Good Faith Estimate Template Excel Form

What is the Good Faith Estimate Template Excel

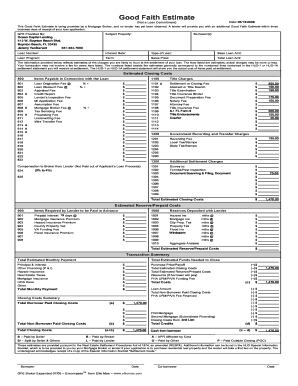

The Good Faith Estimate (GFE) Template Excel is a structured document used primarily in the mortgage industry to provide borrowers with an estimate of the costs associated with a mortgage loan. This template outlines various fees and expenses, allowing borrowers to understand their potential financial obligations before finalizing a loan. It includes essential information such as loan terms, interest rates, and estimated closing costs. By utilizing this template, lenders can ensure transparency and help borrowers make informed decisions regarding their mortgage options.

How to use the Good Faith Estimate Template Excel

Using the Good Faith Estimate Template Excel involves several straightforward steps. First, open the template in Excel and familiarize yourself with the various sections, which typically include loan amount, interest rate, and itemized fees. Next, input the relevant data based on the specific mortgage scenario. Ensure that all calculations are accurate, as this will affect the total estimated costs. After completing the template, review the information to confirm its accuracy before sharing it with potential borrowers. This process helps maintain clarity and trust between lenders and borrowers.

Key elements of the Good Faith Estimate Template Excel

The Good Faith Estimate Template Excel contains several key elements that are crucial for both lenders and borrowers. These include:

- Loan Amount: The total amount the borrower intends to borrow.

- Interest Rate: The percentage charged on the loan amount, which affects monthly payments.

- Estimated Closing Costs: A detailed breakdown of fees associated with closing the loan, such as appraisal fees, title insurance, and attorney fees.

- Loan Terms: Information regarding the duration of the loan and any specific conditions.

- Prepayment Penalties: Any fees that may apply if the borrower pays off the loan early.

Steps to complete the Good Faith Estimate Template Excel

Completing the Good Faith Estimate Template Excel involves a series of methodical steps. Begin by gathering all necessary information related to the mortgage, including borrower details and property information. Next, fill in the loan amount and interest rate in their respective fields. Following that, itemize all estimated closing costs, ensuring to include every applicable fee. Review the calculations to confirm accuracy, and make any necessary adjustments. Finally, save the completed template for distribution to borrowers, ensuring they have a clear understanding of their financial commitments.

Legal use of the Good Faith Estimate Template Excel

The legal use of the Good Faith Estimate Template Excel is governed by federal regulations, including the Real Estate Settlement Procedures Act (RESPA). Lenders are required to provide this estimate to borrowers within three business days of receiving a loan application. This requirement ensures that borrowers have adequate information to compare loan offers from different lenders. Additionally, the template must comply with the specific formatting and content guidelines set forth by regulatory bodies to ensure its validity and enforceability in legal contexts.

Examples of using the Good Faith Estimate Template Excel

Examples of using the Good Faith Estimate Template Excel can vary based on different mortgage scenarios. For instance, a first-time homebuyer may use the template to assess various loan options, comparing interest rates and closing costs from multiple lenders. Similarly, a homeowner refinancing their mortgage can utilize the template to understand the financial implications of their new loan terms. These examples highlight the template's versatility and its role in facilitating informed financial decisions for borrowers.

Quick guide on how to complete good faith estimate template excel

Easily Prepare Good Faith Estimate Template Excel on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Good Faith Estimate Template Excel on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Good Faith Estimate Template Excel Effortlessly

- Obtain Good Faith Estimate Template Excel and click on Get Form to begin.

- Make use of the available tools to complete your document.

- Mark important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign Good Faith Estimate Template Excel and guarantee excellent communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the good faith estimate template excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a good faith estimate in the context of signing documents?

A good faith estimate is a document provided by lenders that outlines the estimated costs associated with a loan, including fees and services. Understanding this estimate is crucial for borrowers to make informed financial decisions. Using airSlate SignNow, you can easily manage, sign, and store documents related to these estimates.

-

How can I create a good faith estimate using airSlate SignNow?

Creating a good faith estimate with airSlate SignNow is straightforward. Our platform offers customizable templates that allow you to draft your estimates efficiently. Simply input the necessary information, and you can eSign and share the document with others quickly.

-

What are the key features of airSlate SignNow related to good faith estimates?

airSlate SignNow provides essential features like document templates, eSignature capabilities, and secure storage. These tools are particularly beneficial when preparing and managing good faith estimates, ensuring you maintain compliance and accuracy. Additionally, our cloud-based solution makes accessing documents convenient and efficient.

-

Can I integrate airSlate SignNow with other software for managing good faith estimates?

Yes, airSlate SignNow offers seamless integrations with popular applications like CRM systems and accounting software. By integrating these tools, you can streamline the process of creating, sending, and tracking good faith estimates. This ensures that your workflow remains efficient and organized.

-

What types of businesses can benefit from using good faith estimates with airSlate SignNow?

A wide range of businesses, especially in the real estate and financial sectors, can benefit from using good faith estimates created with airSlate SignNow. These estimates help maintain transparency with clients and facilitate the closing process. Any business that requires clear cost communication can utilize this feature effectively.

-

How does airSlate SignNow ensure the security of my good faith estimates?

airSlate SignNow prioritizes the security of your documents with advanced encryption methods and secure cloud storage. This safeguards your good faith estimates from unauthorized access. Additionally, we comply with industry standards to ensure your data remains protected throughout its lifecycle.

-

What is the pricing structure for using airSlate SignNow for good faith estimates?

airSlate SignNow offers a range of pricing plans to suit businesses of all sizes, making it a cost-effective solution for managing good faith estimates. Pricing depends on the features and the number of users you require. We recommend checking our website for the latest pricing details to find the best plan for your needs.

Get more for Good Faith Estimate Template Excel

- First that the defendants manufactured andor sold a wood shaper andor pans which at form

- If you believe from the evidence that the defendant form

- You are instructed that the law does not require a seller such as form

- Mcgrew v city of jackson mississippi 307 f supp 754 sd form

- Atlas of worlds official path of exile wiki form

- The problem of the expert juror the scholarly forum form

- Mississippi personal injury laws ampamp statutory rulesalllaw form

- A person who voluntarily placed himself in a position of danger which was or should form

Find out other Good Faith Estimate Template Excel

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple