Loan Abstract Example Form

What is the loan abstract example?

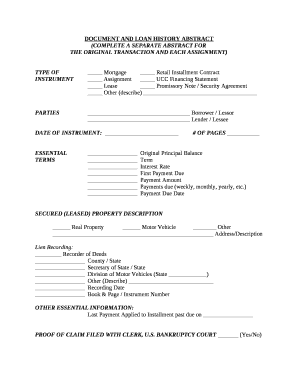

A loan abstract is a concise summary of the key details related to a loan agreement, typically used in real estate transactions. This document outlines essential information such as the loan amount, interest rate, repayment terms, and the parties involved. It serves as a reference for both lenders and borrowers, ensuring that all parties have a clear understanding of the loan's terms and conditions. A well-prepared loan abstract can facilitate smoother transactions and reduce potential disputes.

Key elements of the loan abstract example

When creating a loan abstract, several critical elements should be included to ensure its effectiveness:

- Loan Amount: The total amount borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Loan Term: The duration over which the loan must be repaid.

- Repayment Schedule: Details on how and when payments will be made.

- Borrower Information: Names and contact details of the individuals or entities borrowing the funds.

- Lender Information: Names and contact details of the lending institution or individual.

- Property Description: Information about the property securing the loan.

Steps to complete the loan abstract example

Completing a loan abstract involves several steps to ensure accuracy and compliance:

- Gather all relevant loan documents, including the loan agreement and property details.

- Identify and list all key elements, such as loan amount, interest rate, and repayment terms.

- Ensure that all borrower and lender information is accurate and up-to-date.

- Review the document for clarity and completeness, making sure all necessary details are included.

- Consult with legal or financial professionals if needed to ensure compliance with applicable laws.

- Finalize the document by obtaining the necessary signatures from all parties involved.

Legal use of the loan abstract example

The loan abstract serves a crucial legal function in real estate transactions. It can be used as evidence in court to clarify the terms of the loan agreement. For the loan abstract to be legally binding, it must meet specific requirements, including proper signatures and compliance with relevant laws, such as the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Ensuring that the loan abstract is accurately prepared and executed can help protect the rights of both lenders and borrowers.

How to use the loan abstract example

Using a loan abstract effectively involves several considerations:

- Refer to the loan abstract during discussions with lenders or financial advisors to clarify terms.

- Utilize the document as a checklist to ensure that all loan conditions are met before finalizing the agreement.

- Keep the loan abstract accessible for future reference, especially during repayment periods or if disputes arise.

- Consider digital storage options to maintain the document's integrity and security.

State-specific rules for the loan abstract example

Each state in the U.S. may have specific regulations governing the use and requirements of loan abstracts. It is essential to be aware of these state-specific rules to ensure compliance. This may include variations in required disclosures, notarization requirements, or specific language that must be included in the document. Consulting with a local attorney or real estate professional can provide valuable guidance on navigating these regulations effectively.

Quick guide on how to complete loan abstract example

Complete Loan Abstract Example effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the right template and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your papers swiftly without delays. Handle Loan Abstract Example on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Loan Abstract Example effortlessly

- Obtain Loan Abstract Example and then click Get Form to begin.

- Utilize the tools at your disposal to finalize your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tiresome form searches, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Modify and eSign Loan Abstract Example and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan abstract example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan abstract template?

A loan abstract template is a standardized document designed to summarize the essential details of a loan transaction. It includes key elements such as loan amount, terms, interest rates, and borrower information. By using a loan abstract template, businesses can streamline documentation and ensure all necessary information is captured accurately.

-

How can the loan abstract template benefit my business?

Using a loan abstract template can signNowly improve the efficiency of your loan processing tasks. It helps maintain consistency in documentation and reduces the chances of errors, which can save you time and resources. Additionally, having a clear loan abstract can enhance communication between parties involved in the transaction.

-

Is there a cost associated with the loan abstract template?

The loan abstract template is available through airSlate SignNow's subscription plans. Pricing varies based on the level of features and functionalities your business requires. We offer competitive pricing options suited for businesses of all sizes, ensuring you get the most value from your investment.

-

Are there features that make the loan abstract template easy to use?

Yes, the loan abstract template from airSlate SignNow comes with user-friendly features. It allows for easy customization, enabling you to tailor the template to meet specific loan requirements. Additionally, it integrates seamlessly with other tools to facilitate efficient documentation processing.

-

Can I share the loan abstract template with my team?

Absolutely! The loan abstract template can be easily shared with your team members through airSlate SignNow's platform. This collaborative feature ensures everyone involved in the loan process has access to the same information, enhancing team coordination and reducing miscommunication.

-

What integrations are available for the loan abstract template?

The loan abstract template seamlessly integrates with popular business applications, such as CRMs and document management systems. This integration allows for automatic data transfer and simplifies workflows, making it easy to pull necessary information into your loan documents. Enhance productivity by connecting with tools you already use.

-

Is it possible to customize the loan abstract template?

Yes, customization is one of the key features of the loan abstract template in airSlate SignNow. You can easily add, remove, or modify fields according to your specific needs and preferences. This flexibility ensures that the template reflects your business's unique processes and requirements.

Get more for Loan Abstract Example

Find out other Loan Abstract Example

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT