DR 0122 Colorado Department of Revenue Colorado Gov 2020-2026

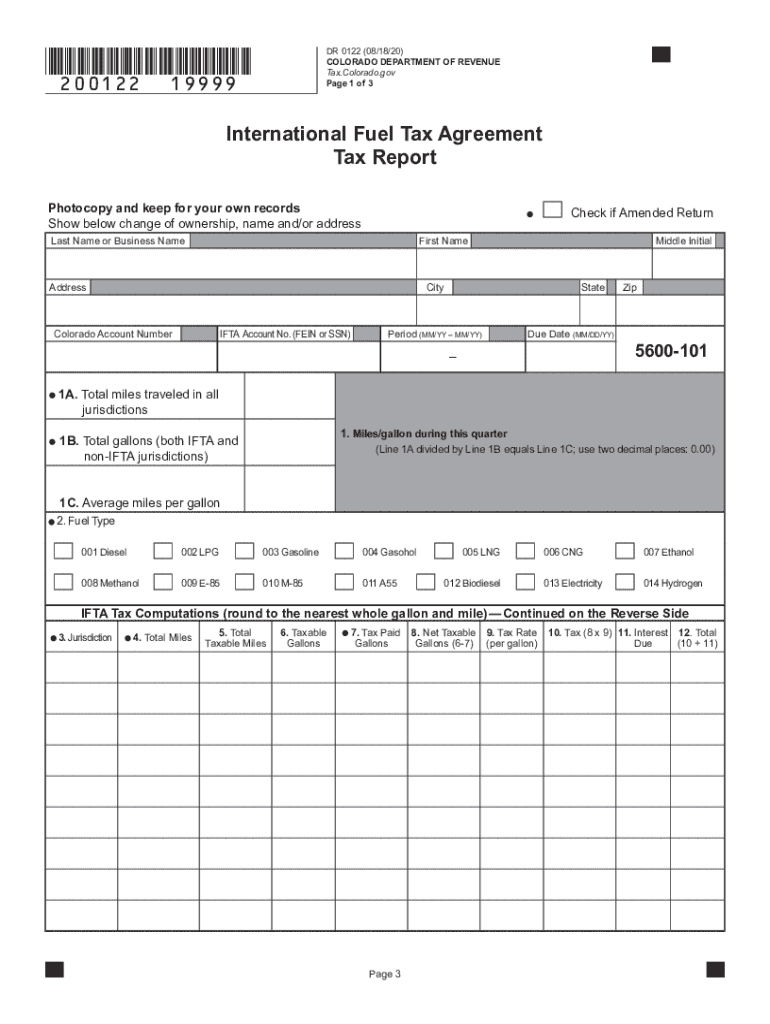

What is the DR 0122?

The DR 0122 form, also known as the Colorado Fuel Tax Agreement, is a crucial document issued by the Colorado Department of Revenue. This form is essential for businesses operating commercial vehicles that travel across state lines. It allows for the reporting and payment of fuel taxes owed to the state of Colorado based on the fuel consumption of these vehicles. Understanding the purpose and requirements of the DR 0122 is vital for compliance with state tax regulations.

Steps to Complete the DR 0122

Completing the DR 0122 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding your fuel purchases and usage. This includes details about the miles driven in each state and the gallons of fuel purchased. Next, accurately fill out the form by entering the required data in the designated fields. Finally, review the completed form for any errors before submitting it to the Colorado Department of Revenue. This thorough process helps prevent delays and potential penalties.

Legal Use of the DR 0122

The DR 0122 form holds legal significance as it serves as an official record of fuel tax reporting for businesses. To be considered legally binding, the form must be completed accurately and submitted on time. Compliance with the regulations governing this form is essential to avoid penalties or legal issues. Utilizing electronic signature solutions can enhance the legal standing of the submitted document, ensuring that it meets all necessary legal requirements.

Filing Deadlines / Important Dates

Staying informed about filing deadlines for the DR 0122 is crucial for compliance. Typically, the form must be submitted quarterly, with specific due dates that vary based on the reporting period. Missing these deadlines can result in penalties or interest on unpaid taxes. It is advisable to mark these dates on your calendar and set reminders to ensure timely submission.

Form Submission Methods

The DR 0122 can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient option, allowing for quicker processing and confirmation. If submitting by mail, ensure that the form is sent to the correct address and consider using a trackable mailing option. In-person submissions can be made at designated Colorado Department of Revenue offices, providing an opportunity for immediate assistance if needed.

Penalties for Non-Compliance

Failure to comply with the requirements of the DR 0122 can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to understand the implications of non-compliance and to take proactive measures to ensure that all forms are completed accurately and submitted on time. Regular audits of fuel tax records can help identify any discrepancies before they become problematic.

Quick guide on how to complete dr 0122 colorado department of revenue coloradogov

Effortlessly Prepare DR 0122 Colorado Department Of Revenue Colorado gov on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage DR 0122 Colorado Department Of Revenue Colorado gov on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

Effortlessly Change and eSign DR 0122 Colorado Department Of Revenue Colorado gov

- Obtain DR 0122 Colorado Department Of Revenue Colorado gov and click Get Form to begin.

- Make use of the tools we supply to fill out your form.

- Select pertinent sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign DR 0122 Colorado Department Of Revenue Colorado gov and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 0122 colorado department of revenue coloradogov

Create this form in 5 minutes!

How to create an eSignature for the dr 0122 colorado department of revenue coloradogov

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is the colorado ifta login and how does it work?

The colorado ifta login is a web portal that allows registered users to access their International Fuel Tax Agreement account. Through this platform, users can manage and submit fuel tax reports, view account details, and ensure compliance with state regulations. The login process is designed to be quick and secure, making it easier for businesses to manage their IFTA needs.

-

How do I create an account for the colorado ifta login?

To create an account for the colorado ifta login, you will need to provide your business information, such as your employer identification number. After filling out the registration form, you will receive an email confirmation with instructions to activate your account. Once activated, you can access the portal to manage your IFTA filings.

-

Is there a cost associated with using the colorado ifta login?

Access to the colorado ifta login is generally free for registered users, as it is provided by state authorities to facilitate fuel tax reporting. However, businesses may incur charges related to the filing of tax returns or late payment fees. It's advisable to review the fee structure on the official website to understand any potential costs.

-

What features does the colorado ifta login offer?

The colorado ifta login provides various features, including the ability to file fuel tax reports electronically, view transaction history, and access important compliance documents. Additionally, users can update their personal information and account settings directly through the platform. These features streamline the filing process and help businesses stay organized.

-

Can I integrate the colorado ifta login with other software?

Yes, the colorado ifta login can be integrated with several third-party accounting and fleet management software solutions. This integration allows businesses to automatically sync their fuel tax data, reducing manual entry and minimizing errors. It's essential to check with your software provider for compatibility and integration options.

-

What are the benefits of using the colorado ifta login for my business?

The primary benefit of using the colorado ifta login is the ease and efficiency it brings to filing fuel tax reports. It allows businesses to streamline their reporting process, saving time and reducing the risk of penalties for late or inaccurate submissions. Additionally, the portal provides important resources and guidance, ensuring compliance with local regulations.

-

How secure is my information on the colorado ifta login?

The colorado ifta login employs advanced security measures to protect user data, including encryption and secure server protocols. Personal and financial information is kept confidential and accessible only to authorized individuals. Always ensure you follow cybersecurity best practices, such as using strong passwords and not sharing login details.

Get more for DR 0122 Colorado Department Of Revenue Colorado gov

Find out other DR 0122 Colorado Department Of Revenue Colorado gov

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template