Paycheck Math Worksheet Form

What is the Paycheck Math Worksheet

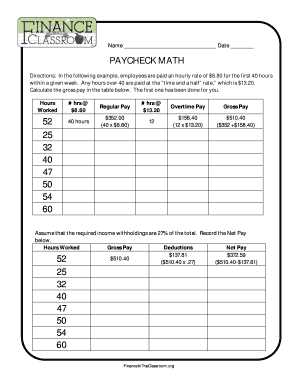

The paycheck math worksheet is a practical tool designed to help individuals understand and calculate their earnings, deductions, and net pay. It is commonly used in educational settings, particularly in finance classes, to teach students about personal finance and budgeting. This worksheet typically includes sections for gross pay, various deductions such as taxes and insurance, and the final net pay amount. By using this worksheet, learners can gain a clearer understanding of how paychecks are structured and the importance of each component in their overall financial picture.

How to use the Paycheck Math Worksheet

Using the paycheck math worksheet involves several straightforward steps. First, gather all necessary information, including your hourly wage or salary, hours worked, and any applicable deductions. Next, fill in the gross pay section by multiplying the hourly wage by the number of hours worked or entering the salary amount. After that, list all deductions, which may include federal and state taxes, Social Security, and health insurance. Finally, subtract the total deductions from the gross pay to find the net pay. This process not only aids in comprehension but also prepares individuals for real-world financial situations.

Steps to complete the Paycheck Math Worksheet

Completing the paycheck math worksheet involves a series of methodical steps:

- Identify your gross pay by calculating your total earnings before any deductions.

- List all applicable deductions, including federal and state taxes, Social Security, and any other withholdings.

- Add up all deductions to determine the total amount to be subtracted from your gross pay.

- Subtract the total deductions from your gross pay to arrive at your net pay.

- Review your entries for accuracy to ensure that your calculations reflect your actual earnings.

Key elements of the Paycheck Math Worksheet

The paycheck math worksheet includes several key elements essential for accurate calculations. These elements typically consist of:

- Gross Pay: The total amount earned before deductions.

- Deductions: Various amounts withheld from gross pay, including taxes and benefits.

- Net Pay: The final amount received after all deductions are subtracted from gross pay.

- Pay Period: The timeframe for which the paycheck is calculated, such as weekly, bi-weekly, or monthly.

Legal use of the Paycheck Math Worksheet

The paycheck math worksheet serves as an educational tool and does not have legal standing on its own. However, understanding how to accurately complete it is crucial for compliance with tax laws and regulations. Properly calculating earnings and deductions ensures that individuals meet their tax obligations and avoid potential penalties. It is important to use reliable sources and tools to ensure that the calculations reflect current tax rates and regulations, as these can vary by state and change over time.

Examples of using the Paycheck Math Worksheet

Examples of using the paycheck math worksheet can enhance understanding and application. For instance, a student might use the worksheet to calculate their earnings from a part-time job, factoring in hours worked and applicable deductions. Another example could involve a teacher demonstrating how to calculate net pay for different salary scenarios, helping students grasp the impact of varying tax rates and deductions. These practical applications reinforce the importance of paycheck math in everyday financial literacy.

Quick guide on how to complete paycheck math worksheet 40817336

Effortlessly Prepare Paycheck Math Worksheet on Any Device

The management of online documents has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and safely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Manage Paycheck Math Worksheet on any platform using the airSlate SignNow apps for Android or iOS, and streamline any document-based process today.

The Easiest Way to Modify and Electronically Sign Paycheck Math Worksheet

- Locate Paycheck Math Worksheet and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides for that specific purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Paycheck Math Worksheet to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the paycheck math worksheet 40817336

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a paycheck math worksheet?

A paycheck math worksheet is a tool that helps individuals calculate their earnings accurately, considering various factors like taxes and deductions. With airSlate SignNow, you can easily create and manage your paycheck math worksheets to ensure you retain the correct amount from your salary.

-

How can airSlate SignNow improve my paycheck math worksheet process?

airSlate SignNow streamlines the paycheck math worksheet process by providing an intuitive interface for creating, sharing, and storing your financial documents securely. You can send your paycheck math worksheets electronically for approval, making the entire process faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for paycheck math worksheets?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for businesses needing to manage their paycheck math worksheets and other documents. You can choose from various subscription options that fit your budget while providing the features you need for document management.

-

Can I integrate airSlate SignNow with my existing payroll software for better paycheck calculations?

Absolutely! airSlate SignNow offers seamless integrations with various payroll software solutions to enhance your paycheck math worksheet calculations. This ensures your data remains accurate and up-to-date across all platforms, improving your overall workflow and reducing errors.

-

What are the benefits of using airSlate SignNow for paycheck math worksheets?

Using airSlate SignNow for paycheck math worksheets provides numerous benefits including increased accuracy in calculations, faster processing times, and enhanced security for your financial documents. It allows you to focus more on your core business activities while we take care of your document management needs.

-

Can I share my paycheck math worksheet with others for review?

Yes, you can easily share your paycheck math worksheet with others for review using airSlate SignNow. Our platform allows you to send documents securely and track who has viewed or signed them, facilitating collaboration and ensuring everyone involved is on the same page.

-

Is training available for using airSlate SignNow with paycheck math worksheets?

Yes, airSlate SignNow provides comprehensive training resources and support to help you make the most of your paycheck math worksheets. We offer tutorials, webinars, and a knowledgeable support team to guide you through any challenges you may face.

Get more for Paycheck Math Worksheet

- Form 5dc48

- Small claims va atj virginia judicial system court self help form

- Statement of claim and notice disagreement court forms

- Form 5dc50

- Temporary restraining order washington state courts form

- How to file for divorce in hawaii step by step guide form

- Self help information divorce familylawhelporghi

- Form 5dc53

Find out other Paycheck Math Worksheet

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document