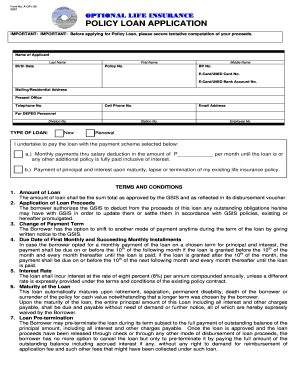

Gsis Policy Loan Computation Form

Understanding the GSIS Policy Loan Computation

The GSIS policy loan computation is a crucial aspect for members looking to understand their borrowing options against their insurance policies. This computation involves determining the maximum loan amount available based on the cash value of the policy and any outstanding loans. Members should be aware that the computation considers various factors, including the policy's accumulated value, the interest rate applicable, and the duration of the loan. Understanding these elements is essential for making informed decisions regarding policy loans.

Steps to Complete the GSIS Policy Loan Computation

Completing the GSIS policy loan computation involves several straightforward steps:

- Gather necessary information about your policy, including the current cash value and any existing loans.

- Determine the interest rate applicable to the loan, which can vary based on the policy terms.

- Calculate the maximum loan amount by subtracting any outstanding loans from the cash value.

- Consider the repayment terms and how they will affect your policy's benefits.

Following these steps ensures that you have a clear understanding of your borrowing capacity and the implications of taking a loan against your policy.

How to Obtain the GSIS Policy Loan Computation

To obtain the GSIS policy loan computation, members can typically follow these steps:

- Contact the GSIS customer service or visit their official website for guidance.

- Provide the necessary details about your policy to receive a personalized computation.

- Utilize any available online tools or calculators provided by GSIS to estimate your loan amount.

It is important to ensure you have all pertinent information at hand to facilitate a smooth computation process.

Legal Use of the GSIS Policy Loan Computation

The GSIS policy loan computation must adhere to specific legal guidelines to ensure that the loan is valid and enforceable. Members should be aware that:

- The computation must reflect accurate and truthful information regarding the policy's cash value.

- All applicable interest rates and terms must comply with GSIS regulations.

- Documentation related to the loan must be properly signed and submitted to maintain legal standing.

Understanding these legal aspects helps protect members' rights and ensures compliance with GSIS policies.

Key Elements of the GSIS Policy Loan Computation

Several key elements are critical in the GSIS policy loan computation:

- Cash Value: The amount accumulated in the policy that can be borrowed against.

- Outstanding Loans: Any previous loans taken against the policy that must be deducted from the cash value.

- Interest Rate: The rate applied to the loan, which affects repayment amounts.

- Loan Terms: The duration and repayment schedule for the loan.

Understanding these elements ensures that members can accurately compute their loan options and make informed decisions.

Quick guide on how to complete gsis policy loan computation

Easily Prepare Gsis Policy Loan Computation on Any Device

Managing documents online has gained popularity among entities and individuals alike. It offers an optimal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, edit, and electronically sign your documents swiftly and without delays. Handle Gsis Policy Loan Computation on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The Most Efficient Way to Edit and eSign Gsis Policy Loan Computation Effortlessly

- Locate Gsis Policy Loan Computation and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing additional copies. airSlate SignNow meets all your document management requirements within a few clicks from any chosen device. Edit and eSign Gsis Policy Loan Computation to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gsis policy loan computation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the policy loan GSIS computation process?

The policy loan GSIS computation process involves calculating the amount you can borrow against your GSIS policy, taking into account the policy's cash value and accrued interest. This helps borrowers understand the financial options available to them without jeopardizing their policy benefits.

-

How does airSlate SignNow facilitate policy loan GSIS computation?

airSlate SignNow offers tools that simplify the process of policy loan GSIS computation by allowing users to fill out and sign necessary documents electronically. This ensures quick access to important information and expeditious processing, enhancing the overall user experience.

-

Are there any fees associated with policy loan GSIS computation through airSlate SignNow?

While airSlate SignNow itself provides a cost-effective solution for document management, there may be standard fees associated with the actual policy loan GSIS computation, which can vary based on the terms of your GSIS policy. It’s recommended to review your policy for specific fee details.

-

What benefits does airSlate SignNow provide for policy loan GSIS computation?

One of the key benefits of using airSlate SignNow for policy loan GSIS computation is its ease of use. The platform allows you to manage documentation effortlessly, ensuring a streamlined process that is both time-efficient and reliable, making it ideal for busy individuals.

-

Can airSlate SignNow integrate with other tools for policy loan GSIS computation?

Yes, airSlate SignNow can integrate with various tools and software, enhancing the policy loan GSIS computation process. This includes data management systems that may help in retrieving and processing the necessary documents swiftly.

-

How secure is the information shared during policy loan GSIS computation with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and security protocols to protect all information shared during the policy loan GSIS computation process, ensuring that your data remains confidential and secure.

-

Can I track the policies I’ve applied for regarding policy loan GSIS computation?

Absolutely! airSlate SignNow features tracking capabilities that allow users to monitor the status of their policy loan GSIS computation applications. This ensures you are always informed about the progress and any actions required on your part.

Get more for Gsis Policy Loan Computation

- 20 do hereby revoke such gift pursuant to the new form

- Amended and restated separation agreement secgov form

- Checklist of standard and illegal hiring interview questions form

- Control number nh p029 pkg form

- Control number nh p032 pkg form

- Control number nh p033 pkg form

- Control number nh p034 pkg form

- 1 new hampshire nh prenuptial agreement form pdf

Find out other Gsis Policy Loan Computation

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document