7216 Form

What is the 7216

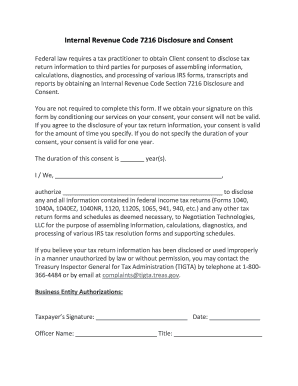

The 7216 form is a tax document used primarily for reporting the disclosure of taxpayer information by tax preparers. This form is crucial for ensuring that tax professionals comply with regulations regarding the confidentiality and security of taxpayer data. It serves as a formal acknowledgment that the taxpayer understands how their information may be shared and used by the preparer.

How to use the 7216

Using the 7216 form involves a few straightforward steps. First, the tax preparer must complete the form by filling in the necessary details about the taxpayer and the specific information being disclosed. Next, the taxpayer should review the form carefully to ensure they understand the implications of the disclosure. Finally, both parties must sign and date the form to validate the agreement. This process ensures transparency and protects the rights of the taxpayer.

Steps to complete the 7216

Completing the 7216 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the taxpayer's name, address, and Social Security number.

- Identify the specific information that will be disclosed and to whom.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form with the taxpayer to ensure they understand the disclosure.

- Obtain signatures from both the tax preparer and the taxpayer.

- Keep a copy of the signed form for your records.

Legal use of the 7216

The legal use of the 7216 form is governed by federal regulations that protect taxpayer information. Tax preparers are required to obtain consent before disclosing any taxpayer information to third parties. This form serves as proof that the taxpayer has been informed about the disclosure and has given their consent. Non-compliance with these regulations can result in penalties for the tax preparer, making the proper use of the 7216 form essential.

Filing Deadlines / Important Dates

Filing deadlines for the 7216 form are typically aligned with the tax filing deadlines. Tax preparers should ensure that the form is completed and signed before any disclosure of taxpayer information occurs. It is advisable to keep track of important dates related to tax filings to ensure compliance and avoid potential penalties.

Required Documents

To complete the 7216 form, certain documents are necessary. These include:

- The taxpayer's identification information, such as their Social Security number.

- Details about the information that will be disclosed.

- Any relevant agreements or contracts that outline the relationship between the taxpayer and the preparer.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the 7216 form can lead to significant penalties. Tax preparers may face fines and legal repercussions for disclosing taxpayer information without proper consent. It is essential to adhere to the guidelines set forth in the form to protect both the taxpayer's rights and the preparer's professional standing.

Quick guide on how to complete 7216

Complete 7216 effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage 7216 on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to adjust and eSign 7216 with ease

- Locate 7216 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds exactly the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, the hassle of searching for forms, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign 7216 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 7216

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the number 7216 in airSlate SignNow?

The number 7216 represents a unique identifier for our product packages that include advanced features in airSlate SignNow. Understanding this code helps customers navigate options tailored to their document signing needs. With 7216, businesses can unlock greater efficiency in document management.

-

How does airSlate SignNow pricing work for plans including 7216?

Our pricing structure for plans with the 7216 identifier is designed to be affordable and scalable for businesses of all sizes. You can choose from a monthly or annual subscription that best fits your budget and needs. With 7216-related plans, you also gain access to premium features that enhance the eSigning experience.

-

What features are included in the 7216 package?

The 7216 package in airSlate SignNow includes essential features such as document templates, advanced security options, and real-time tracking. These features enable businesses to streamline their signing processes and increase productivity. Additionally, the 7216 offerings integrate seamlessly with existing workflows.

-

How can businesses benefit from using airSlate SignNow with 7216?

By using airSlate SignNow with the 7216 configuration, businesses can signNowly reduce turnaround times for document approvals. This leads to faster transactions, improved customer satisfaction, and enhanced productivity. The solution is intuitive, making it easy for teams to adopt.

-

Is it easy to integrate airSlate SignNow 7216 with other applications?

Yes, airSlate SignNow 7216 offers easy integration capabilities with various business applications such as CRM systems and cloud storage solutions. This flexibility allows you to streamline your operational processes effortlessly. Our API supports various integrations, making it simple to connect with your existing tech stack.

-

What security measures are in place for documents signed under the 7216 category?

Documents signed under the 7216 category in airSlate SignNow are protected by robust security measures. These include encryption, multi-factor authentication, and secure storage options. This level of protection ensures your sensitive information is safe throughout the signing process.

-

Can I try airSlate SignNow 7216 before committing to a purchase?

Definitely! We offer a free trial for our 7216 package, allowing prospective customers to explore its features and benefits without any cost. This trial helps businesses assess how airSlate SignNow can meet their document signing needs before making a commitment.

Get more for 7216

- If work is displayed on the drawings but not called for in the form

- Basis of applications for payment submitted to e form

- Interagency cooperation contract between texas facilities form

- Supplement one another form

- In the event of a conflict the specifications shall control the drawings form

- Other than the usual and customary excavation and grading shall be agreed to in a change order form

- Flynn real estate test 2 flashcardsquizlet form

- Change order for an amount in addition to the contract price form

Find out other 7216

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now