Idaho Form 910

What is the Idaho Form 910

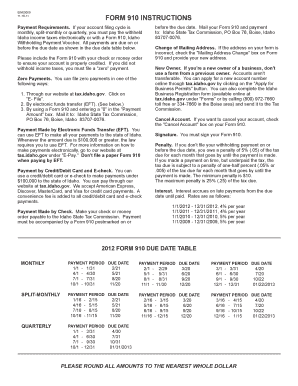

The Idaho Form 910 is a tax form used by individuals and businesses in the state of Idaho to report and remit withholding payments. This form is essential for employers who need to report income tax withheld from employee wages. The Idaho 910 form ensures compliance with state tax regulations and helps maintain accurate records for both employers and the state government.

How to use the Idaho Form 910

Using the Idaho Form 910 involves several steps. First, employers must gather necessary information, including employee details and the amount of tax withheld. Next, the form needs to be filled out accurately, ensuring all required fields are completed. Once the form is completed, it can be submitted electronically or via mail, depending on the preference of the employer and the guidelines set by the Idaho State Tax Commission.

Steps to complete the Idaho Form 910

Completing the Idaho Form 910 involves a systematic approach:

- Gather all relevant information, including employee names, Social Security numbers, and withholding amounts.

- Download the form from the Idaho State Tax Commission website or access a fillable version online.

- Fill out the form, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the appropriate tax authority.

Legal use of the Idaho Form 910

The Idaho Form 910 is legally binding when completed and submitted according to state regulations. It is important for employers to ensure compliance with the Idaho State Tax Commission's guidelines to avoid penalties. By using a reliable electronic signature solution, employers can enhance the legal validity of the form, ensuring that it meets all necessary legal requirements.

Key elements of the Idaho Form 910

Key elements of the Idaho Form 910 include:

- Identification of the employer and employee

- Details of the withholding amounts

- Signature of the authorized representative

- Submission date

These elements are crucial for ensuring that the form is processed correctly and that all necessary information is communicated to the Idaho State Tax Commission.

Form Submission Methods

The Idaho Form 910 can be submitted through various methods:

- Online Submission: Employers can submit the form electronically via the Idaho State Tax Commission's online portal.

- Mail Submission: The completed form can be printed and mailed to the designated tax office.

- In-Person Submission: Employers may also choose to deliver the form in person at local tax offices.

Examples of using the Idaho Form 910

Employers in Idaho use the Form 910 in various scenarios, such as:

- Reporting withholding for full-time employees.

- Submitting withholding information for seasonal workers.

- Adjusting withholding amounts due to changes in employee status or tax regulations.

These examples illustrate the form's versatility and importance in maintaining compliance with state tax laws.

Quick guide on how to complete idaho form 910

Complete Idaho Form 910 effortlessly on any gadget

Web-based document handling has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents rapidly without delays. Manage Idaho Form 910 on any gadget with airSlate SignNow's Android or iOS applications, and simplify any document-related process today.

The most effective way to modify and eSign Idaho Form 910 with ease

- Locate Idaho Form 910 and click Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign function, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to distribute your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require printing new document versions. airSlate SignNow addresses your needs in document management within a few clicks from your selected device. Modify and eSign Idaho Form 910 and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idaho form 910

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Idaho Form 910?

The Idaho Form 910 is a specific document utilized by businesses and organizations for various purposes, such as applications or agreements. Understanding how to properly fill out and submit the Idaho Form 910 is essential for compliance with state requirements.

-

How can airSlate SignNow help with Idaho Form 910?

AirSlate SignNow streamlines the process of completing and eSigning the Idaho Form 910. With its user-friendly interface, you can easily fill out, sign, and send this document securely online, saving time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for Idaho Form 910?

Yes, airSlate SignNow offers various pricing plans that are both affordable and flexible, catering to different business needs. Specific costs will depend on your chosen plan, which provides access to features that aid in managing documents like the Idaho Form 910.

-

What features does airSlate SignNow offer for handling Idaho Form 910?

AirSlate SignNow includes features such as customizable templates, automatic reminders, and real-time tracking for documents like the Idaho Form 910. These tools enhance efficiency and ensure that all parties are informed throughout the signing process.

-

Can I integrate airSlate SignNow with other software for Idaho Form 910?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing for easier management of the Idaho Form 910. Whether it's CRM systems or cloud storage solutions, these integrations enhance your workflow and document handling.

-

What are the benefits of using airSlate SignNow for my Idaho Form 910?

Using airSlate SignNow for the Idaho Form 910 offers numerous benefits, such as increased efficiency, enhanced security, and improved collaboration. These advantages help businesses streamline their document processes and comply with state regulations effectively.

-

How do I start using airSlate SignNow for Idaho Form 910?

Starting with airSlate SignNow is simple. You can sign up for an account, explore available features, and begin creating or uploading your Idaho Form 910. The intuitive platform guides you through the steps to complete and send your documents easily.

Get more for Idaho Form 910

Find out other Idaho Form 910

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now