5405 Form

What is the 5405 Form

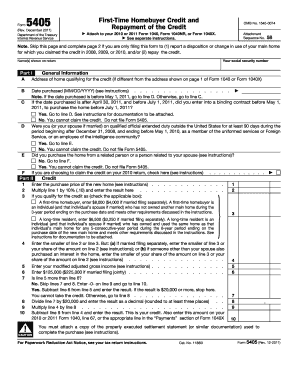

The 5405 Form is a specific document used primarily for tax purposes in the United States. It serves as a means for taxpayers to report certain information to the Internal Revenue Service (IRS). Understanding the purpose of this form is crucial for ensuring compliance with tax regulations. It is typically utilized by individuals and businesses to provide necessary details related to their financial activities, which can affect their tax obligations.

How to use the 5405 Form

Using the 5405 Form involves several steps to ensure accurate completion and submission. First, gather all relevant financial documents that pertain to the information required on the form. Next, carefully fill out each section, ensuring that all details are accurate and complete. It is advisable to double-check the entries for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements outlined by the IRS.

Steps to complete the 5405 Form

Completing the 5405 Form requires a systematic approach. Begin by identifying the sections that apply to your situation. Follow these steps:

- Read the instructions carefully to understand what information is required.

- Fill in your personal details, including name, address, and taxpayer identification number.

- Provide the necessary financial information as requested in the form.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the 5405 Form

The legal use of the 5405 Form is governed by IRS regulations. To ensure that the form is legally binding, it must be completed accurately and submitted on time. Compliance with all relevant tax laws is essential to avoid penalties or issues with the IRS. Additionally, utilizing a reliable electronic signature solution can enhance the legal standing of the submitted document, ensuring that it meets the requirements set forth by eSignature laws.

Examples of using the 5405 Form

There are various scenarios in which the 5405 Form may be utilized. For instance, a self-employed individual might use this form to report income and deductions related to their business activities. Similarly, a small business owner may need to complete the form to provide information about employee wages and tax withholdings. Each example highlights the importance of accurately reporting financial information to the IRS to maintain compliance and avoid potential legal issues.

Required Documents

When filling out the 5405 Form, certain documents may be required to support the information provided. These documents can include:

- Previous tax returns for reference.

- Financial statements or records of income and expenses.

- Identification documents such as a Social Security number or Employer Identification Number.

Having these documents on hand can facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Quick guide on how to complete 5405 form

Complete 5405 Form effortlessly on any gadget

Digital document management has become a prevalent choice for businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your files quickly without delays. Manage 5405 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign 5405 Form with ease

- Obtain 5405 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign 5405 Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5405 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5405 Form and how is it used?

The 5405 Form is a document utilized for specific tax purposes in various jurisdictions. It allows individuals and businesses to report important financial information to the relevant authorities. airSlate SignNow simplifies the signing process for the 5405 Form, ensuring that you can complete and submit it with ease.

-

How can airSlate SignNow help with the 5405 Form?

airSlate SignNow offers features that streamline the electronic signing of the 5405 Form. With its intuitive interface, users can quickly fill out and eSign the form, reducing paperwork and saving time. This digital solution is compliant with legal standards, making it safe and reliable.

-

What are the pricing options for using airSlate SignNow with the 5405 Form?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses and individuals needing to manage the 5405 Form. These plans vary based on features and user capacity, ensuring you find an option that fits your budget. Regularly check for promotions and discounts to maximize your savings.

-

Are there any special features for managing the 5405 Form in airSlate SignNow?

Yes, airSlate SignNow provides features specifically designed for handling the 5405 Form efficiently. Users can track document status, set reminders for signing deadlines, and integrate templates for repetitive submissions. These features enhance workflow and ensure compliance with submission deadlines.

-

Can I integrate airSlate SignNow with other software for the 5405 Form?

Absolutely! airSlate SignNow seamlessly integrates with popular applications, allowing you to manage the 5405 Form alongside other essential business tools. Integrations with CRMs, cloud storage, and email platforms enhance your productivity and document management capabilities.

-

Is eSigning the 5405 Form legally binding?

Yes, eSigning the 5405 Form through airSlate SignNow is legally binding in accordance with electronic signature laws. This ensures that your signed documents hold the same legal weight as traditional handwritten signatures. Rest assured, your document's integrity is maintained throughout the signing process.

-

How secure is the airSlate SignNow platform for the 5405 Form?

airSlate SignNow prioritizes security when handling sensitive documents like the 5405 Form. The platform employs advanced encryption technology and follows stringent security protocols to safeguard your data. You can confidently sign and store your forms knowing they are protected from unauthorized access.

Get more for 5405 Form

- Nebraska letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to form

- Nebraska copy form

- Nj landlord form

- Nj guaranty form

- Cancellation lease contract 481374997 form

- Amendment lease tenant form

- New jersey lease agreement form

- Nm odometer statement form

Find out other 5405 Form

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT