15a Form

What is the 15a Form

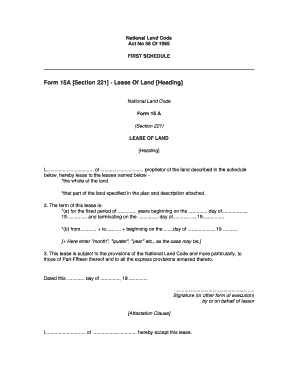

The 15a form is a crucial document used in various legal and administrative processes within the United States. It serves as a formal request or declaration that may pertain to land use, property transfers, or other legal obligations. Understanding the purpose and implications of the 15a form is essential for compliance with local regulations and ensuring that all necessary information is accurately reported.

Steps to Complete the 15a Form

Completing the 15a form requires careful attention to detail. Here are the key steps to ensure proper completion:

- Gather necessary information, including personal details and any relevant property information.

- Fill out each section of the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign and date the form where indicated to validate your submission.

Legal Use of the 15a Form

The legal use of the 15a form is governed by specific regulations that vary by state. It is essential to understand how this form fits into the broader legal context, including its implications for property rights and obligations. Proper use ensures that the document is recognized by courts and governmental agencies, thus safeguarding your interests.

How to Obtain the 15a Form

The 15a form can typically be obtained through local government offices, such as county clerks or land registries. Many jurisdictions also provide downloadable versions of the form on their official websites. It is advisable to ensure that you are using the most current version of the form to avoid any issues during submission.

Examples of Using the 15a Form

There are various scenarios in which the 15a form may be utilized. Common examples include:

- Submitting a request for land use permits.

- Documenting property transfers between parties.

- Filing for exemptions or variances related to property regulations.

Form Submission Methods

Submitting the 15a form can typically be done through several methods, including:

- Online submission via the relevant government agency's website.

- Mailing the completed form to the designated office.

- In-person submission at local government offices.

Key Elements of the 15a Form

Understanding the key elements of the 15a form is vital for ensuring accurate completion. Essential components often include:

- Personal identification information of the applicant.

- Detailed descriptions of the property or subject matter.

- Signatures of all relevant parties to validate the form.

Quick guide on how to complete 15a form

Complete 15a Form effortlessly on any device

Web-based document administration has become increasingly popular with businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents swiftly without any delays. Manage 15a Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The simplest way to edit and electronically sign 15a Form effortlessly

- Obtain 15a Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize specific sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and electronically sign 15a Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 15a form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 15a and how can it be used with airSlate SignNow?

Form 15a is a document that can be eSigned using airSlate SignNow's electronic signature platform. It allows businesses to securely sign and manage important documents online. By using airSlate SignNow, you can streamline the signing process for form 15a, saving time and reducing paperwork.

-

How does airSlate SignNow ensure the security of form 15a?

airSlate SignNow employs advanced security measures to protect your form 15a and other documents. This includes encryption, secure cloud storage, and compliance with legal standards like ESIGN and UETA. You can confidently eSign form 15a, knowing that your data is safe and protected.

-

What are the pricing plans for using airSlate SignNow with form 15a?

airSlate SignNow offers various pricing plans that cater to different business needs, making it affordable to eSign form 15a. Each plan includes access to all essential features, making it easy to manage and sign documents. To find the best pricing option for your needs, you can visit our pricing page for more information.

-

Can I customize my form 15a templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your form 15a templates to suit your specific requirements. You can add fields, branding, and other elements to enhance the document's appearance and functionality. Customization ensures that your form 15a aligns with your business's professional image.

-

What integrations does airSlate SignNow offer for managing form 15a?

airSlate SignNow integrates seamlessly with numerous popular applications, enhancing your workflow around form 15a. You can connect with tools like Google Drive, Dropbox, and Salesforce to easily access and manage your documents. These integrations improve efficiency and enable better collaboration.

-

Is it possible to track the status of my form 15a in airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive tracking features that allow you to monitor the status of your form 15a in real-time. You will receive notifications when it is viewed, signed, or completed, ensuring you stay informed throughout the signing process.

-

What are the benefits of using airSlate SignNow for eSigning form 15a?

Using airSlate SignNow to eSign form 15a offers numerous benefits, including increased efficiency and reduced turnaround time. You can sign documents from any device, ensuring flexibility for you and your clients. Additionally, the cost-effective nature of the platform makes it a smart choice for businesses of all sizes.

Get more for 15a Form

- Landscaping contractor package california form

- Commercial contractor package california form

- Excavation contractor package california form

- California contractor form

- Concrete mason contractor package california form

- Demolition contractor package california form

- Security contractor package california form

- Ca contractor form

Find out other 15a Form

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template