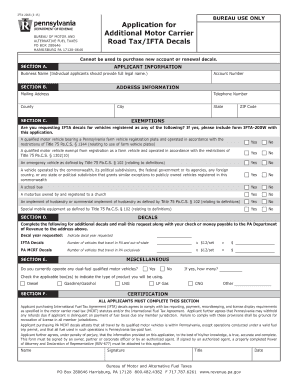

Ifta 200s Form

What is the IFTA 200s?

The IFTA 200s form, also known as the International Fuel Tax Agreement (IFTA) Quarterly Fuel Use Tax Return, is a crucial document for motor carriers operating in multiple jurisdictions. This form enables carriers to report fuel usage and calculate the taxes owed to various states and provinces based on their fuel consumption. It simplifies the tax reporting process for businesses that operate across state lines, ensuring compliance with fuel tax regulations.

How to use the IFTA 200s

Using the IFTA 200s form involves several key steps. First, gather all relevant fuel purchase receipts and mileage records for the reporting period. Next, enter the total miles driven in each jurisdiction and the total gallons of fuel purchased. The form will require you to calculate the tax owed for each jurisdiction based on these figures. Once completed, the form must be submitted to the appropriate state authority, along with any payment due.

Steps to complete the IFTA 200s

Completing the IFTA 200s form requires careful attention to detail. Here are the steps to follow:

- Collect all fuel purchase receipts and mileage logs for the reporting period.

- Fill in the total miles driven in each state or province.

- Record the total gallons of fuel purchased in each jurisdiction.

- Calculate the tax owed for each jurisdiction based on the applicable rates.

- Review the form for accuracy before submission.

- Submit the completed form to your state’s tax authority, along with any payment required.

Legal use of the IFTA 200s

The IFTA 200s form is legally binding when completed accurately and submitted on time. Compliance with the regulations set forth by the International Fuel Tax Agreement is essential for avoiding penalties. It is important to ensure that all information entered on the form is truthful and reflects actual fuel usage and mileage. Failure to comply with IFTA regulations can result in audits, fines, or other legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA 200s form are typically quarterly. Carriers must submit their returns by the last day of the month following the end of each quarter. The quarters are defined as follows:

- First Quarter: January 1 - March 31, due by April 30

- Second Quarter: April 1 - June 30, due by July 31

- Third Quarter: July 1 - September 30, due by October 31

- Fourth Quarter: October 1 - December 31, due by January 31

Penalties for Non-Compliance

Non-compliance with IFTA regulations can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits by state tax authorities. In severe cases, repeated violations can result in the suspension of a carrier's operating authority. It is crucial for businesses to stay informed about their filing obligations and ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete ifta 200s

Effortlessly Prepare Ifta 200s on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Ifta 200s on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Modify and eSign Ifta 200s with Ease

- Obtain Ifta 200s and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, either via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document duplicates. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Adjust and eSign Ifta 200s while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta 200s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IFTA 200s and how does it work?

IFTA 200s is a crucial form used for reporting fuel taxes for interstate commerce. With airSlate SignNow, businesses can easily fill out and eSign IFTA 200s documents seamlessly, ensuring compliance with state laws while saving time and resources.

-

How can airSlate SignNow help with completing IFTA 200s forms?

airSlate SignNow offers a user-friendly platform that simplifies the completion of IFTA 200s forms. Users can easily input necessary information, upload supporting documents, and send for signatures from anywhere, making the entire process efficient and straightforward.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow provides various pricing plans tailored to different business sizes and needs. Each plan includes access to features for managing IFTA 200s forms, ensuring whether you’re a small business or a large fleet, there’s an affordable option.

-

What features does airSlate SignNow offer for managing IFTA 200s?

airSlate SignNow includes essential features like real-time tracking, templates for IFTA 200s, and secure cloud storage. These features help streamline the eSigning process while allowing businesses to maintain accurate tax records.

-

Is airSlate SignNow compliant with IFTA regulations?

Yes, airSlate SignNow is fully compliant with IFTA regulations, providing users with the confidence that their IFTA 200s forms are completed correctly. Our platform ensures that all necessary data is captured and structured in accordance with tax requirements.

-

Can I integrate airSlate SignNow with other software for IFTA 200s?

Absolutely! airSlate SignNow offers integrations with various accounting and fleet management software to streamline your IFTA 200s filing process. This facilitates automatic data entry and document management, enhancing overall operational efficiency.

-

What are the benefits of using airSlate SignNow for IFTA 200s?

Using airSlate SignNow for IFTA 200s allows businesses to expedite their compliance process while ensuring accuracy. The platform offers an innovative approach to document management that increases productivity and reduces the likelihood of errors.

Get more for Ifta 200s

- 2008 form ak tz 94ha 612 fill online printable fillable

- Free appellee legal forms findformscom

- Ap 102 notice of appeal 1 12 appeal forms

- In an administrative appeal request alaska form

- Designation of transcript shs ap 140 alaska court system form

- Ap 140 response to request alaska form

- Notice of appeal from administrative agency to superior form

- How to write up a bill of sale when giving it away for freeit form

Find out other Ifta 200s

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure