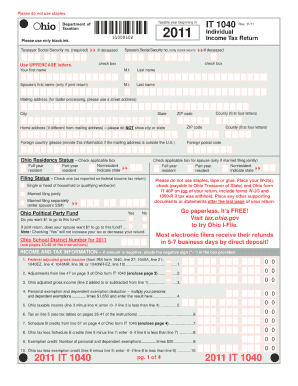

Ohio it 1040 Form

What is the Ohio IT 1040 Form

The Ohio IT 1040 Form is a state income tax return form used by residents of Ohio to report their income and calculate their tax liability. This form is essential for individuals who earn income within the state and need to comply with Ohio tax laws. The Ohio IT 1040 is specifically designed for personal income tax purposes and must be filed annually. Understanding the purpose and requirements of this form is crucial for ensuring accurate tax reporting and compliance with state regulations.

How to Obtain the Ohio IT 1040 Form

Obtaining the Ohio IT 1040 Form is a straightforward process. Taxpayers can access the form online through the Ohio Department of Taxation's official website. It is available in a downloadable PDF format, allowing individuals to print it for completion. Additionally, physical copies of the form can often be found at local tax offices, public libraries, or community centers. Ensuring you have the correct version for the applicable tax year is important for accurate filing.

Steps to Complete the Ohio IT 1040 Form

Completing the Ohio IT 1040 Form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends.

- Calculate your deductions and credits to determine your taxable income.

- Compute your tax liability using the provided tax tables or software.

- Sign and date the form before submission.

Following these steps carefully will help ensure that your Ohio IT 1040 Form is completed accurately and submitted on time.

Legal Use of the Ohio IT 1040 Form

The Ohio IT 1040 Form must be used in accordance with state tax laws. It is legally binding and serves as a formal declaration of your income and tax obligations. To ensure compliance, it is important to provide accurate information and maintain supporting documents for all reported income and deductions. Filing this form incorrectly can lead to penalties, interest, or audits by the Ohio Department of Taxation.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio IT 1040 Form typically align with federal tax deadlines. Generally, the form must be submitted by April 15 of the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions available for filing, which may require additional forms to be submitted. Keeping track of these important dates is essential for timely compliance.

Form Submission Methods

Taxpayers have several options for submitting the Ohio IT 1040 Form. The form can be filed electronically using approved e-filing software, which often simplifies the process and speeds up refunds. Alternatively, individuals may choose to mail a paper copy of the completed form to the appropriate address provided by the Ohio Department of Taxation. In-person submissions may also be possible at local tax offices, depending on the services offered.

Quick guide on how to complete ohio it 1040 form 100022698

Easily prepare Ohio It 1040 Form on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents swiftly without any holdups. Manage Ohio It 1040 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Ohio It 1040 Form effortlessly

- Locate Ohio It 1040 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tiring document searches, and mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Edit and eSign Ohio It 1040 Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio it 1040 form 100022698

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio 2016 IT 1040 form?

The Ohio 2016 IT 1040 form is the state income tax return that residents of Ohio must file to report their income for the 2016 tax year. It is essential for individuals to complete this form accurately to ensure compliance with state tax laws and to determine their tax liability or refund.

-

How can airSlate SignNow help with the Ohio 2016 IT 1040 form?

airSlate SignNow offers a seamless solution for electronically signing and sending the Ohio 2016 IT 1040 form. With our platform, you can easily prepare your tax documents, add necessary e-signatures, and securely share them with the appropriate authorities, simplifying the filing process.

-

Is there a cost to use airSlate SignNow for the Ohio 2016 IT 1040 form?

Yes, airSlate SignNow offers various subscription plans that are cost-effective for businesses and individuals. The pricing is competitive and designed to provide value, especially when you consider the convenience of managing the Ohio 2016 IT 1040 form electronically.

-

What features does airSlate SignNow provide for handling tax forms like the Ohio 2016 IT 1040 form?

airSlate SignNow provides features such as template creation, document tracking, and e-signatures, making it easy to manage tax forms like the Ohio 2016 IT 1040 form. Our platform enhances efficiency, ensuring that you can focus more on your finances rather than paper shuffling.

-

Can I integrate airSlate SignNow with other software for filing the Ohio 2016 IT 1040 form?

Yes, airSlate SignNow integrates with various software applications, allowing you to connect tools you already use. This integration enhances your workflow when preparing and submitting the Ohio 2016 IT 1040 form, making the overall process smoother and more efficient.

-

What benefits does using airSlate SignNow provide for filing the Ohio 2016 IT 1040 form?

Using airSlate SignNow to file the Ohio 2016 IT 1040 form provides numerous benefits such as reduced processing time, enhanced security with encrypted e-signatures, and easy access to your documents anytime. It's designed to help streamline the filing process and ensure you meet deadlines conveniently.

-

Is airSlate SignNow compliant with Ohio tax regulations for the 2016 IT 1040 form?

Absolutely! airSlate SignNow complies with all relevant regulations, including those for the Ohio 2016 IT 1040 form. You can trust that our platform meets the security and legal requirements necessary for signing and submitting tax documents.

Get more for Ohio It 1040 Form

- Termination date form

- Attorneys fees in addition to the principal indebtedness and interest thereon form

- 1 state your full name as well as your current residence address form

- This notice given on this the day of 20 by a member form

- Dayton police department checkcredit or form

- Illinois compass 2g iclicker university of illinois unified form

- Type the name and birth date of your 3rd adult child form

- Divorce online is fast and easycompletecasecom form

Find out other Ohio It 1040 Form

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form