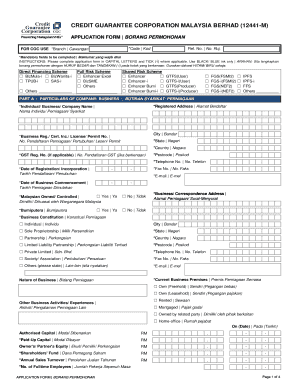

Credit Guarantee Corporation Powering Malaysian SMEs Form

What is the Credit Guarantee Corporation Powering Malaysian SMEs

The Credit Guarantee Corporation (CGC) is a pivotal institution designed to facilitate financing for small and medium-sized enterprises (SMEs) in Malaysia. By providing guarantees to financial institutions, CGC helps mitigate the risks associated with lending to SMEs, which often struggle to secure funding due to limited credit history or collateral. This initiative aims to bolster the growth of SMEs, which are crucial to the Malaysian economy, contributing significantly to GDP and employment.

How to use the Credit Guarantee Corporation Powering Malaysian SMEs

Utilizing the services of the Credit Guarantee Corporation involves several steps. First, SMEs must assess their financing needs and identify suitable financial institutions that collaborate with CGC. Next, businesses can apply for a guarantee by submitting the necessary documentation, which typically includes financial statements and a business plan. Once approved, the guarantee enables the SME to access loans with more favorable terms, enhancing their ability to invest and grow.

Steps to complete the Credit Guarantee Corporation Powering Malaysian SMEs

Completing the application process for the Credit Guarantee Corporation involves a systematic approach:

- Gather necessary documents, including business registration details and financial reports.

- Identify a participating financial institution that offers loans backed by CGC guarantees.

- Fill out the application form provided by the financial institution, ensuring all information is accurate.

- Submit the application along with the required documentation to the financial institution.

- Await approval from both the financial institution and CGC, which may take several days.

Legal use of the Credit Guarantee Corporation Powering Malaysian SMEs

The legal framework surrounding the Credit Guarantee Corporation ensures that all guarantees provided are compliant with Malaysian laws governing financial transactions. This includes adherence to regulations set forth by Bank Negara Malaysia and other relevant authorities. The guarantees offered by CGC are legally binding, providing a secure foundation for both lenders and SMEs, thereby fostering trust in the financing process.

Eligibility Criteria

To qualify for a guarantee from the Credit Guarantee Corporation, SMEs must meet specific eligibility criteria. Generally, businesses should be registered in Malaysia and fall within the defined size limits for SMEs. Additionally, the applicant must demonstrate a viable business model and the potential for growth. Financial health, including creditworthiness and repayment capability, is also assessed as part of the eligibility evaluation.

Application Process & Approval Time

The application process for obtaining a guarantee from the Credit Guarantee Corporation involves several stages. After submitting the application, it typically undergoes a review process that can take anywhere from a few days to several weeks, depending on the complexity of the application and the volume of requests being processed. During this time, CGC may request additional information or clarification to ensure that the application meets all necessary criteria.

Quick guide on how to complete credit guarantee corporation powering malaysian smes

Complete Credit Guarantee Corporation Powering Malaysian SMEs effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct version and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Credit Guarantee Corporation Powering Malaysian SMEs on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign Credit Guarantee Corporation Powering Malaysian SMEs with ease

- Obtain Credit Guarantee Corporation Powering Malaysian SMEs and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Credit Guarantee Corporation Powering Malaysian SMEs to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit guarantee corporation powering malaysian smes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the Credit Guarantee Corporation Powering Malaysian SMEs?

The Credit Guarantee Corporation Powering Malaysian SMEs provides guarantees for loans to small and medium enterprises, facilitating access to financing. This support helps businesses grow by reducing the risk for lenders. By backing these loans, the Credit Guarantee Corporation effectively helps stimulate the Malaysian economy.

-

How does airSlate SignNow integrate with the services of the Credit Guarantee Corporation Powering Malaysian SMEs?

airSlate SignNow integrates seamlessly with the Credit Guarantee Corporation Powering Malaysian SMEs by allowing users to sign documents digitally and securely. This integration streamlines the loan application process and enhances customer experience. Furthermore, it ensures that all documentation is completed efficiently, meeting the standards set by the Corporation.

-

What pricing options does airSlate SignNow offer for Malaysian SMEs?

airSlate SignNow offers flexible pricing plans tailored for Malaysian SMEs that fit various budgetary needs. Pricing is competitive and designed to be cost-effective, ensuring businesses can access essential tools without overspending. Additionally, the plans are structured to provide value for money without compromising on features.

-

What features does airSlate SignNow provide to support Malaysian SMEs?

airSlate SignNow features a user-friendly interface, mobile access, and robust security measures designed to empower Malaysian SMEs. Key functionalities include document templates, eSigning capabilities, and real-time tracking. These tools help streamline operations, making it easier for businesses to manage their documentation efficiently.

-

What benefits do SMEs gain from using airSlate SignNow in relation to the Credit Guarantee Corporation?

By utilizing airSlate SignNow alongside the support of the Credit Guarantee Corporation Powering Malaysian SMEs, businesses can expedite their document processes. This effectively reduces turnaround times for loan approvals and enhances operational efficiency. The combination of these services ensures SMEs are positioned for better growth opportunities.

-

Is airSlate SignNow secure for sensitive documents related to the Credit Guarantee Corporation Powering Malaysian SMEs?

Yes, airSlate SignNow ensures the highest level of security for all documents handled, including those related to the Credit Guarantee Corporation Powering Malaysian SMEs. The platform employs top-tier encryption and security protocols to protect sensitive information. Users can confidently manage their documents knowing that their data is secure.

-

Can airSlate SignNow assist in compliance with regulations for businesses in Malaysia?

Absolutely, airSlate SignNow assists Malaysian SMEs in ensuring compliance with legal and regulatory requirements when it comes to documents. The solution is designed to meet the legal standards necessary for legitimate eSigning practices, which is essential for those working with the Credit Guarantee Corporation Powering Malaysian SMEs.

Get more for Credit Guarantee Corporation Powering Malaysian SMEs

- Other credits not shown on another schedule describe form

- Gc 400e1gc 405e1 cash assets on hand at end of form

- Standard accounting forms superior court riverside yumpu

- Judicial council of california california courts cagov form

- Gc 400b gc 405b schedule b gains on salesstandard and simplified accounts judicial council forms

- Gc 400c4 schedule c disbursements fiduciary and form

- Gc 400sumgc 405sum summary of accountstandard form

- Gc 400ph2gc 405ph2 non cash assets on hand at form

Find out other Credit Guarantee Corporation Powering Malaysian SMEs

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now