Nyc Statement of Undistributed Paychecks Form

What is the NYC Statement of Undistributed Paychecks

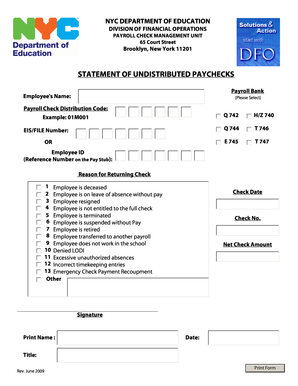

The NYC Statement of Undistributed Paychecks is a crucial document used by employees to track paychecks that have not been distributed. This form is particularly relevant for individuals who may have unclaimed wages or paychecks that have not been cashed. Understanding this form is essential for ensuring that employees receive their rightful earnings and for maintaining accurate financial records.

How to Use the NYC Statement of Undistributed Paychecks

To effectively use the NYC Statement of Undistributed Paychecks, individuals should first gather all relevant payroll information. This includes details about pay periods, amounts owed, and any correspondence with the employer regarding unpaid wages. The form can be filled out by entering the necessary information regarding the undistributed paychecks, including dates and amounts. Once completed, it is advisable to keep a copy for personal records and submit it as required by the employer or relevant agency.

Steps to Complete the NYC Statement of Undistributed Paychecks

Completing the NYC Statement of Undistributed Paychecks involves several straightforward steps:

- Gather necessary documents, including pay stubs and employment records.

- Fill out the form with accurate details about the undistributed paychecks.

- Review the information for accuracy to avoid delays.

- Submit the completed form to the appropriate department or employer.

Key Elements of the NYC Statement of Undistributed Paychecks

Understanding the key elements of the NYC Statement of Undistributed Paychecks is vital for proper completion. Important components include:

- Employee identification information, such as name and employee number.

- Details of the undistributed paychecks, including dates and amounts.

- Signature of the employee or authorized representative.

Legal Use of the NYC Statement of Undistributed Paychecks

The NYC Statement of Undistributed Paychecks serves a legal purpose in documenting unpaid wages. It can be used as evidence in disputes regarding unpaid wages or when filing claims with labor boards. Ensuring that the form is completed accurately and submitted in a timely manner is essential for protecting employee rights under labor laws.

Who Issues the Form

The NYC Statement of Undistributed Paychecks is typically issued by the employer or the payroll department within an organization. Employees may also obtain this form from the New York City Department of Finance or relevant labor agencies, depending on their specific situation. It is important for employees to know where to access this form to ensure they can address any issues related to undistributed paychecks promptly.

Quick guide on how to complete nyc statement of undistributed paychecks

Effortlessly complete Nyc Statement Of Undistributed Paychecks on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can easily access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage Nyc Statement Of Undistributed Paychecks on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

How to edit and electronically sign Nyc Statement Of Undistributed Paychecks with ease

- Find Nyc Statement Of Undistributed Paychecks and select Get Form to begin.

- Utilize the tools available to finalize your document.

- Highlight important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to store your changes.

- Select your preferred method for sharing the form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Nyc Statement Of Undistributed Paychecks and ensure top-notch communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc statement of undistributed paychecks

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to et pay e adj?

airSlate SignNow is an innovative eSignature solution that enables businesses to send and eSign documents effortlessly. By incorporating et pay e adj into our services, users can ensure a smooth and cost-effective signing process that meets their needs.

-

How does pricing work for airSlate SignNow when considering et pay e adj?

Our pricing for airSlate SignNow is designed to be budget-friendly, allowing businesses of all sizes to leverage the benefits of et pay e adj. We offer flexible subscription plans, ensuring you only pay for what you need while accessing the full range of features.

-

What features does airSlate SignNow offer for users concerned with et pay e adj?

airSlate SignNow offers a variety of features such as document templates, mobile signing, and secure storage, all optimized around the concept of et pay e adj. These features enhance the user experience and streamline the signing process for every business.

-

Can airSlate SignNow integrate with other applications relevant to et pay e adj?

Yes, airSlate SignNow integrates seamlessly with various applications, ensuring that your workflow enhances the benefits of et pay e adj. Key integrations include popular CRM platforms, cloud storage solutions, and other tools that facilitate document management.

-

Is airSlate SignNow compliant with regulations regarding et pay e adj?

Absolutely, airSlate SignNow is fully compliant with industry regulations that govern the use of et pay e adj for electronic signatures. Our solution meets the standards set forth by ESIGN and UETA, providing peace of mind to users.

-

What are the main benefits of using airSlate SignNow with et pay e adj?

By using airSlate SignNow alongside et pay e adj, businesses can improve turnaround times, enhance accuracy, and reduce costs. Our solution streamlines the entire signing process, helping you close deals faster and more efficiently.

-

How can I get started with airSlate SignNow to utilize et pay e adj?

Getting started with airSlate SignNow is easy! Simply sign up for a free trial or choose one of our subscription plans to experience the benefits of et pay e adj firsthand. Our user-friendly interface ensures you can start sending and signing documents in no time.

Get more for Nyc Statement Of Undistributed Paychecks

- Current residence address date of birth marital status drivers license number and issuing state form

- Sample worthless check noticealabama retail association form

- Read the guide to representing yourself in an iowa divorce case with children on the iowa judicial branch website form

- Chapter 5301 conveyances lawriter orc form

- Bill of sale form iowa petition for dissolution of marriage

- 1 chapter 9 child support guidelines rule 91 form

- Type the name and birth date of your 2nd adult child form

- Performance planning and evaluation iowa department of

Find out other Nyc Statement Of Undistributed Paychecks

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe