Gift of Works of Art Form

What is the Gift Of Works Of Art

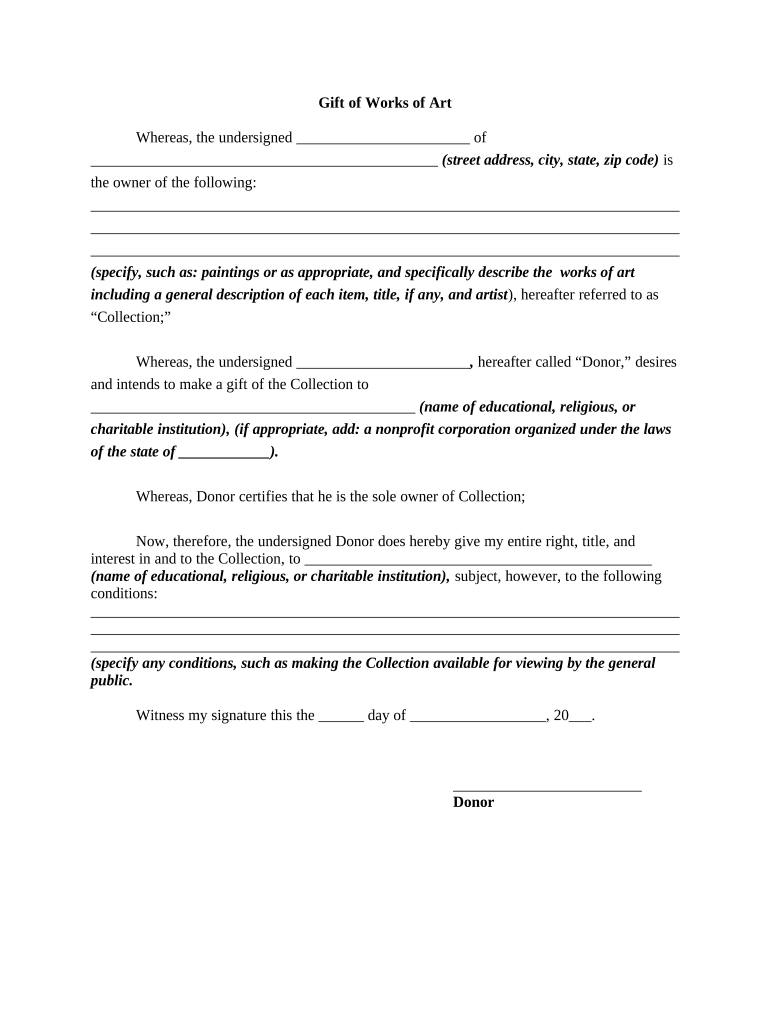

The Gift Of Works Of Art is a legal document used to formally transfer ownership of artistic works from one party to another. This form outlines the specifics of the gift, including details about the artwork, the donor, and the recipient. It serves to clarify the intentions of both parties and provides a record of the transaction, which can be important for tax purposes and future reference. Understanding the contents and implications of this form is essential for both donors and recipients to ensure a smooth transfer process.

How to use the Gift Of Works Of Art

Using the Gift Of Works Of Art involves several steps to ensure that the transfer of ownership is legally recognized. First, both the donor and recipient should carefully read the form to understand its requirements. Next, the donor must fill out the necessary information, including a description of the artwork and the value of the gift. After completing the form, both parties should sign it, ideally in the presence of a witness or notary, to enhance its legal standing. Once signed, the form should be securely stored by both parties for future reference.

Steps to complete the Gift Of Works Of Art

Completing the Gift Of Works Of Art requires attention to detail to ensure its validity. The following steps outline the process:

- Gather necessary information about the artwork, including title, artist, medium, and estimated value.

- Complete the form by providing the donor's and recipient's names and addresses.

- Clearly state the terms of the gift, including any conditions or restrictions.

- Both parties should sign and date the document to acknowledge their agreement.

- Consider having the document notarized for added legal protection.

- Keep copies of the completed form for personal records.

Legal use of the Gift Of Works Of Art

The legal use of the Gift Of Works Of Art form is crucial for ensuring that the transfer of ownership is recognized by law. This document must comply with relevant state and federal laws regarding gifts and property transfers. It is important to note that the form should accurately reflect the intentions of both parties and include all necessary details to avoid disputes. Proper execution of the form can also have implications for tax reporting, as gifts of significant value may need to be reported to the IRS.

IRS Guidelines

According to IRS guidelines, gifts of artworks can have tax implications for both the donor and the recipient. If the value of the gift exceeds a certain threshold, the donor may need to file a gift tax return. Additionally, the recipient may need to consider the fair market value of the artwork when reporting income or potential capital gains in the future. Understanding these guidelines is essential for both parties to ensure compliance with tax laws and avoid penalties.

Required Documents

When completing the Gift Of Works Of Art, certain documents may be required to support the transaction. These may include:

- A written appraisal of the artwork to establish its fair market value.

- Proof of ownership from the donor, such as previous purchase receipts or provenance documentation.

- Identification documents for both the donor and recipient to verify their identities.

Form Submission Methods

The Gift Of Works Of Art can be submitted in various ways, depending on the preferences of the parties involved. Common submission methods include:

- Online submission through a secure electronic platform that supports eSignatures.

- Mailing a physical copy of the completed form to the recipient or relevant authority.

- In-person delivery, which may be preferred for high-value artworks to ensure proper handling.

Quick guide on how to complete gift of works of art

Complete Gift Of Works Of Art effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Gift Of Works Of Art on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Gift Of Works Of Art with ease

- Find Gift Of Works Of Art and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Gift Of Works Of Art and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 'Gift Of Works Of Art' offered by airSlate SignNow?

The 'Gift Of Works Of Art' refers to our unique feature that simplifies the process of signing and managing documents electronically. It allows users to create, send, and eSign important documents with ease, making it an invaluable tool for businesses and individuals alike.

-

How much does the 'Gift Of Works Of Art' feature cost?

Pricing for the 'Gift Of Works Of Art' feature varies based on the plan you choose. airSlate SignNow offers several flexible pricing options tailored to meet the needs of different users, ensuring that the cost remains competitive while providing comprehensive eSigning solutions.

-

What are the key benefits of using the 'Gift Of Works Of Art' feature?

The 'Gift Of Works Of Art' feature offers numerous benefits, including increased efficiency, time savings, and enhanced document security. By streamlining the eSigning process, it helps businesses focus on what matters most, thereby optimizing workflow.

-

Can I integrate the 'Gift Of Works Of Art' with other software?

Yes, the 'Gift Of Works Of Art' feature is designed to seamlessly integrate with various applications and services. This includes CRM systems, document management tools, and other business platforms to enhance your overall productivity and efficiency.

-

Is the 'Gift Of Works Of Art' secure for sensitive documents?

Absolutely! The 'Gift Of Works Of Art' feature employs strong encryption and security measures to ensure that all your sensitive documents are protected. You can confidently send and sign important legal documents without worrying about data bsignNowes or unauthorized access.

-

Do I need any special software to use the 'Gift Of Works Of Art' feature?

No special software is required to use the 'Gift Of Works Of Art' feature with airSlate SignNow. All you need is an internet connection and a web browser to access the platform, making it convenient and user-friendly for everyone.

-

Can I use the 'Gift Of Works Of Art' feature on mobile devices?

Yes, the 'Gift Of Works Of Art' feature is fully compatible with mobile devices. You can easily send, manage, and eSign documents on-the-go, making it perfect for busy professionals who need to work remotely or while traveling.

Get more for Gift Of Works Of Art

- Kansas application of ex parte orders form

- Journal entry of competency hearing kansasjudicialcouncil form

- 1 101 informaci n para padres sus derechos y responsabilidades kansasjudicialcouncil

- Xml us government publishing office kansasjudicialcouncil form

- Diversion application neosho county form

- Ky need deposition form

- Lusersa_mgmt sharedconnieformsrepossession form 2

- Voluntary transfer of custody louisiana form

Find out other Gift Of Works Of Art

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors