LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM

What is the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM

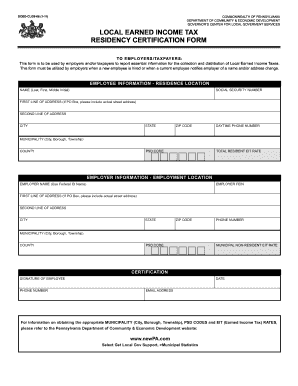

The local earned income tax residency certification form is an essential document used by individuals to certify their residency status for local tax purposes. This form is particularly relevant for taxpayers who may work in multiple jurisdictions or have income sourced from different locations. By completing this form, individuals can ensure they are taxed appropriately based on their residency status, potentially avoiding double taxation on their earned income.

Steps to complete the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM

Completing the local earned income tax residency certification form involves several straightforward steps:

- Gather necessary personal information, including your name, address, and Social Security number.

- Identify the local jurisdiction where you claim residency for tax purposes.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate your certification.

How to obtain the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM

The local earned income tax residency certification form can typically be obtained through your local tax authority's website or office. Many jurisdictions provide downloadable versions of the form, while others may require you to request it in person or via mail. Ensure you have the most current version of the form to avoid any compliance issues.

Legal use of the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM

This form serves a critical legal function in establishing your residency status for local tax purposes. When filled out correctly, it can protect you from being taxed in multiple jurisdictions on the same income. It is important to understand the legal implications of the information provided, as inaccuracies may result in penalties or additional tax liabilities.

State-specific rules for the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM

Each state may have unique requirements regarding the local earned income tax residency certification form. It is essential to familiarize yourself with your state’s specific rules, including submission deadlines, required documentation, and any additional forms that may need to accompany the certification. Checking with your local tax authority can provide clarity on these state-specific regulations.

Examples of using the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM

Common scenarios for using the local earned income tax residency certification form include:

- A taxpayer who lives in one city but works in another may use the form to certify residency and avoid paying taxes in both locations.

- Individuals who have moved between states during the tax year may need to complete the form to clarify their residency status for local tax obligations.

Quick guide on how to complete local earned income tax residency certification form

Easily prepare LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without holdups. Manage LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related operations today.

The simplest way to modify and electronically sign LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM effortlessly

- Find LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM and guarantee excellent communication throughout the preparation process of your form with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the local earned income tax residency certification form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM?

The LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM is an essential document that certifies an individual's residency for local earned income tax purposes. It helps streamline tax processes by confirming where a taxpayer resides and works, ensuring that any taxes withheld are applicable to the correct jurisdiction.

-

How can airSlate SignNow help with the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM?

airSlate SignNow allows users to electronically sign and send the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM easily. This automated process not only saves time but also ensures that the document is securely stored and readily accessible when needed.

-

Is there a cost associated with using airSlate SignNow for the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features that streamline the signing process for documents like the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage for the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM. These features enhance efficiency and ensure that your documents are managed effectively.

-

Can I integrate airSlate SignNow with other software for managing the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, including CRM systems and accounting software, to enhance the management of the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM. This allows for smoother workflows and data transfers across platforms.

-

What are the benefits of using airSlate SignNow for the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM?

Using airSlate SignNow for the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM simplifies the signing process, reduces paperwork, and enhances compliance. The platform ensures that your documents are signed in a legally binding manner while keeping your information secure.

-

Is using airSlate SignNow for the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM legally compliant?

Yes, airSlate SignNow complies with various electronic signature laws, ensuring that the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM is signed securely and is legally binding. This gives you peace of mind that your documentation meets legal standards.

Get more for LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM

- Trim carpenter contract for contractor arizona form

- Fencing contract for contractor arizona form

- Hvac contract for contractor arizona form

- Landscape contract for contractor arizona form

- Commercial contract for contractor arizona form

- Excavator contract for contractor arizona form

- Renovation contract for contractor arizona form

- Concrete mason contract for contractor arizona form

Find out other LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online