International Fuel Tax Agreement Tax Report IFTA Colorado Gov Colorado 2014

What is the International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado

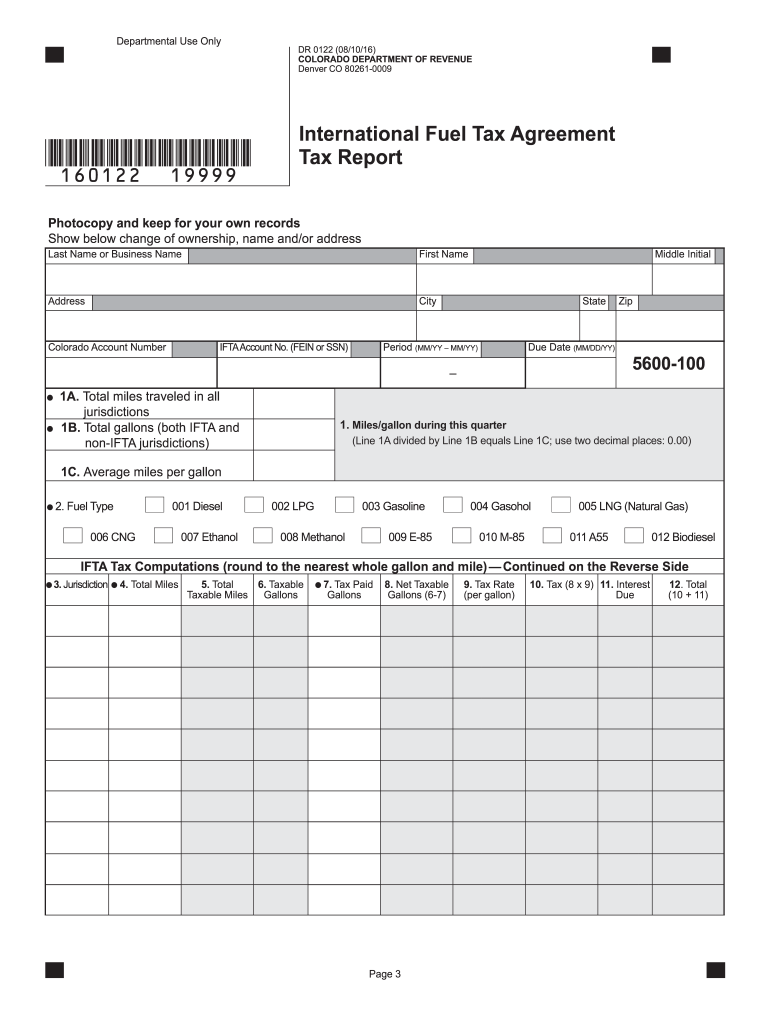

The International Fuel Tax Agreement (IFTA) Tax Report is a crucial document for motor carriers operating in multiple jurisdictions. This report simplifies the process of reporting fuel use and taxes owed to various states, including Colorado. Under IFTA, carriers can file a single tax return to cover fuel taxes for all member jurisdictions, reducing the complexity of managing multiple filings. The Colorado Department of Revenue oversees the implementation of IFTA in the state, ensuring compliance with both state and federal regulations.

Steps to complete the International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado

Completing the IFTA Tax Report involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including fuel purchase receipts and mileage logs. Next, calculate the total miles driven and the total gallons of fuel purchased in each jurisdiction. After compiling this information, fill out the IFTA Tax Report form, ensuring that all fields are accurately completed. Finally, review the report for any errors before submitting it electronically or by mail to the Colorado Department of Revenue.

Key elements of the International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado

Several key elements must be included in the IFTA Tax Report to ensure it meets regulatory requirements. These elements include:

- Carrier Information: Name, address, and IFTA account number.

- Jurisdiction Information: Total miles driven and total gallons of fuel purchased in each state.

- Tax Calculation: Calculation of fuel taxes owed for each jurisdiction based on the reported fuel usage.

- Signature: An authorized signature to validate the report.

Filing Deadlines / Important Dates

It is essential to adhere to the filing deadlines for the IFTA Tax Report to avoid penalties. In Colorado, the IFTA Tax Report is typically due on the last day of the month following the end of each quarter. This means that reports for the first quarter are due by April 30, for the second quarter by July 31, for the third quarter by October 31, and for the fourth quarter by January 31. Carriers should mark these dates on their calendars to ensure timely submissions.

Legal use of the International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado

The IFTA Tax Report is legally binding and must be completed accurately to comply with state and federal tax laws. Falsifying information on this report can lead to severe penalties, including fines and potential legal action. Carriers are encouraged to maintain thorough records of their fuel purchases and mileage to support the information reported. The Colorado Department of Revenue may audit these records to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

Carriers have several options for submitting the IFTA Tax Report in Colorado. The preferred method is online submission through the Colorado Department of Revenue's website, which allows for faster processing and confirmation of receipt. Alternatively, carriers can mail their completed forms to the appropriate address provided by the state. In-person submissions are also accepted at designated revenue offices, although this method may require waiting in line.

Quick guide on how to complete international fuel tax agreement tax report ifta coloradogov colorado

Your assistance manual on how to prepare your International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado

If you’re wondering how to design and submit your International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado, here are some brief guidelines on how to make tax declaration simpler.

To start, you only need to create your airSlate SignNow account to change how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to modify, generate, and complete your tax documents with ease. With its editor, you can alternate between text, check boxes, and eSignatures and return to change details as necessary. Simplify your tax handling with advanced PDF editing, eSigning, and intuitive sharing.

Follow the procedures below to complete your International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado in our editor.

- Enter the required fillable fields with your information (text, numbers, check marks).

- Utilize the Signature Tool to add your legally-binding eSignature (if needed).

- Examine your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Employ this manual to file your taxes electronically with airSlate SignNow. Please remember that filing on paper can lead to return errors and postpone refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct international fuel tax agreement tax report ifta coloradogov colorado

Create this form in 5 minutes!

How to create an eSignature for the international fuel tax agreement tax report ifta coloradogov colorado

How to generate an electronic signature for your International Fuel Tax Agreement Tax Report Ifta Coloradogov Colorado online

How to make an electronic signature for the International Fuel Tax Agreement Tax Report Ifta Coloradogov Colorado in Google Chrome

How to create an eSignature for signing the International Fuel Tax Agreement Tax Report Ifta Coloradogov Colorado in Gmail

How to generate an electronic signature for the International Fuel Tax Agreement Tax Report Ifta Coloradogov Colorado from your mobile device

How to make an eSignature for the International Fuel Tax Agreement Tax Report Ifta Coloradogov Colorado on iOS devices

How to create an electronic signature for the International Fuel Tax Agreement Tax Report Ifta Coloradogov Colorado on Android

People also ask

-

What is the International Fuel Tax Agreement (IFTA) Tax Report for Colorado residents?

The International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado is a crucial document for commercial vehicle operators who travel across multiple jurisdictions. It ensures that fuel taxes are paid fairly based on the miles driven in each state. Colorado residents must comply with these regulations to avoid penalties.

-

How can airSlate SignNow assist with filing the IFTA Tax Report in Colorado?

airSlate SignNow streamlines the process of completing and filing the International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado. By providing an easy-to-use platform, it enables users to electronically sign, send, and manage their tax reports efficiently, reducing the risk of errors and saving valuable time.

-

What are the costs associated with using airSlate SignNow for IFTA reporting?

airSlate SignNow offers a cost-effective solution for businesses needing to manage the International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado. Pricing is based on usage, and customers can choose from various plans that cater to their specific needs, ensuring flexibility without compromising service quality.

-

Are there integrations available with airSlate SignNow for IFTA Tax Report processes?

Yes, airSlate SignNow provides seamless integrations with various accounting and tax software, enabling businesses to incorporate the International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado into their existing workflows. This facilitates a smoother data transfer and reduces manual entry, making compliance more efficient.

-

What are the benefits of using airSlate SignNow for my IFTA Tax Report in Colorado?

Utilizing airSlate SignNow for your International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado offers multiple benefits, including enhanced efficiency, error reduction, and cost savings. The platform's user-friendly interface allows for quicker processing of documents while ensuring compliance with state regulations.

-

Can I track the status of my IFTA Tax Report submitted through airSlate SignNow?

Absolutely! airSlate SignNow provides users with the ability to track the status of the International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado submissions. This feature allows businesses to maintain oversight and accountability in their filing process, ensuring peace of mind.

-

Is the airSlate SignNow platform secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance when it comes to handling sensitive documents such as the International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado. The platform includes bank-level encryption and advanced authentication features to safeguard users' data.

Get more for International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado

- Case study consent form

- Material request form

- Abc 207e form

- Ration card surrender application letter form

- Prescription medication form seminole county schools scps k12 fl

- Special order axle confirmation dexter parts online form

- Pest control invoice template doc form

- Form mo dor 1716 fill online printable fillable blank

Find out other International Fuel Tax Agreement Tax Report IFTA Colorado gov Colorado

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast