In Kind Donation Receipt Transitionslifecare Form

What is the In Kind Donation Receipt Transitionslifecare

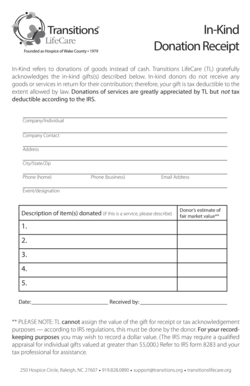

The In Kind Donation Receipt Transitionslifecare is a document used to acknowledge non-cash contributions made to the organization. It serves as proof of the donation for both the donor and the recipient, detailing the items or services provided. This receipt is particularly important for tax purposes, as it allows donors to claim deductions for their contributions. The form typically includes information such as the donor's name, the date of the donation, a description of the donated items, and the estimated value of those items.

How to use the In Kind Donation Receipt Transitionslifecare

To use the In Kind Donation Receipt Transitionslifecare, donors should first ensure that they accurately describe the items or services they are donating. Once the donation is made, the organization will fill out the receipt, including all necessary details. Donors should keep a copy of this receipt for their records, as it may be required when filing taxes. It is essential to retain this document for at least three years, as the IRS may request it during an audit.

Key elements of the In Kind Donation Receipt Transitionslifecare

The key elements of the In Kind Donation Receipt Transitionslifecare include:

- Donor Information: Full name and contact details of the donor.

- Date of Donation: The specific date when the donation was made.

- Description of Donated Items: A detailed list of the items or services donated.

- Estimated Value: A fair market value of the donated items, as determined by the donor.

- Organization Information: Name and contact details of Transitionslifecare.

- Signature: Signature of an authorized representative from the organization.

Steps to complete the In Kind Donation Receipt Transitionslifecare

Completing the In Kind Donation Receipt Transitionslifecare involves several straightforward steps:

- Gather necessary information about the donation, including the items' descriptions and estimated values.

- Fill out the receipt with the donor's information and donation details.

- Have an authorized representative from Transitionslifecare sign the receipt.

- Provide a copy of the completed receipt to the donor for their records.

- Retain a copy of the receipt for the organization's records.

Legal use of the In Kind Donation Receipt Transitionslifecare

The In Kind Donation Receipt Transitionslifecare is legally recognized as a valid document for tax purposes, provided it meets specific criteria set by the IRS. It is essential that the receipt accurately reflects the details of the donation and is signed by an authorized representative of the organization. This ensures that the document can be used effectively to substantiate tax deductions claimed by the donor. Failure to provide a proper receipt may result in disallowance of the deduction during tax audits.

IRS Guidelines

According to IRS guidelines, donors can claim deductions for in-kind donations if they meet certain conditions. The IRS requires that the value of the donation must be substantiated with a receipt when the value exceeds $250. For items valued over $5,000, additional documentation may be required, such as a qualified appraisal. Donors should familiarize themselves with these guidelines to ensure compliance and maximize their potential tax benefits.

Quick guide on how to complete in kind donation receipt transitionslifecare

Accomplish In Kind Donation Receipt Transitionslifecare seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, as you can obtain the accurate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents swiftly without interruptions. Handle In Kind Donation Receipt Transitionslifecare on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and eSign In Kind Donation Receipt Transitionslifecare effortlessly

- Obtain In Kind Donation Receipt Transitionslifecare and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or hide sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign feature, which takes a matter of seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and eSign In Kind Donation Receipt Transitionslifecare and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the in kind donation receipt transitionslifecare

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an In Kind Donation Receipt Transitionslifecare?

An In Kind Donation Receipt Transitionslifecare is a formal acknowledgment provided to donors for non-monetary contributions made to the organization. This receipt details the items or services donated, helping donors keep track of their charitable giving for tax purposes and ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with In Kind Donation Receipts Transitionslifecare?

airSlate SignNow streamlines the process of generating and sending In Kind Donation Receipts Transitionslifecare, allowing organizations to create professional, customizable templates quickly. This simplifies the documentation and enhances the donor experience, fostering goodwill and encouraging future donations.

-

Are there any costs associated with using airSlate SignNow for In Kind Donation Receipts Transitionslifecare?

While airSlate SignNow offers various pricing plans tailored to different organizational needs, the costs are generally competitive and provide value for the features included. Many users find the investment worthwhile as it saves time and improves the efficiency of managing In Kind Donation Receipts Transitionslifecare.

-

What features does airSlate SignNow offer for In Kind Donation Receipts Transitionslifecare?

airSlate SignNow provides features such as customizable templates, electronic signatures, and easy sharing options for In Kind Donation Receipts Transitionslifecare. Additionally, the solution includes tracking and reporting tools, enhancing the way organizations manage their donation records.

-

Can I integrate airSlate SignNow with other tools for managing In Kind Donation Receipts Transitionslifecare?

Yes, airSlate SignNow offers integrations with various CRM and accounting tools, making it easier to manage In Kind Donation Receipts Transitionslifecare within your existing workflow. These integrations help streamline operations and ensure smoother data handling across platforms.

-

How does airSlate SignNow enhance the donor experience when issuing In Kind Donation Receipts Transitionslifecare?

With airSlate SignNow, organizations can instantly issue In Kind Donation Receipts Transitionslifecare digitally, improving the responsiveness and professionalism expected by donors. This efficiency not only elevates customer satisfaction but also increases the likelihood of repeat donations.

-

Is it easy to customize In Kind Donation Receipts Transitionslifecare in airSlate SignNow?

Absolutely! airSlate SignNow allows users to easily customize In Kind Donation Receipts Transitionslifecare with their branding, logos, and specific language. This customization ensures that each receipt reflects the unique identity of the organization, enhancing recognition and trust among donors.

Get more for In Kind Donation Receipt Transitionslifecare

- Public adjuster contract template 71918863 form

- Webquest ecology of amphibians answer key form

- Centurion application form

- Irp 5 form

- Nalco 460 s0209 soln barium chloride crystals form solid sds

- Navpers 1070 613 bah form

- Visa application form rlj morocco visahq co uk morocco visahq co

- Transcript request form for whrhs graduates whitman hanson whrsd

Find out other In Kind Donation Receipt Transitionslifecare

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online