Fill in Form 8821

What is the Fill In Form 8821

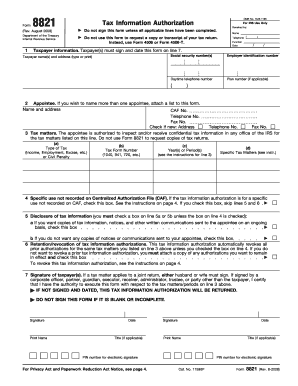

The Fill In Form 8821, officially known as the IRS Form 8821, is a document used by taxpayers in the United States to authorize an individual or organization to receive and inspect their tax information. This form is particularly useful for those who wish to grant access to their tax records to a third party, such as a tax professional or family member, without transferring the authority to act on their behalf. By completing this form, taxpayers can ensure that their sensitive tax information is shared securely with trusted individuals or entities.

How to Use the Fill In Form 8821

Using the Fill In Form 8821 involves several straightforward steps. First, you need to download the form from the IRS website or access a fillable version online. Next, complete the required fields, including your personal information and the details of the individual or organization you are authorizing. It is important to provide accurate information to avoid any delays in processing. After filling out the form, you can submit it to the IRS either by mail or electronically, depending on your preference. Ensure that you keep a copy for your records.

Steps to Complete the Fill In Form 8821

Completing the Fill In Form 8821 requires attention to detail. Follow these steps:

- Download the form from the IRS website or access a fillable version.

- Enter your name, address, and Social Security number or Employer Identification Number.

- Provide the name and address of the person or organization you are authorizing.

- Specify the tax information you are allowing them to access.

- Sign and date the form to validate your authorization.

Once completed, submit the form to the IRS according to the instructions provided.

Legal Use of the Fill In Form 8821

The Fill In Form 8821 is legally recognized as a valid means for taxpayers to authorize access to their tax information. It complies with IRS regulations, ensuring that the authorized individual or organization can legally receive and inspect the specified records. To maintain its legal standing, it is crucial that the form is filled out accurately and submitted in accordance with IRS guidelines. Any discrepancies or errors may result in the form being rejected, thereby delaying access to your tax information.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Fill In Form 8821. Taxpayers should ensure they are using the most current version of the form, as outdated forms may not be accepted. Additionally, the IRS outlines the types of tax information that can be authorized for disclosure, as well as the duration of the authorization. Familiarizing yourself with these guidelines can help ensure a smooth process and compliance with IRS requirements.

Form Submission Methods

There are several methods for submitting the Fill In Form 8821 to the IRS. Taxpayers can choose to mail the completed form to the appropriate IRS address based on their location. Alternatively, electronic submission may be available through authorized e-file providers. It is important to check the IRS website for the latest submission options and any potential updates to the process. Regardless of the method chosen, keeping a copy of the submitted form is recommended for personal records.

Quick guide on how to complete fill in form 8821

Complete Fill In Form 8821 effortlessly on any device

Web-based document management has become favored among businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, as you can find the appropriate template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle Fill In Form 8821 on any device using airSlate SignNow’s Android or iOS applications and streamline any document-driven process today.

How to modify and eSign Fill In Form 8821 seamlessly

- Find Fill In Form 8821 and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, by email, text message (SMS), or invite link, or download it to your computer.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fill in form 8821

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the best way to fill in form 8821 using airSlate SignNow?

To fill in form 8821 with airSlate SignNow, simply upload the form to the platform. Our user-friendly interface allows you to fill in the necessary fields, ensuring you can complete and customize the document according to your needs. Once you finish, you can easily eSign the form and send it to the relevant parties.

-

Is there a cost associated with using airSlate SignNow to fill in form 8821?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that suits your requirements for filling in form 8821 and other documents. Our plans are designed to be cost-effective while providing robust features for document management.

-

Can I access my completed form 8821 from any device?

Absolutely! Once you fill in form 8821 using airSlate SignNow, you can access it from any device with internet connectivity. Our cloud-based platform ensures that your documents are securely stored and available for access anytime, anywhere, making it convenient for ongoing management.

-

What are the benefits of using airSlate SignNow to fill in form 8821?

Using airSlate SignNow to fill in form 8821 streamlines the document completion process, saving you time and reducing errors. The platform enhances collaboration as you can share the form with others for reviews and signatures. Additionally, airSlate SignNow provides templates and automation tools that simplify repetitive tasks.

-

Does airSlate SignNow integrate with other applications to help fill in form 8821?

Yes, airSlate SignNow offers seamless integrations with various applications, which can enhance your experience while filling in form 8821. These integrations allow you to pull data from other platforms or send completed documents directly to your preferred storage solution. This feature streamlines your workflow and increases efficiency.

-

Is it safe to fill in form 8821 with airSlate SignNow?

Definitely! airSlate SignNow prioritizes security, ensuring that your data is protected while you fill in form 8821. We implement advanced encryption and compliance measures to safeguard sensitive information. You can have peace of mind knowing that your documents are secure on our platform.

-

How can I track the status of my filled form 8821?

With airSlate SignNow, you can easily track the status of your filled form 8821 in real-time. Our platform provides notifications on document activity, including when the form is viewed, signed, or completed by recipients. This feature keeps you informed and helps you manage your documents efficiently.

Get more for Fill In Form 8821

- Re contracts ch 10 possession and temporary lease forms

- 14 printable letter to tenant for eviction forms and

- The specific deductions are itemized as follows form

- Deposit return request letter form

- And applicable law due to your withholding wrongful amounts of my security deposit form

- What landlords need to know about subletting rocket lawyer form

- Ex 10 19 sublease agreement secgov form

- Notice to landlord refusal to allow sub lease unreasonable form

Find out other Fill In Form 8821

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast