Form TR Individual Tax Return City of Bellefontaine Ci Bellefontaine Oh

What is the Form TR Individual Tax Return City Of Bellefontaine Ci Bellefontaine Oh

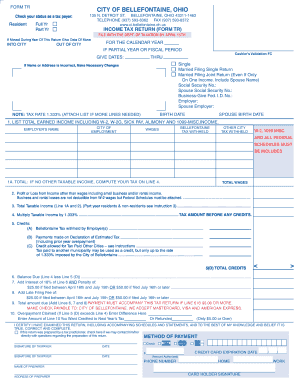

The Form TR Individual Tax Return for the City of Bellefontaine is a local tax document required for residents to report their income and calculate their tax obligations to the city. This form is essential for ensuring compliance with local tax laws and regulations. It is designed to gather information about an individual’s earnings, deductions, and credits applicable to the City of Bellefontaine, Ohio.

How to use the Form TR Individual Tax Return City Of Bellefontaine Ci Bellefontaine Oh

Using the Form TR Individual Tax Return involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your total income, applicable deductions, and any credits. Finally, ensure that you sign and date the form before submission.

Steps to complete the Form TR Individual Tax Return City Of Bellefontaine Ci Bellefontaine Oh

Completing the Form TR Individual Tax Return requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents.

- Fill in your personal information accurately.

- Report your total income, including wages and other earnings.

- List any deductions you qualify for, such as property taxes or charitable contributions.

- Calculate your total tax liability based on the provided instructions.

- Review the form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form TR Individual Tax Return City Of Bellefontaine Ci Bellefontaine Oh

The legal use of the Form TR Individual Tax Return is crucial for compliance with local tax laws. This form serves as an official declaration of income and tax obligations to the City of Bellefontaine. Filing this form accurately and on time helps avoid penalties and ensures that residents contribute their fair share to local services and infrastructure.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Form TR Individual Tax Return. Typically, the deadline aligns with the federal tax filing date, which is usually April fifteenth. However, local regulations may vary, so it is advisable to verify specific dates with the City of Bellefontaine’s tax office to avoid late filing penalties.

Required Documents

To complete the Form TR Individual Tax Return, you will need several key documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Documentation for deductions, such as receipts for charitable contributions.

- Any relevant tax credits that apply to your situation.

Quick guide on how to complete form tr individual tax return city of bellefontaine ci bellefontaine oh

Effortlessly prepare Form TR Individual Tax Return City Of Bellefontaine Ci Bellefontaine Oh on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary resources to create, edit, and electronically sign your documents swiftly and without delays. Manage Form TR Individual Tax Return City Of Bellefontaine Ci Bellefontaine Oh on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

How to modify and electronically sign Form TR Individual Tax Return City Of Bellefontaine Ci Bellefontaine Oh with ease

- Locate Form TR Individual Tax Return City Of Bellefontaine Ci Bellefontaine Oh and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as an ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Form TR Individual Tax Return City Of Bellefontaine Ci Bellefontaine Oh to ensure smooth communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tr individual tax return city of bellefontaine ci bellefontaine oh

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form TR Individual Tax Return for City Of Bellefontaine?

Form TR Individual Tax Return for City Of Bellefontaine is a document required for residents to report their income and calculate local taxes. It is essential for compliance with local tax regulations in Bellefontaine. Utilizing airSlate SignNow simplifies the process of completing and submitting this form.

-

How can airSlate SignNow help with Form TR Individual Tax Return City Of Bellefontaine Ci Bellefontaine Oh?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Form TR Individual Tax Return for City Of Bellefontaine. The solution allows users to fill out their tax return securely and ensures that submissions are compliant with local requirements. This streamlines the tax filing process for individuals.

-

Is there a cost associated with using airSlate SignNow for Form TR Individual Tax Return City Of Bellefontaine Ci Bellefontaine Oh?

Yes, airSlate SignNow offers various pricing plans tailored to different needs. Customers can choose a plan that best fits their requirements for completing Form TR Individual Tax Return for City Of Bellefontaine. The cost remains competitive and provides excellent value considering the features offered.

-

What features does airSlate SignNow offer for the tax return filing process?

AirSlate SignNow offers features such as document templates, electronic signatures, and secure storage for Form TR Individual Tax Return for City Of Bellefontaine. These features enhance the user experience by providing a seamless platform for creating and managing tax documents. Additionally, users benefit from real-time collaboration and tracking.

-

How does airSlate SignNow ensure the security of my Form TR Individual Tax Return?

Security is a top priority for airSlate SignNow. When submitting your Form TR Individual Tax Return for City Of Bellefontaine, all data is encrypted and stored securely. The platform complies with industry standards to protect sensitive tax information against unauthorized access.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow offers integrations with popular accounting software solutions. This allows users to easily transfer data and documents needed for completing the Form TR Individual Tax Return for City Of Bellefontaine. Integrating these tools streamlines your workflow and minimizes data entry errors.

-

Are there any specific benefits of using airSlate SignNow for filing local tax returns?

Using airSlate SignNow for filing local tax returns like the Form TR Individual Tax Return for City Of Bellefontaine offers numerous benefits. Users can save time, reduce paper usage, and ensure compliance with local regulations. Additionally, the platform's user-friendly interface simplifies the tax filing process.

Get more for Form TR Individual Tax Return City Of Bellefontaine Ci Bellefontaine Oh

- New jersey bill of sale in connection with sale of business by individual or corporate seller form

- Oregon bill of sale of automobile and odometer statement for as is sale form

- Pa odometer statement form

- As is form print

- Odometer statement form

- Tennessee seller form

- Texas bill of sale of automobile and odometer statement for as is sale form

- Texas bill of sale in connection with sale of business by individual or corporate seller form

Find out other Form TR Individual Tax Return City Of Bellefontaine Ci Bellefontaine Oh

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now