Form 8879 Vt

What is the Form 8879 Vt

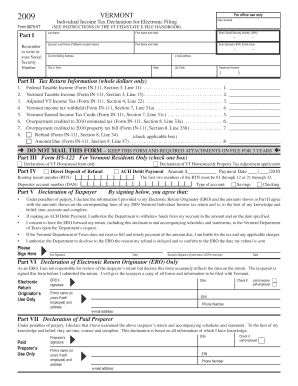

The Vermont Form 8879 is an essential document used for electronic filing of state tax returns in Vermont. This form serves as an eSignature authorization for taxpayers, allowing them to electronically sign their tax returns and submit them to the Vermont Department of Taxes. By using this form, taxpayers can streamline the filing process, ensuring that their returns are submitted accurately and efficiently. The form captures important taxpayer information, including the taxpayer's name, Social Security number, and the tax year for which the return is being filed.

How to use the Form 8879 Vt

Using the Vermont Form 8879 involves a straightforward process. First, taxpayers must complete their state tax return using approved tax software. Once the return is prepared, the software will prompt the user to fill out the Form 8879. After entering the required information, the taxpayer can electronically sign the form. This eSignature confirms that the taxpayer has reviewed the return and authorizes its submission. It is important to retain a copy of the signed Form 8879 for personal records, as it serves as proof of authorization for the electronic filing.

Steps to complete the Form 8879 Vt

Completing the Vermont Form 8879 involves several key steps:

- Prepare your Vermont state tax return using compatible tax software.

- Access the Form 8879 within the software once your tax return is ready.

- Fill in the required fields, including your name, Social Security number, and tax year.

- Review the information for accuracy to ensure all details are correct.

- Sign the form electronically, confirming your authorization for filing.

- Submit the form along with your tax return electronically through the software.

Legal use of the Form 8879 Vt

The Vermont Form 8879 is legally binding when completed and signed in accordance with state regulations. To ensure its validity, the form must meet specific requirements set forth by the Vermont Department of Taxes. This includes compliance with the Electronic Signatures in Global and National Commerce Act (ESIGN), which recognizes electronic signatures as legally equivalent to handwritten ones. By using a secure platform for electronic signatures, taxpayers can ensure that their Form 8879 is legally recognized and that their tax return is filed appropriately.

Key elements of the Form 8879 Vt

Several key elements must be included in the Vermont Form 8879 for it to be valid:

- Taxpayer Information: Full name, Social Security number, and address.

- Tax Year: The specific tax year for which the return is being filed.

- Signature: Electronic signature of the taxpayer, confirming their authorization.

- Date: The date on which the form is signed.

- Return Information: Reference to the tax return being authorized for submission.

Filing Deadlines / Important Dates

Filing deadlines for the Vermont Form 8879 typically align with the state tax return deadlines. Taxpayers must file their returns by April 15 for the previous tax year unless an extension has been granted. It is crucial to submit the Form 8879 along with the tax return by this deadline to avoid penalties. Taxpayers should also be aware of any changes in deadlines due to state legislation or unforeseen circumstances, such as natural disasters or public health emergencies.

Quick guide on how to complete form 8879 vt

Complete Form 8879 Vt seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the functionality required to create, modify, and electronically sign your documents swiftly without delays. Handle Form 8879 Vt on any gadget using the airSlate SignNow apps for Android or iOS and enhance any document-focused operation today.

How to alter and electronically sign Form 8879 Vt effortlessly

- Obtain Form 8879 Vt and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form 8879 Vt and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8879 vt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Vermont Form 8879?

Vermont Form 8879 is an IRS e-file Signature Authorization that allows taxpayers to electronically sign their state tax returns. By using airSlate SignNow, you can easily complete and submit Vermont Form 8879 securely and efficiently.

-

How can airSlate SignNow help me with Vermont Form 8879?

airSlate SignNow provides a user-friendly platform for preparing and signing Vermont Form 8879 electronically. With our tool, you can ensure compliance and save time compared to traditional paper processes.

-

Is there a cost associated with using airSlate SignNow for Vermont Form 8879?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, including features tailored for preparing Vermont Form 8879. You can choose a plan that fits your budget while enjoying the benefits of electronic document management.

-

Can I track the status of my Vermont Form 8879 submissions?

Absolutely! airSlate SignNow allows you to track the status of your Vermont Form 8879 as it moves through the signing process. This feature ensures that you're always informed and can follow up as needed.

-

What features does airSlate SignNow offer for Vermont Form 8879?

airSlate SignNow offers features like secure electronic signatures, document templates for Vermont Form 8879, and integration with other applications. These features make it easy to manage your documents efficiently and securely.

-

Is airSlate SignNow compatible with other tax software for Vermont Form 8879?

Yes, airSlate SignNow integrates seamlessly with various tax software platforms, enabling you to access and manage Vermont Form 8879 alongside your other tax documents. This integration enhances your workflow and simplifies the process.

-

How secure is my information when using airSlate SignNow for Vermont Form 8879?

Your security is our priority at airSlate SignNow. We use advanced encryption and secure storage methods to protect your information while you work with Vermont Form 8879, ensuring that your data remains confidential.

Get more for Form 8879 Vt

- Royalty ownersgrenadier energy partners ii llc form

- Chapter xii durable power of attorney act texas form

- Georgia statutory financial power of attorney instructions form

- Durable special power of attorney granting agent the right form

- A recorded power of attorney form

- The undersigned the seller for the sum of ten dollars form

- Current and emerging issues in oil and gas title examination form

- Evaluating and drafting oil and gas lease assignments form

Find out other Form 8879 Vt

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy