Business Credit Card effortlessly

- Locate Wells Fargo Secured Business Credit Card and click on Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign function, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and eSign Wells Fargo Secured Business Credit Card and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wells fargo secured business credit card

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the main features of the secured business credit card Wells Fargo offers?

The secured business credit card Wells Fargo provides features such as purchase security, fraud protection, and the ability to build credit over time. Users can benefit from online account management and reporting tools, making it easier to track and manage expenses for their business. Additionally, cardholders can access valuable rewards programs and offers.

-

How does the secured business credit card Wells Fargo help in building credit?

Using the secured business credit card Wells Fargo can help businesses establish or improve their credit history by reporting payment activity to major credit bureaus. Consistent on-time payments and responsible credit use can lead to better credit scores, which can enhance future financing options. This makes it an ideal choice for startups and small businesses.

-

What is the cost associated with the secured business credit card Wells Fargo?

The secured business credit card Wells Fargo has a minimal annual fee, which provides excellent features tailored for business needs. Additionally, there is a security deposit required to open the account, typically refundable after certain conditions are met. These costs are competitive, especially considering the benefits offered.

-

Are there any rewards available with the secured business credit card Wells Fargo?

Yes, the secured business credit card Wells Fargo offers rewards in the form of cash back on eligible purchases. This can be beneficial for businesses that want to maximize their spending. The potential for earning rewards while building credit makes it an appealing choice for many business owners.

-

How can businesses integrate the secured business credit card Wells Fargo with their accounting tools?

The secured business credit card Wells Fargo can easily integrate with various accounting software and tools, streamlining the financial tracking process. Most accounting programs allow for automatic data import, enabling users to manage expenses efficiently. This integration can save time and reduce errors in financial reporting.

-

What are the eligibility requirements for the secured business credit card Wells Fargo?

To qualify for the secured business credit card Wells Fargo, applicants must have a valid business entity and provide necessary documentation, including a personal guarantee from the owner. There is no minimum credit score requirement, making it accessible for those looking to build or rebuild their credit. This opens doors for many aspiring business owners and entrepreneurs.

-

Can the secured business credit card Wells Fargo be used internationally?

Yes, the secured business credit card Wells Fargo is accepted internationally, giving businesses the flexibility to make purchases abroad. Users can enjoy the convenience of using their card in various currencies, though foreign transaction fees may apply. It's essential to review the terms regarding international usage for optimal benefits.

Get more for Wells Fargo Secured Business Credit Card

- Form 18 lockoututility shut off masslegalhelp

- Amended nineteenth year action plan honolulu form

- Form an llc or corporation incorporate onlinebizfilings

- Installment purchase and security agreement clydesdale form

- State summary mechanics lien lawfullerton ampamp knowles form

- Rcw 1827114 disclosure statement requiredprerequisite form

- Installment sale and security agreement legal form

- Request for information by subcontractorindividual

Find out other Wells Fargo Secured Business Credit Card

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online