Classic Gap Cancellation Form

What is the classic gap cancellation form

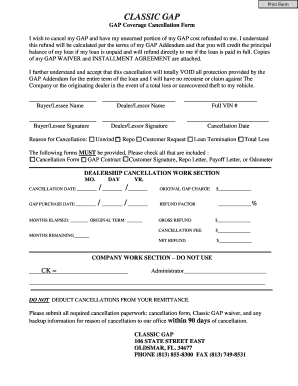

The classic gap cancellation form is a document used by consumers to formally request the cancellation of their classic gap insurance policy. This type of insurance typically covers the difference between what a car owner owes on their vehicle and its actual cash value in the event of a total loss. By submitting this form, policyholders can initiate the process of obtaining a refund for any unused premium associated with the policy. Understanding the purpose and function of this form is crucial for anyone looking to manage their insurance coverage effectively.

How to use the classic gap cancellation form

Using the classic gap cancellation form involves several straightforward steps. First, ensure you have the correct version of the form, which can usually be obtained from your insurance provider or dealership. Next, fill out the required fields, which often include personal information, policy details, and the reason for cancellation. After completing the form, review it for accuracy to avoid delays. Finally, submit the form according to the instructions provided, which may include options for online submission, mailing, or delivering it in person.

Key elements of the classic gap cancellation form

Several key elements must be included in the classic gap cancellation form to ensure it is processed efficiently. These elements typically consist of:

- Policyholder Information: Full name, address, and contact details.

- Policy Information: Policy number, vehicle details, and coverage dates.

- Cancellation Reason: A brief explanation of why you are requesting the cancellation.

- Signature: A signature or electronic signature to validate the request.

Including all these elements helps facilitate a smooth cancellation process and ensures that your request is legally binding.

Steps to complete the classic gap cancellation form

Completing the classic gap cancellation form involves a series of clear steps:

- Obtain the Form: Access the classic gap cancellation form from your insurance provider or dealership.

- Fill Out the Form: Enter your personal and policy information accurately.

- Specify the Cancellation Reason: Provide a concise reason for your cancellation.

- Review Your Information: Double-check all entries for correctness.

- Sign the Form: Add your signature or use an electronic signature if submitting online.

- Submit the Form: Follow the submission instructions provided, whether online, by mail, or in person.

Following these steps ensures that your cancellation request is properly submitted and processed.

Legal use of the classic gap cancellation form

The classic gap cancellation form serves a legal purpose, as it documents the policyholder's intent to cancel their insurance coverage. To be considered legally binding, the form must be completed accurately and submitted according to the guidelines set by the insurance provider. Compliance with eSignature regulations, such as the ESIGN Act and UETA, is essential when submitting the form electronically. This ensures that the cancellation request is recognized and upheld in any legal context.

Form submission methods

There are various methods for submitting the classic gap cancellation form, each catering to different preferences:

- Online Submission: Many insurance providers allow for electronic submission through their websites, making it a quick and convenient option.

- Mail: You can print the completed form and send it via postal mail to the designated address provided by your insurance company.

- In-Person: Some policyholders may prefer to deliver the form directly to their insurance agent or dealership for immediate processing.

Selecting the appropriate submission method can help ensure that your cancellation request is handled promptly and efficiently.

Quick guide on how to complete classic gap cancellation form

Complete Classic Gap Cancellation Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any delays. Manage Classic Gap Cancellation Form on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to alter and eSign Classic Gap Cancellation Form without any hassle

- Find Classic Gap Cancellation Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information carefully and then click the Done button to finalize your modifications.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Classic Gap Cancellation Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the classic gap cancellation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is classic gap insurance?

Classic gap insurance is a type of auto insurance that covers the difference between what you owe on your vehicle and its actual cash value in the event of a total loss. This insurance is particularly useful for those who finance their vehicles, ensuring that you're not left with a large debt if your car is damaged or stolen.

-

How does classic gap insurance benefit car buyers?

Classic gap insurance provides peace of mind to car buyers by protecting them from financial loss in the unfortunate event of an accident. It ensures that you are covered for the full amount owed on your car loan, allowing you to focus on other financial priorities without the worry of remaining debt.

-

What does classic gap insurance typically cover?

Classic gap insurance generally covers the difference between the car’s value at the time of loss and the outstanding balance on your car loan. This includes any depreciation that occurs after the purchase, which can signNowly impact the amount you might receive from a standard insurance payout.

-

Is classic gap insurance worth it?

Whether classic gap insurance is worth it depends on your financing situation and vehicle value. If you owe more on your car than its current market value, this insurance can save you from financial strain after a total loss. For new and financed vehicles, it often presents a valuable financial protection opportunity.

-

How much does classic gap insurance cost?

The cost of classic gap insurance varies based on factors such as the vehicle's make and model, your location, and the insurer. Typically, it can range from a few hundred to over a thousand dollars for the policy term, but many find the investment reasonable for the coverage it provides.

-

Can I purchase classic gap insurance after buying a car?

Yes, you can purchase classic gap insurance even after you've bought your car. Many insurers allow you to add this coverage at any point during the financing period, ensuring that you remain protected against potential financial pitfalls due to vehicle depreciation.

-

Do I need classic gap insurance if I have full coverage?

While full coverage is essential for your vehicle, it may not cover the entire gap if your car is totaled. Classic gap insurance specifically addresses the difference between the loan amount and the car's value, making it a crucial addition for those who finance their vehicles.

Get more for Classic Gap Cancellation Form

- Business legal english viewbusiness legal english templates form

- Your state law may require that additional form

- Air filtration contractor agreement form

- Fireplace contractor agreement form

- Last will and testament faq united states form

- Educator independent contractor agreement form

- Framework contractor agreement form

- Essex awards deer paddock work contract digifind it form

Find out other Classic Gap Cancellation Form

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free