S5 Form Richmond County Tax

What is the S5 Form Richmond County Tax

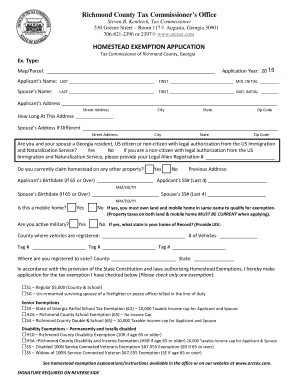

The S5 Form Richmond County Tax is a crucial document for property owners seeking to apply for the homestead exemption in Richmond County, Georgia. This exemption allows eligible homeowners to reduce their property tax burden by exempting a portion of their home's value from taxation. Understanding the details of the S5 form is essential for homeowners looking to benefit from this financial relief.

Eligibility Criteria

To qualify for the homestead exemption in Richmond County, applicants must meet specific criteria. Generally, the homeowner must occupy the property as their primary residence and must not have claimed a homestead exemption on any other property. Additional requirements may include age restrictions, income limitations, or disability status. It is important to review these criteria carefully to ensure eligibility before submitting the S5 form.

Steps to Complete the S5 Form Richmond County Tax

Completing the S5 form requires careful attention to detail. Here are the essential steps to follow:

- Gather necessary documentation, including proof of residency and identification.

- Fill out the S5 form accurately, providing all required information such as property address and owner's details.

- Review the completed form for accuracy to avoid delays in processing.

- Submit the form by the designated deadline to ensure eligibility for the current tax year.

Required Documents

When applying for the homestead exemption using the S5 form, certain documents are typically required. These may include:

- Proof of ownership, such as a deed or tax bill.

- Identification documents, including a driver's license or state ID.

- Any additional documentation that supports eligibility, such as income statements or disability verification.

Form Submission Methods

The S5 form can be submitted through various methods to accommodate different preferences. Homeowners may choose to:

- Submit the form online via the Richmond County tax office's website.

- Mail the completed form to the appropriate tax office address.

- Deliver the form in person to the tax office for immediate processing.

Key Elements of the S5 Form Richmond County Tax

The S5 form contains several key sections that applicants must complete. Important elements include:

- Property description, including the parcel number and address.

- Owner's personal information, such as name and contact details.

- Declaration of eligibility, where the applicant affirms their qualification for the exemption.

Quick guide on how to complete s5 form richmond county tax

Complete S5 Form Richmond County Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as it allows you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without holdups. Manage S5 Form Richmond County Tax on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign S5 Form Richmond County Tax with ease

- Obtain S5 Form Richmond County Tax and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant parts of your documents or conceal sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign S5 Form Richmond County Tax and guarantee effective communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s5 form richmond county tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Richmond County homestead exemption?

The Richmond County homestead exemption is a property tax reduction available to homeowners to decrease their property tax liability. It is designed to provide financial relief to residents who occupy their homes. Eligibility requirements may vary, so it's essential to check your specific situation to take advantage of the Richmond County homestead exemption.

-

How do I apply for the Richmond County homestead exemption?

To apply for the Richmond County homestead exemption, you need to complete an application form available through the local tax assessor's office. Documentation such as proof of residency and property ownership may be required. Completing the application correctly can ensure you receive the benefits of the Richmond County homestead exemption.

-

What are the benefits of obtaining the Richmond County homestead exemption?

The primary benefit of the Richmond County homestead exemption is the reduction in your property taxes, which can lead to signNow savings each year. Additionally, it may provide protections against certain types of creditors and help you qualify for other state benefits. Taking advantage of the Richmond County homestead exemption helps homeowners maintain financial stability.

-

Are there any eligibility requirements for the Richmond County homestead exemption?

Yes, eligibility for the Richmond County homestead exemption typically requires that the applicant occupy the property as their primary residence. There may also be income limitations or age requirements, depending on the specific exemption type. It's important to review these criteria to determine your qualification for the Richmond County homestead exemption.

-

Is there a deadline to apply for the Richmond County homestead exemption?

Yes, there is usually a deadline for applying for the Richmond County homestead exemption which may vary each year. Typically, applications must be submitted by a certain date, often in the spring. To avoid missing out on potential savings, it’s crucial to check with the local tax authority for the specific deadline related to the Richmond County homestead exemption.

-

Can I apply for the Richmond County homestead exemption online?

Many local tax assessors' offices now offer the ability to apply for the Richmond County homestead exemption online. This can make the application process more convenient and accessible for homeowners. Always check the official website to confirm if online applications are accepted for the Richmond County homestead exemption.

-

What should I do if my application for the Richmond County homestead exemption is denied?

If your application for the Richmond County homestead exemption is denied, you will typically receive a notification with the reasons for the denial. You can address the issues noted and either reapply or appeal the decision. Contacting the local tax assessor's office for further guidance can help clarify your next steps regarding the Richmond County homestead exemption.

Get more for S5 Form Richmond County Tax

- Nvb 4002 rev nvb uscourts form

- Rental applicationpdf anchor realty group form

- Sample formscompanion animals

- New client referral form preferredprivatecarecom

- Ancc certification application form

- Non military affidavit texas form

- Cpd 96 03 tenant rent calculations for certain hud mckinney act programs hud form

- Publication 1321 rev 10 2021 special instructions for bona fide residents of puerto rico who must file a us individual income form

Find out other S5 Form Richmond County Tax

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document