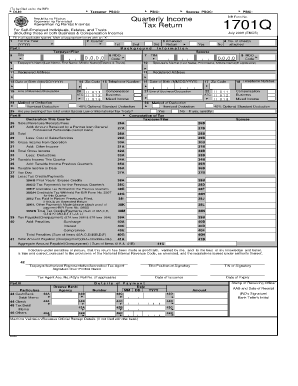

1701Qguidejuly2008 DOC Form

What is the 1701Qguidejuly2008 doc

The 1701Qguidejuly2008 doc is a specific form used primarily for tax-related purposes in the United States. It provides guidance for taxpayers on various aspects of tax filing, including eligibility criteria, required documents, and filing deadlines. This form is essential for ensuring compliance with IRS regulations and helps taxpayers understand their obligations and rights when it comes to reporting income and claiming deductions.

How to use the 1701Qguidejuly2008 doc

Using the 1701Qguidejuly2008 doc involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and financial records. Next, carefully read the instructions provided in the form to understand the requirements. Fill out the form accurately, ensuring that all information is complete and truthful. Once completed, review the form for any errors before submitting it through the appropriate channels, whether online or by mail.

Steps to complete the 1701Qguidejuly2008 doc

Completing the 1701Qguidejuly2008 doc requires a systematic approach. Start by downloading the form from a reliable source. Next, follow these steps:

- Read the instructions thoroughly to understand what information is needed.

- Gather all required documents, such as W-2 forms, 1099s, and receipts for deductions.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide accurate financial data, ensuring that all figures are correct and match your supporting documents.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal use of the 1701Qguidejuly2008 doc

The legal use of the 1701Qguidejuly2008 doc hinges on its compliance with IRS regulations and guidelines. When completed correctly, this form serves as a legally binding document that reflects your tax obligations. It is crucial to ensure that all information provided is accurate and truthful to avoid potential penalties. Additionally, using a reliable eSignature solution can enhance the legal validity of the document by providing a secure method for signing and submitting electronically.

Filing Deadlines / Important Dates

Filing deadlines for the 1701Qguidejuly2008 doc are critical for ensuring compliance with tax regulations. Typically, individual taxpayers must submit their forms by April 15 of each year. However, specific circumstances, such as extensions or special filing situations, may alter these deadlines. It is essential to stay informed about any changes to tax laws that could affect your filing dates to avoid late penalties.

Required Documents

To complete the 1701Qguidejuly2008 doc accurately, several documents are required. These may include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses, such as medical bills or charitable contributions

- Any relevant financial statements, including bank statements and investment records

Gathering these documents in advance will streamline the completion process and help ensure accuracy.

Quick guide on how to complete 1701qguidejuly2008 doc

Manage 1701Qguidejuly2008 doc effortlessly on any device

Digital document administration has become increasingly popular among companies and individuals. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without delays. Handle 1701Qguidejuly2008 doc on any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign 1701Qguidejuly2008 doc with ease

- Find 1701Qguidejuly2008 doc and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important portions of the documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign 1701Qguidejuly2008 doc and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1701qguidejuly2008 doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1701Qguidejuly2008 doc and how can it help my business?

The 1701Qguidejuly2008 doc is a crucial resource for businesses to understand compliance and reporting. airSlate SignNow provides a platform to easily eSign and send this document, ensuring your business stays on track with regulatory requirements while maintaining efficiency.

-

Can I integrate the 1701Qguidejuly2008 doc into my existing workflows?

Yes, airSlate SignNow allows seamless integration of the 1701Qguidejuly2008 doc into your existing workflows. Our platform supports various business applications, making it simple to incorporate document signing into everyday operations.

-

What are the pricing options for using airSlate SignNow with the 1701Qguidejuly2008 doc?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes looking to manage documents like the 1701Qguidejuly2008 doc. For detailed pricing information and potential discounts for annual subscriptions, visit our pricing page.

-

How secure is the airSlate SignNow platform for handling the 1701Qguidejuly2008 doc?

Security is a priority at airSlate SignNow. We use advanced encryption protocols to ensure that your documents, including the 1701Qguidejuly2008 doc, are kept safe during transmission and storage, protecting sensitive information.

-

What are the key features of airSlate SignNow for managing the 1701Qguidejuly2008 doc?

Key features of airSlate SignNow include customizable templates, real-time tracking, and automated reminders, all of which enhance the management of the 1701Qguidejuly2008 doc. These tools streamline the signing process, making it faster and more efficient for your business.

-

Can multiple users collaborate on the 1701Qguidejuly2008 doc using airSlate SignNow?

Absolutely! With airSlate SignNow, multiple users can easily collaborate on the 1701Qguidejuly2008 doc. Our platform supports team workflows, allowing everyone involved to track progress and make necessary edits in real time.

-

Is there a mobile app for accessing the 1701Qguidejuly2008 doc on-the-go?

Yes, airSlate SignNow offers a mobile app that allows you to access and manage the 1701Qguidejuly2008 doc from anywhere. This feature ensures you can send, sign, and monitor documents while on the move, providing ultimate convenience.

Get more for 1701Qguidejuly2008 doc

- Third party notification for real property taxes application form

- New york state department of taxation and finance tp 584 i form

- Ptax 343 application for the homestead exemption for form

- The basis of venue is form

- Fillable online download new ob patient packet womenampampamp39 form

- Of the respective parties and due deliberation having been had thereon form

- Upon a showing of i a substantial change in circumstances or ii that form

- Supreme court of the state of new york county of index no form

Find out other 1701Qguidejuly2008 doc

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement