Gr 1120es Form

What is the Gr 1120es Form

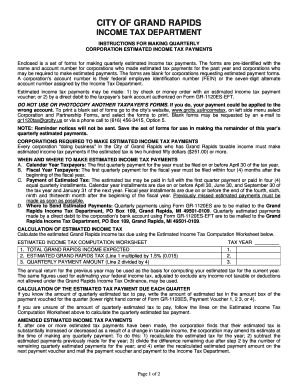

The Gr 1120es Form is a tax form used by corporations in the United States to make estimated tax payments. This form is essential for corporations that expect to owe tax of $500 or more when they file their annual return. By submitting the Gr 1120es Form, businesses can ensure they meet their tax obligations throughout the year, rather than facing a larger tax bill at the end of the fiscal period.

How to use the Gr 1120es Form

Using the Gr 1120es Form involves several key steps. First, corporations must determine their estimated tax liability for the current year. This estimate should be based on the previous year’s tax return or projected income for the current year. Once the estimated amount is calculated, the corporation can fill out the Gr 1120es Form, indicating the payment amount and the due date. It is important to submit the form along with the estimated payment to the IRS by the specified deadlines.

Steps to complete the Gr 1120es Form

Completing the Gr 1120es Form requires careful attention to detail. Follow these steps for accurate completion:

- Gather financial information, including income, deductions, and credits.

- Calculate the estimated tax liability based on projected earnings.

- Fill out the Gr 1120es Form with the required information, including the corporation's name, address, and Employer Identification Number (EIN).

- Indicate the estimated payment amount and the applicable payment period.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Gr 1120es Form. Generally, the estimated tax payments are due four times a year, typically on the fifteenth day of April, June, September, and December. It is crucial for corporations to mark these dates on their calendars to avoid penalties and interest for late payments.

Legal use of the Gr 1120es Form

The Gr 1120es Form is legally binding when completed and submitted according to IRS regulations. To ensure its validity, corporations must follow the guidelines set forth by the IRS, including accurate reporting of estimated tax liabilities. Electronic submissions are accepted, provided they comply with the relevant eSignature laws, ensuring that the form is recognized as legally executed.

Required Documents

When preparing to file the Gr 1120es Form, corporations should have several documents ready. These include:

- Previous year’s tax return for reference.

- Financial statements detailing income and expenses.

- Any relevant tax credits or deductions that may apply.

Having these documents on hand can streamline the process of estimating tax obligations and completing the form accurately.

Quick guide on how to complete gr 1120es form

Effortlessly Prepare Gr 1120es Form on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Gr 1120es Form on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-oriented procedure today.

Modify and eSign Gr 1120es Form with Ease

- Obtain Gr 1120es Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, via email, text message (SMS), invitation link, or download it to your computer.

Leave behind issues of lost or misplaced files, the hassle of tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and eSign Gr 1120es Form to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gr 1120es form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Gr 1120es Form and why is it important?

The Gr 1120es Form is essential for corporations filing estimated tax payments. It helps businesses ensure compliance with IRS regulations and avoid penalties. Understanding its purpose is crucial for effective tax planning and financial management.

-

How can airSlate SignNow help with the Gr 1120es Form?

airSlate SignNow streamlines the process of preparing and signing the Gr 1120es Form. Our user-friendly platform allows businesses to easily fill out, eSign, and send the form quickly. This saves time and reduces the hassle of traditional paperwork.

-

Is airSlate SignNow cost-effective for businesses needing the Gr 1120es Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Gr 1120es Form. With flexible pricing plans, businesses can choose a package that fits their budget while accessing all essential features. Our solution helps save on printing and mailing costs as well.

-

What features does airSlate SignNow offer for the Gr 1120es Form?

airSlate SignNow provides features tailored for the Gr 1120es Form, including easy document management, secure eSigning, and customizable templates. These features ensure that users can complete the form accurately and efficiently. Additionally, our platform supports cloud storage, enabling easy access to documents anytime.

-

Can I track the status of the Gr 1120es Form with airSlate SignNow?

Absolutely! With airSlate SignNow, you can track the status of your Gr 1120es Form in real-time. This feature allows businesses to monitor when the document is signed and sent back, ensuring accountability and facilitating better communication.

-

What integrations does airSlate SignNow offer for the Gr 1120es Form?

airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems, making it easy to manage the Gr 1120es Form. These integrations enhance productivity by allowing users to pull existing data into their documents without manual entry. This saves time and minimizes errors.

-

How secure is airSlate SignNow when handling the Gr 1120es Form?

Security is a top priority for airSlate SignNow. We employ advanced encryption and strict compliance protocols to protect your Gr 1120es Form and other documents. Our platform ensures that all sensitive information remains confidential and secure throughout the process.

Get more for Gr 1120es Form

Find out other Gr 1120es Form

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online