Il K 1 P 2012

What is the IL K-1 P?

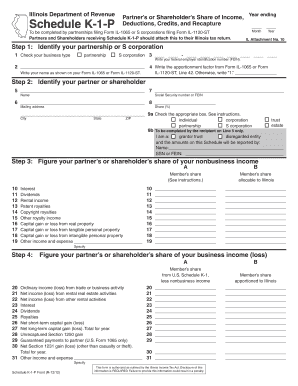

The IL K-1 P is a tax form used in Illinois to report income, deductions, and credits from partnerships. This document is essential for individuals who are partners in a partnership, allowing them to report their share of the partnership's income on their personal tax returns. The form includes detailed information about the partnership's financial activities and the individual partner's share, ensuring compliance with state tax regulations.

Steps to Complete the IL K-1 P

Completing the IL K-1 P involves several key steps:

- Gather necessary financial information from the partnership, including income, deductions, and credits.

- Fill out the partner's identifying information, such as name, address, and taxpayer identification number.

- Report the partner's share of income, losses, and other relevant financial details as provided by the partnership.

- Ensure all amounts are accurately calculated and reported in the appropriate sections of the form.

- Review the completed form for accuracy before submission.

Legal Use of the IL K-1 P

The IL K-1 P is legally binding and must be filed accurately to comply with Illinois tax laws. It serves as an official document that partners use to report their income from the partnership on their personal tax returns. Proper completion and submission of this form are crucial to avoid potential penalties from the Illinois Department of Revenue.

IRS Guidelines

While the IL K-1 P is specific to Illinois, it is important to align its use with IRS guidelines for partnership income reporting. The IRS requires partnerships to issue a Schedule K-1 (Form 1065) to each partner, which provides similar information at the federal level. Partners should ensure that the information reported on the IL K-1 P is consistent with the federal K-1 to maintain compliance.

Who Issues the Form

The IL K-1 P is issued by partnerships operating in Illinois. It is the responsibility of the partnership to prepare and distribute this form to each partner by the required deadlines. Partners should ensure they receive their copy in a timely manner to complete their personal tax filings accurately.

Filing Deadlines / Important Dates

Filing deadlines for the IL K-1 P align with the overall tax filing deadlines in Illinois. Typically, partnerships must issue the form to partners by March 15 of the following tax year. Partners must then use the information from the IL K-1 P to file their individual tax returns by April 15. It is crucial to be aware of these deadlines to avoid late penalties.

Examples of Using the IL K-1 P

Partners may use the IL K-1 P in various scenarios, such as:

- Reporting income from a family-owned business structured as a partnership.

- Claiming deductions for business expenses passed through from the partnership.

- Calculating tax credits based on the partner's share of the partnership's activities.

Quick guide on how to complete il k 1 p

Complete Il K 1 P effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Il K 1 P on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Il K 1 P with ease

- Locate Il K 1 P and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Edit and electronically sign Il K 1 P and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il k 1 p

Create this form in 5 minutes!

How to create an eSignature for the il k 1 p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to il k?

airSlate SignNow is an eSignature solution that allows businesses to send, sign, and manage documents efficiently. With its intuitive interface, it simplifies the signing process, making it easy for users to apply their il k on documents without any hassle. This user-friendly platform is designed to enhance productivity by streamlining document workflows.

-

How does pricing work for airSlate SignNow in the context of il k?

Pricing for airSlate SignNow is competitive and tailored for businesses of all sizes looking to leverage il k for document management. Different plans are available, allowing you to choose based on your specific needs. We provide transparent pricing with no hidden fees, ensuring that you get the best value for your investment.

-

What features does airSlate SignNow offer that support il k?

airSlate SignNow comes packed with features that enhance document workflows, including customizable templates, advanced security measures, and comprehensive reporting tools. These features ensure that users can apply their il k efficiently, resulting in faster turnaround times and improved operational efficiency. The platform is designed to cater to your specific document signing needs.

-

What are the benefits of using airSlate SignNow for il k?

Using airSlate SignNow for il k brings numerous benefits such as increased efficiency, reduced paper usage, and the convenience of remote signing. This allows teams to work collaboratively from anywhere, facilitating faster decision-making processes. Additionally, il k enhances compliance and security, ensuring that your documents are handled safely.

-

Can airSlate SignNow integrate with other software for il k workflows?

Yes, airSlate SignNow offers seamless integrations with a variety of popular applications, which is crucial for streamlining il k workflows. This includes CRM systems, cloud storage services, and productivity tools, enabling you to manage documents more effectively. Integrations help centralize your operations, making them more efficient.

-

Is airSlate SignNow suitable for individuals or only for businesses regarding il k?

While airSlate SignNow is highly beneficial for businesses, individuals can also take full advantage of its features related to il k. Whether you’re signing personal documents or managing contracts, the platform is user-friendly for all types of users. It empowers everyone to streamline their document signing process effortlessly.

-

How secure is airSlate SignNow in relation to il k?

Security is a top priority for airSlate SignNow, especially for managing il k. The platform employs advanced encryption and authentication protocols to secure your documents. This means your sensitive information remains protected, reducing the risk of data bsignNowes while conducting business transactions.

Get more for Il K 1 P

- Release waiver of liability assumption of all risks of form

- Temporary staffing agreement form

- Second lease agreement secgov form

- Registered investment bond form

- He applicationfiling federal reserve bank form

- Notice of demotion form

- Sample of life saving award letters the family wealth hub form

- Affidavit of current marital status ua local 1 form

Find out other Il K 1 P

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document