Au 262 55 Form

What is the AU 262 55?

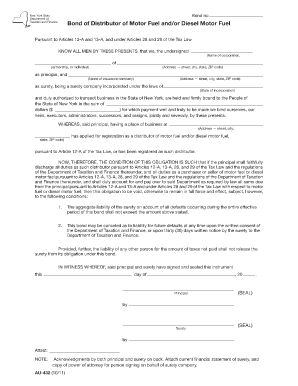

The AU 262 55 is a specific form used in the context of bond contracts, particularly relevant for individuals and businesses in New York. This form is essential for documenting the allocation of income related to bond issuance and serves as a formal declaration of compliance with state regulations. Understanding its purpose is crucial for ensuring that all parties involved in a bond contract fulfill their legal obligations.

How to Use the AU 262 55

Using the AU 262 55 involves several straightforward steps. First, gather the necessary information regarding the bond contract, including details about the parties involved and the terms of the bond. Next, accurately fill out the form, ensuring that all required fields are completed. Once the form is filled out, it should be reviewed for accuracy before submission. Utilizing digital tools can streamline this process, making it easier to complete and sign the document securely.

Steps to Complete the AU 262 55

Completing the AU 262 55 requires attention to detail. Follow these steps for successful completion:

- Gather all relevant information about the bond contract.

- Access the AU 262 55 form online or through your preferred method.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Sign the form electronically or in person, as required.

- Submit the form according to the specified guidelines.

Legal Use of the AU 262 55

The AU 262 55 holds legal significance in the context of bond contracts. It serves as a formal record that can be referenced in legal proceedings if necessary. To ensure its legal standing, it is essential to comply with all relevant regulations, including those outlined by the state of New York. This compliance helps protect the interests of all parties involved and ensures that the bond contract is enforceable in a court of law.

Key Elements of the AU 262 55

Several key elements must be included in the AU 262 55 to ensure its validity. These elements typically include:

- Identification of the parties involved in the bond contract.

- Details regarding the terms and conditions of the bond.

- Signature fields for all parties to confirm their agreement.

- Any additional information required by state regulations.

State-Specific Rules for the AU 262 55

In New York, the AU 262 55 is subject to specific state regulations that govern its use. These rules may include deadlines for submission, requirements for electronic signatures, and guidelines for maintaining records. It is important for users to familiarize themselves with these regulations to ensure compliance and avoid potential penalties.

Quick guide on how to complete au 262 55

Effortlessly prepare Au 262 55 on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents rapidly without any hold-ups. Manage Au 262 55 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Au 262 55 with ease

- Obtain Au 262 55 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Au 262 55 to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the au 262 55

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bond contract and how can airSlate SignNow help with it?

A bond contract is a legal agreement that outlines the terms of a bond issued between two parties. airSlate SignNow streamlines the process of creating, sending, and electronically signing bond contracts, making it faster and more efficient for businesses to manage their agreements.

-

How does pricing for bond contract management work with airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs, including those focused on bond contracts. You can choose a plan that includes features specifically designed for efficient contract management, ensuring you get the value necessary for your bond-related documents.

-

What features does airSlate SignNow offer for managing bond contracts?

With airSlate SignNow, you can create, edit, and send bond contracts effortlessly. Our platform includes features like templates, in-app collaboration, and automated reminders, all designed to enhance the efficiency of managing your bond contracts.

-

Can I integrate airSlate SignNow with other tools for bond contract management?

Yes, airSlate SignNow seamlessly integrates with various business applications, making it easy to incorporate bond contract management into your existing workflows. Integrations with popular tools enhance productivity and ensure your bond contracts are efficiently handled alongside other documents.

-

What are the benefits of using airSlate SignNow for bond contracts?

Using airSlate SignNow for bond contracts enhances security, saves time, and reduces paper usage. Our electronic signature process ensures compliance and allows you to track the status of your bond contracts in real time, all while maintaining the integrity of your agreements.

-

Is airSlate SignNow secure for handling sensitive bond contracts?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure storage, to protect your bond contracts. We prioritize data safety to ensure that all your sensitive information remains confidential and secure.

-

How does airSlate SignNow ensure compliance with bond contracts?

airSlate SignNow is designed to meet industry standards for compliance, which is crucial for bond contracts. Our platform provides audit trails, legal validity, and customizable workflows to help you stay aligned with regulatory requirements.

Get more for Au 262 55

- Judgment and decree form

- Dakota county district court minnesota judicial branch form

- Affidavit of attorney form

- For rent payments under the lease agreement up to the amount of the guarantee as described form

- 10 tips for writing a persuasive family law declaration form

- The uniform child custody jurisdiction and ncjrs

- Rule 36 requests for admissionfederal rules of civil form

- Above named by and through his form

Find out other Au 262 55

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template