Download Washington Exemption Certificate REV 27 0021E Form

What is the Washington exemption certificate?

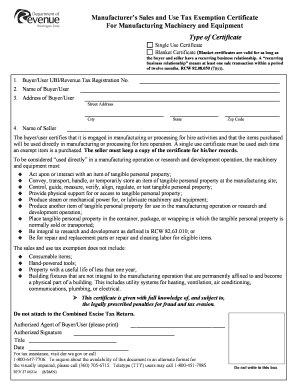

The Washington exemption certificate, officially known as the Washington State Tax Exempt Form, is a legal document that allows qualifying entities to make tax-exempt purchases in Washington State. This certificate is primarily used by organizations such as non-profits, government entities, and certain educational institutions that meet specific criteria set by the state. By presenting this form at the time of purchase, these entities can avoid paying sales tax on eligible items, thereby reducing their operational costs.

Key elements of the Washington exemption certificate

The Washington exemption certificate includes several critical components that ensure its validity and proper use. Key elements consist of:

- Entity Information: The name, address, and tax identification number of the organization claiming the exemption.

- Type of Exemption: A clear statement regarding the nature of the exemption, such as non-profit status or government affiliation.

- Signature: The signature of an authorized representative of the entity, confirming the accuracy of the information provided.

- Date: The date on which the certificate is completed and signed.

Steps to complete the Washington exemption certificate

Completing the Washington exemption certificate involves several straightforward steps to ensure compliance with state regulations:

- Download the Washington exemption certificate form from an official source.

- Fill in the required entity information, including the organization’s name, address, and tax ID number.

- Select the appropriate exemption type that applies to your organization.

- Have an authorized representative sign the form to validate the information.

- Keep a copy of the completed form for your records and provide the original to the vendor at the time of purchase.

Legal use of the Washington exemption certificate

The legal use of the Washington exemption certificate is governed by state tax laws. To ensure compliance, organizations must only use the certificate for purchases that qualify for exemption. Misuse of the form can result in penalties, including fines and back taxes owed. It is important for organizations to maintain accurate records of all transactions made under this exemption to support their claims in case of an audit.

Eligibility criteria for the Washington exemption certificate

To qualify for the Washington exemption certificate, organizations must meet specific eligibility criteria established by the state. Generally, eligible entities include:

- Non-profit organizations recognized under IRS regulations.

- Government agencies and entities.

- Educational institutions that are publicly funded.

- Other organizations specifically designated by state law as exempt from sales tax.

Obtaining the Washington exemption certificate

Organizations can obtain the Washington exemption certificate by downloading the form from the Washington State Department of Revenue website or other official state resources. It is essential to ensure that the most current version of the form is used to avoid any compliance issues. After downloading, organizations should follow the completion steps outlined above to ensure proper use.

Quick guide on how to complete download washington exemption certificate rev 27 0021e

Complete Download Washington Exemption Certificate REV 27 0021E effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without any holdups. Manage Download Washington Exemption Certificate REV 27 0021E on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to modify and eSign Download Washington Exemption Certificate REV 27 0021E with ease

- Obtain Download Washington Exemption Certificate REV 27 0021E and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Download Washington Exemption Certificate REV 27 0021E and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the download washington exemption certificate rev 27 0021e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Washington State tax exempt form?

A Washington State tax exempt form is a document used by organizations or individuals to claim exemption from certain taxes in Washington State. By properly filling out and submitting this form, entities can avoid paying sales tax on qualified purchases. It's important to understand the eligibility requirements to ensure compliance.

-

How can airSlate SignNow help with the Washington State tax exempt form?

airSlate SignNow allows users to easily create, send, and sign the Washington State tax exempt form electronically. This not only saves time but also ensures that all submitted documents are securely stored and easily accessible. With our user-friendly interface, managing tax exempt forms has never been more efficient.

-

Is there a charge for using the Washington State tax exempt form with airSlate SignNow?

While airSlate SignNow offers various subscription plans, creating and managing the Washington State tax exempt form is included in our service. Users can choose a plan that fits their needs and budget without any hidden fees. Our pricing structure is designed to provide cost-effective solutions for all organizations.

-

What features does airSlate SignNow provide for managing tax forms?

With airSlate SignNow, users can enjoy features like customizable templates for the Washington State tax exempt form, electronic signatures, and document tracking. These tools streamline the process and enhance productivity, allowing for quick handling of tax-related documents while ensuring accuracy and compliance.

-

Can I integrate airSlate SignNow with other software for processing tax exempt forms?

Yes, airSlate SignNow offers seamless integrations with various platforms like CRM systems, accounting software, and more to help process the Washington State tax exempt form efficiently. These integrations allow users to manage their documents in one place, reducing the hassle of switching between different applications.

-

What are the benefits of using airSlate SignNow for tax exempt forms?

Using airSlate SignNow to manage the Washington State tax exempt form provides numerous benefits, including faster turnaround times, enhanced security of information, and reduced paper waste. Our solution allows businesses to operate more sustainably and efficiently, ensuring compliance with state tax regulations.

-

How secure is the Washington State tax exempt form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When filling out the Washington State tax exempt form, all data is encrypted and stored securely, ensuring that sensitive information remains confidential. Our platform complies with industry standards for data protection, giving users peace of mind.

Get more for Download Washington Exemption Certificate REV 27 0021E

Find out other Download Washington Exemption Certificate REV 27 0021E

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed