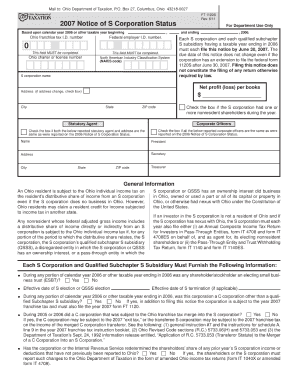

Ft 1120 Form

What is the FT 1120

The FT 1120 is a tax form used by corporations in the United States to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their federal income tax liability. It is typically filed annually and provides the Internal Revenue Service (IRS) with a comprehensive overview of a corporation's financial activities for the year. Understanding the FT 1120 is crucial for compliance with tax regulations and for ensuring accurate reporting of corporate financial information.

How to Obtain the FT 1120

To obtain the FT 1120 form, corporations can visit the IRS website, where the form is available for download. It is also possible to request a physical copy by contacting the IRS directly. Additionally, many tax preparation software programs include the FT 1120, making it accessible for those who prefer to file electronically. Ensuring that the latest version of the form is used is important, as tax regulations may change from year to year.

Steps to Complete the FT 1120

Completing the FT 1120 involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and records of deductions.

- Fill out the form by entering the corporation's income, deductions, and credits in the appropriate sections.

- Ensure that all calculations are accurate to avoid errors that could lead to penalties.

- Review the completed form for completeness and accuracy.

- File the FT 1120 by the designated deadline, either electronically or by mail.

Legal Use of the FT 1120

The FT 1120 is a legally binding document that must be filed in accordance with IRS regulations. It is important for corporations to ensure that the information provided is accurate and complete, as any discrepancies can lead to audits or penalties. The form must be signed by an authorized representative of the corporation, affirming that the information is true and correct to the best of their knowledge. Compliance with the legal requirements surrounding the FT 1120 is essential for maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the FT 1120. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also request an extension, but it is important to understand that this does not extend the time to pay any taxes owed.

Penalties for Non-Compliance

Failure to file the FT 1120 by the deadline can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the length of the delay. Additionally, inaccuracies or omissions on the form can lead to further penalties, including interest on unpaid taxes. It is crucial for corporations to adhere to the filing requirements and ensure that all information is reported accurately to avoid these consequences.

Quick guide on how to complete ft 1120

Prepare Ft 1120 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Ft 1120 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The easiest way to edit and eSign Ft 1120 without difficulty

- Find Ft 1120 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, frustrating form hunting, or mistakes that require new copies to be printed. airSlate SignNow takes care of all your document management needs in a few clicks from any device you choose. Edit and eSign Ft 1120 and ensure excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ft 1120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ft 1120 and how does it relate to airSlate SignNow?

The ft 1120 form is used by corporations to report their income, deductions, and tax liability to the IRS. With airSlate SignNow, you can easily eSign and send your ft 1120 documents securely, making tax filing straightforward and efficient.

-

How much does airSlate SignNow cost for ft 1120 document management?

airSlate SignNow offers flexible pricing plans to accommodate your business needs, focusing on cost-effectiveness. Pricing for managing ft 1120 documents can vary based on features and user count, but we provide a value-driven solution for all users.

-

What features does airSlate SignNow offer for handling ft 1120 forms?

With airSlate SignNow, you can enjoy features like customizable templates, real-time tracking, and automated workflows specifically tailored for ft 1120 form management. These features streamline the signing process and reduce the administrative burden.

-

Are there benefits to using airSlate SignNow for ft 1120 submissions?

Yes, utilizing airSlate SignNow for ft 1120 submissions enhances efficiency, improves compliance, and minimizes errors in document handling. You can save time and ensure accuracy when preparing and sending your tax forms.

-

Can I integrate airSlate SignNow with my accounting software for ft 1120 forms?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing you to easily manage your ft 1120 forms alongside your existing systems. This ensures a seamless workflow and helps maintain all your documents in one place.

-

Is it easy to eSign the ft 1120 using airSlate SignNow?

Yes, eSigning the ft 1120 using airSlate SignNow is incredibly easy. Our user-friendly interface allows you to eSign documents within minutes, ensuring that you can complete your tax filings without any hassle.

-

What security measures does airSlate SignNow have for ft 1120 filings?

airSlate SignNow employs robust security measures, such as end-to-end encryption and secure data storage, to protect your ft 1120 filings. Your sensitive information remains confidential and secure during the eSigning process.

Get more for Ft 1120

Find out other Ft 1120

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF